Combining the logic of the Wyckoff Methodology and the objectivity of the Volume Profile

No part of this book may be reproduced or stored in a retrieval system or transmitted in any form or by any means, electronic, photocopying, recording or otherwise, without the express permission of the publisher.

Part 1. Advanced Concepts of the Wyckoff Methodology

As with the previous book, it is not intended at any point to divulge the Wyckoff methodology approach from its purest point of view. There may be Wyckoff traders who do but we understand that today's markets have changed substantially from those studied by Richard Wyckoff and it is our task to know how to adapt to these changes.

But if there is one thing that is unchanging and where the advantage of this approach over others really lies, it is the principles underlying its teachings. Regardless of how markets and their traders have changed, everything is still governed by the universal law of supply and demand; and this is the cornerstone of the methodology.5

This new way of analyzing the markets that I propose has caused me some discussion with well-known (purist) disseminators of the method. As I say, my objective is not to teach the most primitive form of the methodology, but to take the principles that I consider valid and enhance it together with the most modern tools of volume analysis.

Actually, I believe that disseminating Richard Wyckoff's teachings as he shared them is practically impossible. In the end, everyone teaches their own view of the methodology along with the tools they trust the most; and this is not to say that any one is above the rest. The important thing is to obtain profitability from the market regardless of the approach used.

Having said this, I am sure that if Richard Wyckoff were alive today, he himself would have taken care to evolve his own teachings to adapt to new markets. As he was at the time, he would have remained a student of volume and this would have led him to delve deeper into tools such as the Volume Profile and Order Flow.

And this is exactly what we have done and what I will introduce you to throughout the book; bringing together the most solid principles of market analysis with the most advanced tools of volume analysis.

But before we get to that point we are going to add some advanced concepts that you should know and clarify a number of frequently asked questions.

1.1 The labels

All the theoretical section seen in the first book is necessary and indispensable content to master this approach and truly understand how the market moves, but the Wyckoff methodology, or my way of understanding it, goes much further.

It is not simply a matter of labeling a chart almost robotically and that's it. We have learned what underlies each event; how it is formed, how it is represented on the chart, the psychology behind it and so on. But as I say, the method is much richer.

I say this because, by the very nature of the market, it is practically impossible for any two structures to be completely the same. While it is true that on a daily basis we see "textbook" schemes, which are very genuinely adapted to classic examples, on most occasions the market will develop less conventional structures, where the identification of such events will be more complex.

It is therefore essential not to focus on the exact search for events (mainly the stop events that make up Phase A) and to keep in mind that what is really important is the action as a whole. In other words, in many charts we will see that a trend movement stops and starts a lateralization process, but we are not able to correctly identify those first 4 stopping events. In view of this, we may discard the asset and miss a future trading opportunity. This is a mistake. As I say, the important thing is not that we know how to identify those 4 stop events, but that the market has objectively produced the stop of the trend movement. You may not identify the Climax, the Reaction and the Test in a genuine way, but the objective is that the market has stopped and has initiated a change of character (migration from trend to sideways).

