Villahermosa - The Wyckoff Methodology in Depth

Here you can read online Villahermosa - The Wyckoff Methodology in Depth full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2019, genre: Business. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:The Wyckoff Methodology in Depth

- Author:

- Genre:

- Year:2019

- Rating:4 / 5

- Favourites:Add to favourites

- Your mark:

- 80

- 1

- 2

- 3

- 4

- 5

The Wyckoff Methodology in Depth: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "The Wyckoff Methodology in Depth" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

The Wyckoff Methodology in Depth — read online for free the complete book (whole text) full work

Below is the text of the book, divided by pages. System saving the place of the last page read, allows you to conveniently read the book "The Wyckoff Methodology in Depth" online for free, without having to search again every time where you left off. Put a bookmark, and you can go to the page where you finished reading at any time.

Font size:

Interval:

Bookmark:

The Wyckoff Methodology in Depth

How to trade financial markets logically

Rubn Villahermosa Chaves

All rights reserved. No part of this work may be reproduced, incorporated into a computer system or transmitted in any form or by any means (electronic, mechanical, photocopying, recording or otherwise) without the prior written permission of the copyright holders. Infringement of these rights may constitute a crime against intellectual property.

Rubn Villahermosa, 2019

Independently published

Contents

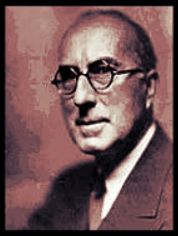

Richard Wyckoff (1873-1934) became a Wall Street celebrity.

He was a forerunner in the investment world as he started as a stockbroker at the age of 15 and by the age of 25 already owned his own brokerage firm.

The method he developed of technical analysis and speculation arose from his observation and communication skills.

Working as a Broker, Wyckoff saw the game of the big traders and began to observe through the tape and the graphics the manipulations they carried out and which they obtained high profits with.

He stated that it was possible to judge the future course of the market by its own actions since the price action reflects the plans and purposes of those who dominated it.

Wyckoff carried out its investment methods achieving a high return. As time passed his altruism grew until he redirected his attention and passion to education.

He wrote several books as well as the publication of a popular magazine of the time "Magazine of Wall Street".

He felt compelled to compile the ideas he had gathered during his 40 years of Wall Street experience and bring them to the attention of the general public. I wanted to offer a set of principles and procedures about what it takes to win on Wall Street.

These rules were embodied in the 1931 course "The Richard D. Wyckoff Method of Trading and Investing Stocks. A course of Instruction in Stock Market Science and Technique" becoming the well-known Wyckoff method.