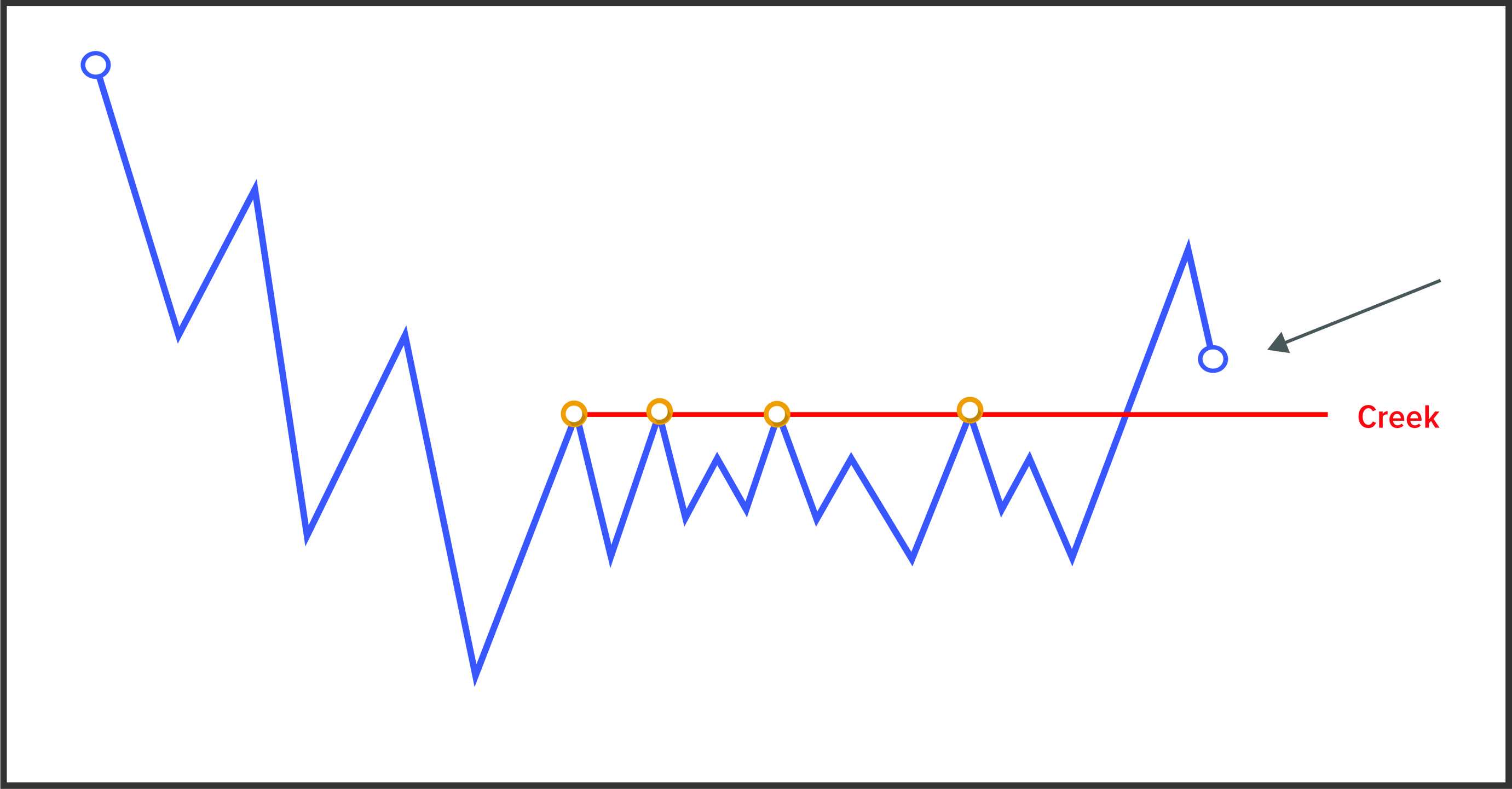

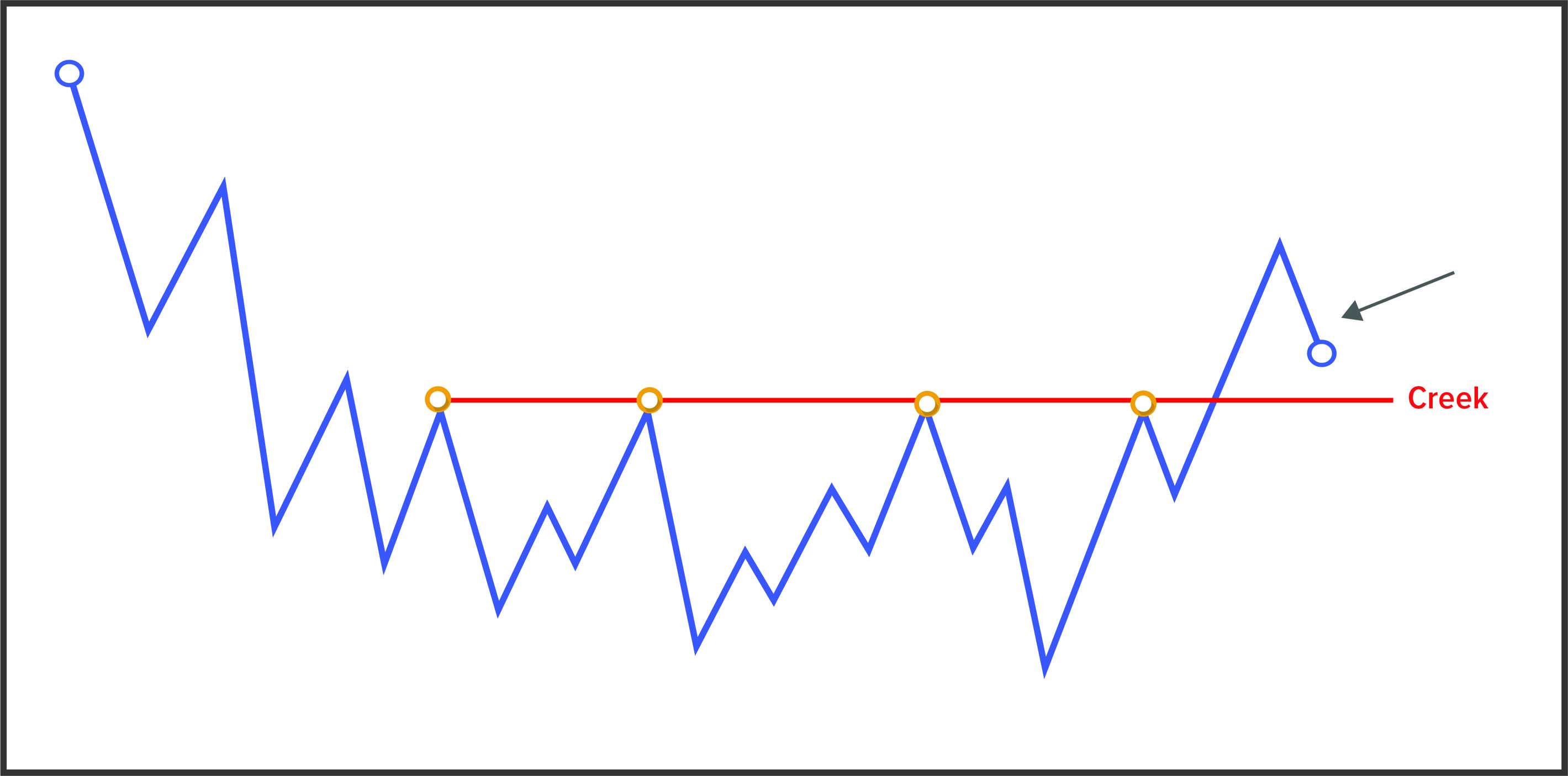

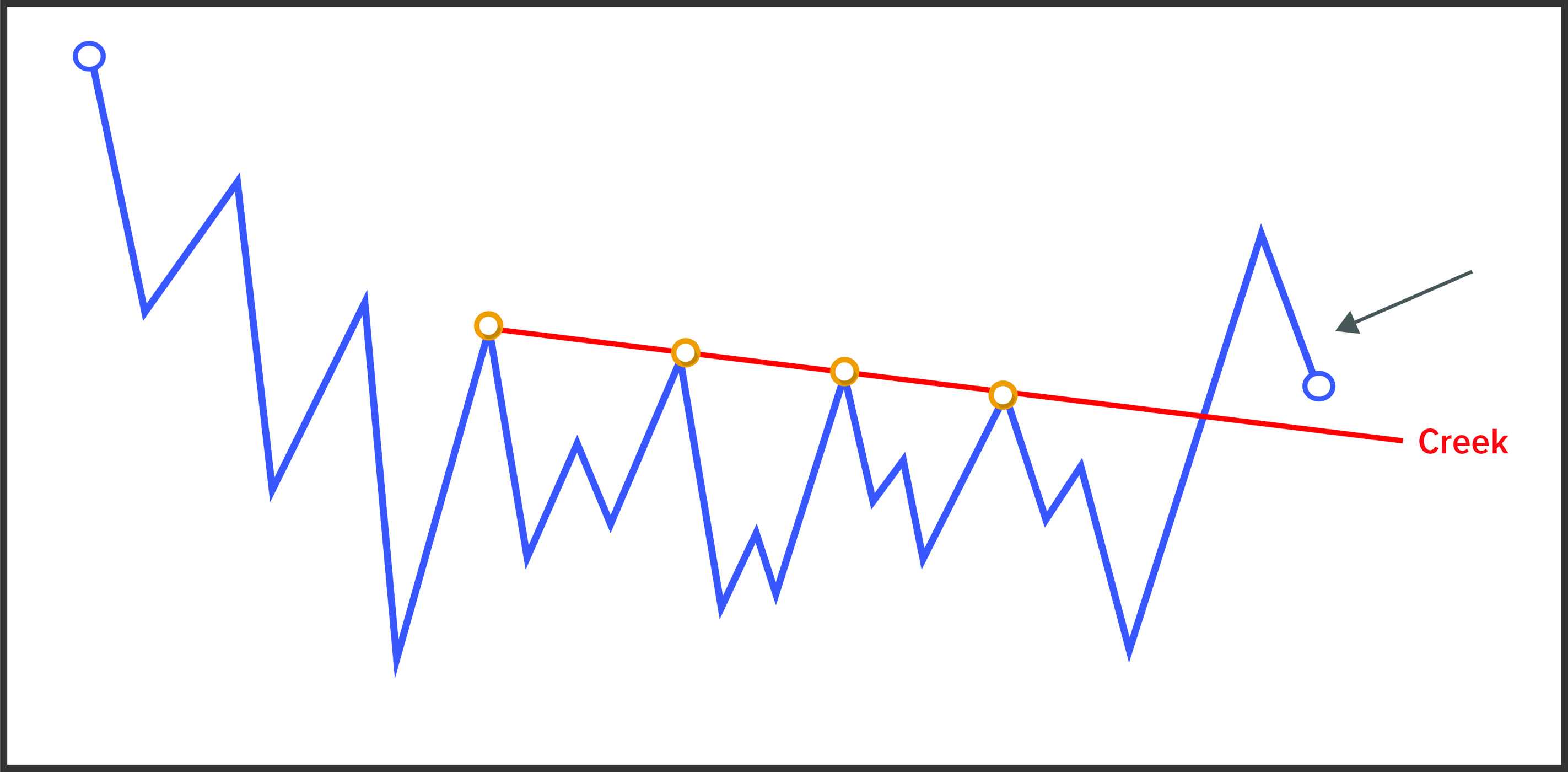

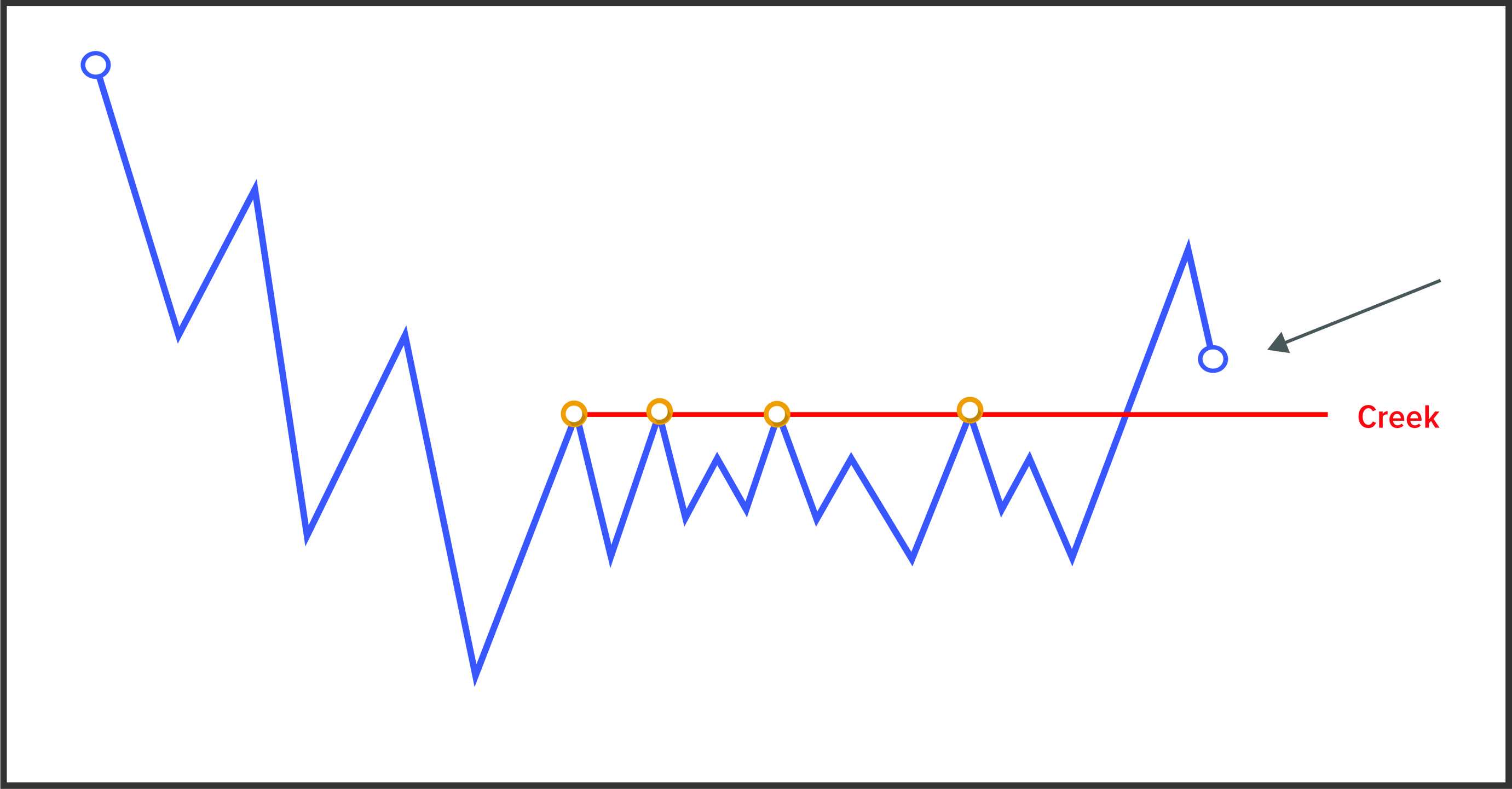

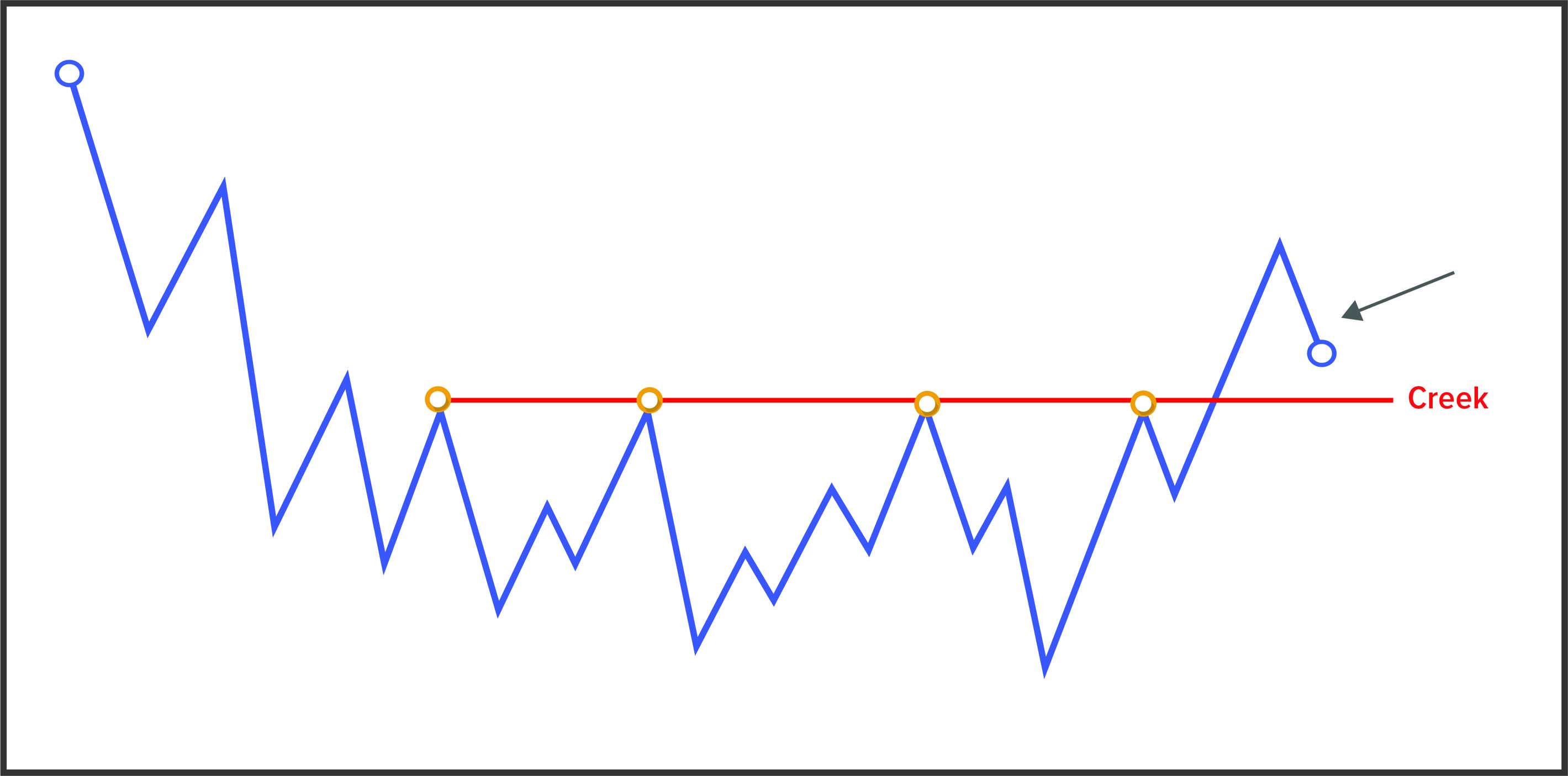

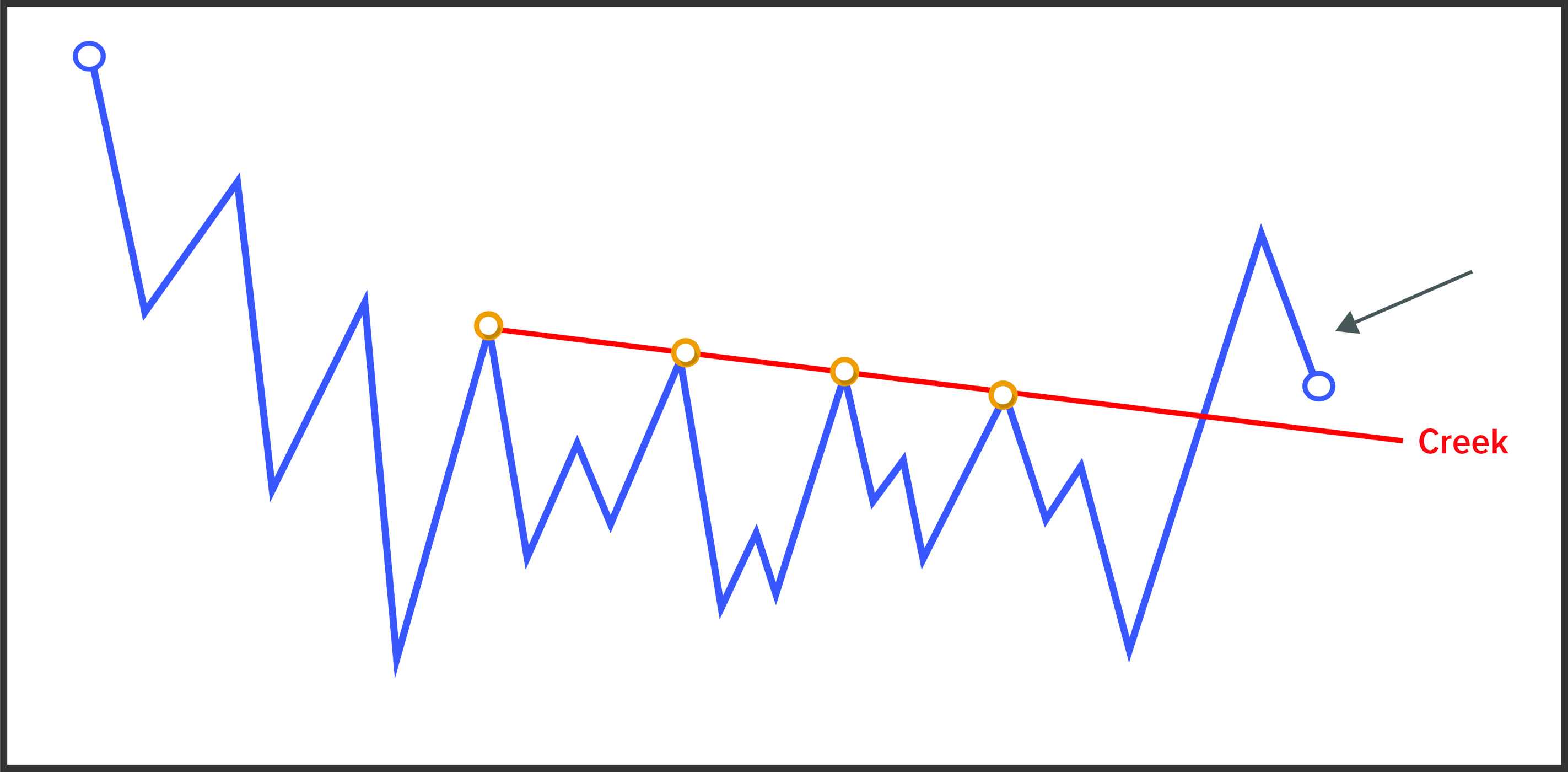

As we can see in the examples, although these structures do not look anything like the classic structures already studied, if