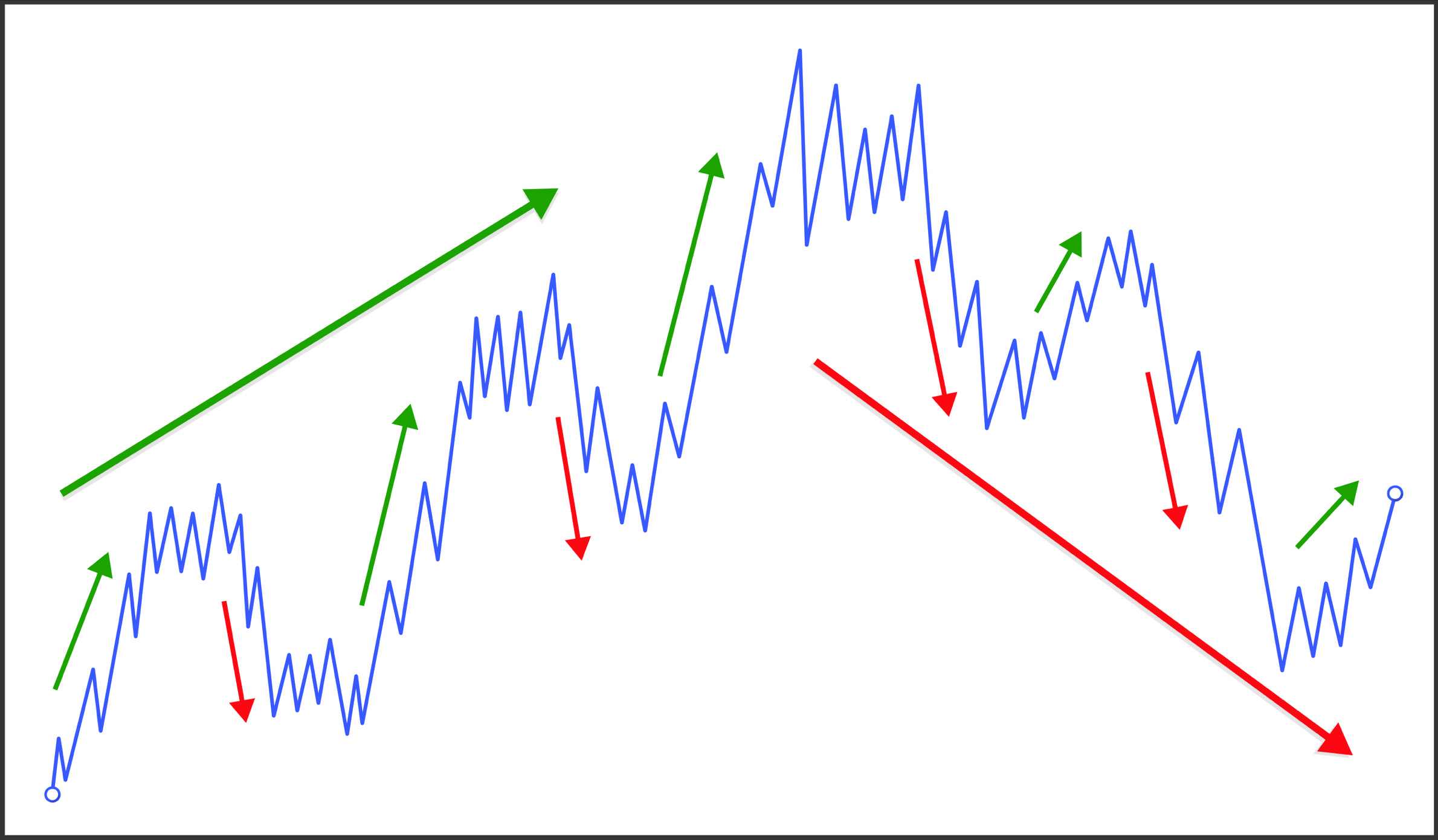

Wyckoff and the first readers of the tape understood that the movements of the price do not develop in periods of time of equal duration, but that they do it in waves of different sizes, for this reason they studied the relation between the upward and downward waves.

The price does not move between two points in a straight line; it does so in a wave pattern. At first glance they seem to be random movements, but this is not the case at all. The price is shifted up and down by fluctuations.

Waves have a fractal nature and interrelate with each other; lower grade waves are part of intermediate grade waves, and these in turn are part of higher grade waves.

Each uptrend and downtrend is made up of numerous minor uptrend and downtrend waves. When one wave ends, another wave starts in the opposite direction. By studying and comparing the relationship between waves; their duration, speed and range, we will be able to determine the nature of the trend.

Wave analysis provides a clear picture of the relative changes between supply and demand and helps us judge the relative strength or weakness of buyers and sellers as price movement progresses.

Through judicious wave analysis, the ability to determine the end of waves in one direction and the beginning in the opposite direction will gradually develop.

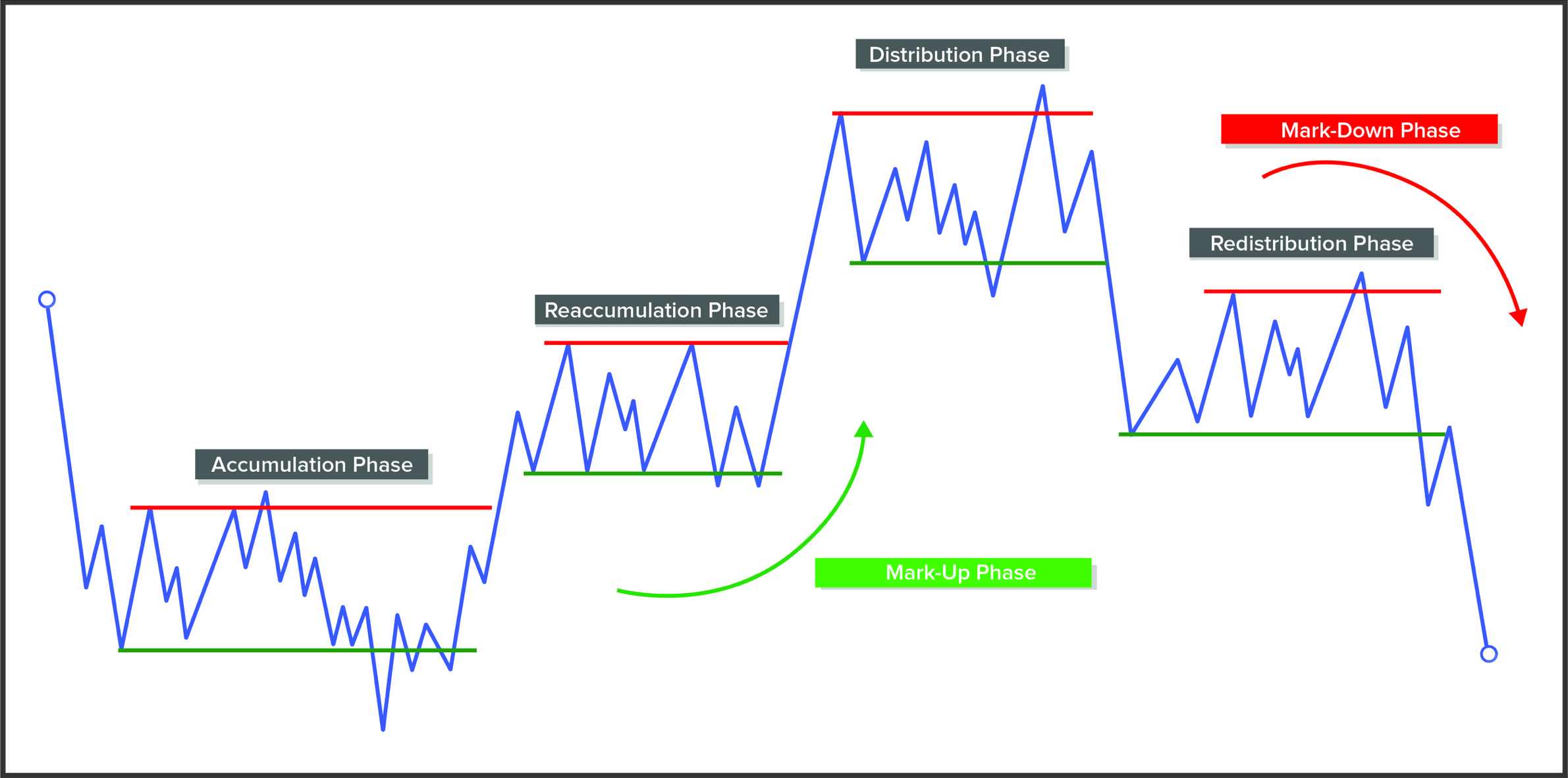

In the basic structure of the market there are only two types of training:

Trends. These can be bullish if they go up or bearish if they go down.

Trading ranges. They can be of accumulation if they are at the beginning of the cycle, or of distribution if they are in the high part of the cycle.

As we have already seen, the displacement of the price during these Phases is done by means of waves.

During the accumulation phase, professional traders buy all the stock available for sale on the market. When they are assured by various manoeuvres that there is no longer any floating bid, they begin the upward trend phase. This trend Phase is about the path of least resistance. Professionals have already verified that they will not encounter too much resistance (supply) that would prevent the price from reaching higher levels. This concept is very important because until they prove that the road is free (absence of sellers), they will not initiate the upward movement; they will carry out test maneuvers again and again. In case the offer is overwhelming, the path of least resistance will be down and the price at that point can only fall.

During the uptrend, buyers' demand is more aggressive than sellers' supply. At this stage there is the participation of large traders who are less well-informed and the general public whose demand shifts the price upwards. The movement will continue until buyers and sellers consider the price to have reached an interesting level; buyers will see it as valuable to close their positions; and sellers will see it as valuable to start taking short positions.

The market has entered the distribution phase. A market ceiling will be formed and it is said that the big traders are finishing distributing (selling) the stock they previously bought. There is the entry of the last greedy buyers as well as the entry for sale of well-informed traders.

When they find that the path of least resistance is now down, they begin the downtrend phase. If they see that demand is present and with no intention of giving up, this resistance to lower prices will only leave a viable path: upward. If you continue to climb after a pause, this structure will be identified as a reaccumulation phase. The same is true for the bearish case: if the price comes in a bearish trend and there is a pause before continuing the fall, that lateral movement will be identified as a redistribution phase.

During the downtrend sellers' supply is more aggressive than buyers' demand so only lower prices can be expected.

Being able to determine at what stage of the price cycle the market is at is a significant advantage. Knowing the general context helps us avoid entering the wrong side of the market. This means that if the market is in a bullish phase after accumulation we will avoid trading short and if it is in a bearish phase after distribution we will avoid trading long. You may not know how to take advantage of the trend movement; but with this premise in mind, you will surely avoid having a loss by not attempting to trade against the trend.

When the price is in phases of accumulation or uptrend it is said to be in a buying position, and when it is in Phases of distribution or downtrend it is said to be in a selling position. When there is no interest, that no campaign has been carried out, it is said to be in neutral position.

A cycle is considered to be complete when all stages of the cycle are observed: accumulation, uptrend, distribution, and downtrend. These complete cycles occur in all time frames. This is why it is important to take into account all the time frames; because each of them can be at different stages. It is necessary to contextualize the market from this point of view in order to carry out a correct analysis of it.

Font size:

Interval:

Bookmark:

Similar books «The Wyckoff Methodology in Depth»

Look at similar books to The Wyckoff Methodology in Depth. We have selected literature similar in name and meaning in the hope of providing readers with more options to find new, interesting, not yet read works.

Discussion, reviews of the book The Wyckoff Methodology in Depth and just readers' own opinions. Leave your comments, write what you think about the work, its meaning or the main characters. Specify what exactly you liked and what you didn't like, and why you think so.