we open the graph and we find ourselves at the point marked with the arrow, it is not unreasonable to think that possibly a process of accumulation has developed below. It will be more or less difficult to identify the events of the methodology, but what is objective is that we see a level where the price is that we see a level where the price has rejected on several occasions (Creek) and has finally managed to break it and position itself above. This is the key.

Surely if we force ourselves we can label each and every movement but I repeat that this is not the important thing. The important thing about the methodology is the logic behind it: that for the price to go up there must first be an accumulation; and for it to go down there must be a distribution. The form or manner in which they develop these processes should not be the determining factor.

The level of open-mindedness required is very great. Maybe even some people's heads have exploded, but this is the reality. Fortunately, we often see classic structures, but the continuous interplay between supply and demand means that these processes can develop in infinite ways, and we have to be prepared to see them all the same.

Rather than thinking about labeling each and every price movement, we are going to focus on trying to identify according to the traces we observe who is probably gaining market control based on the theory studied.

1.2 Price vs. Volume

In our way of conceiving market analysis, we initially do not value the possibility of not taking into account either of these two data points, price and volume. But as you delve deeper into the ecosystem that surrounds the financial world, some obstacles start to arise.

Without beating around the bush, I have to say that in my view price data is certainly more relevant than volume data. And I will now reason this assertion on the basis of two elements.