HOW I

TRADE AND INVEST

IN STOCKS AND BONDS

Being Some Methods Evolved and Adopted During My Thirty-Three Years Experience in Wall Street

BY

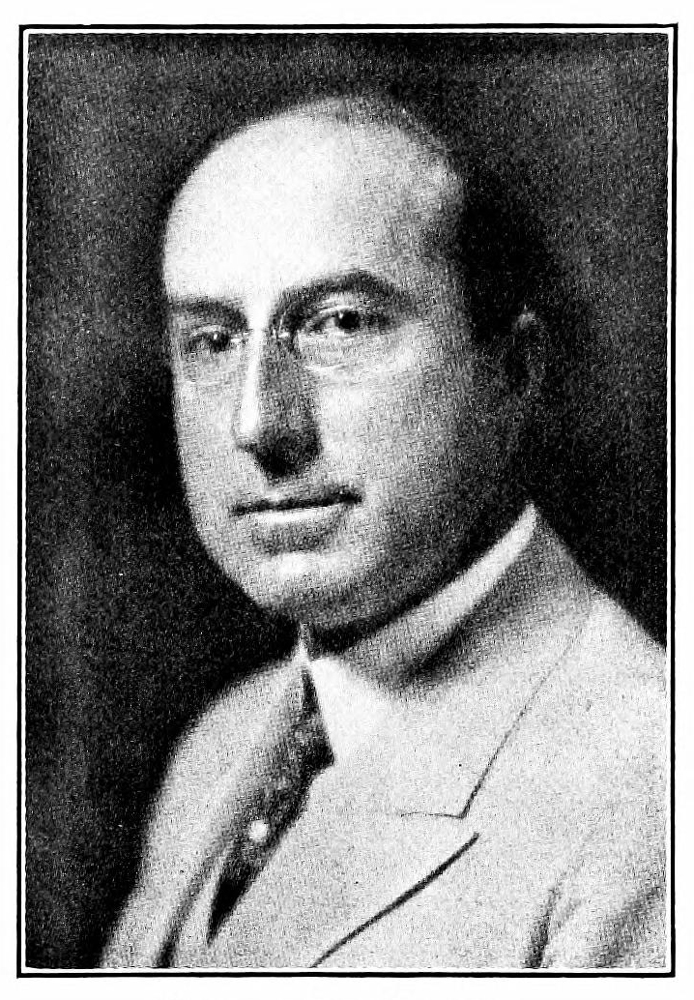

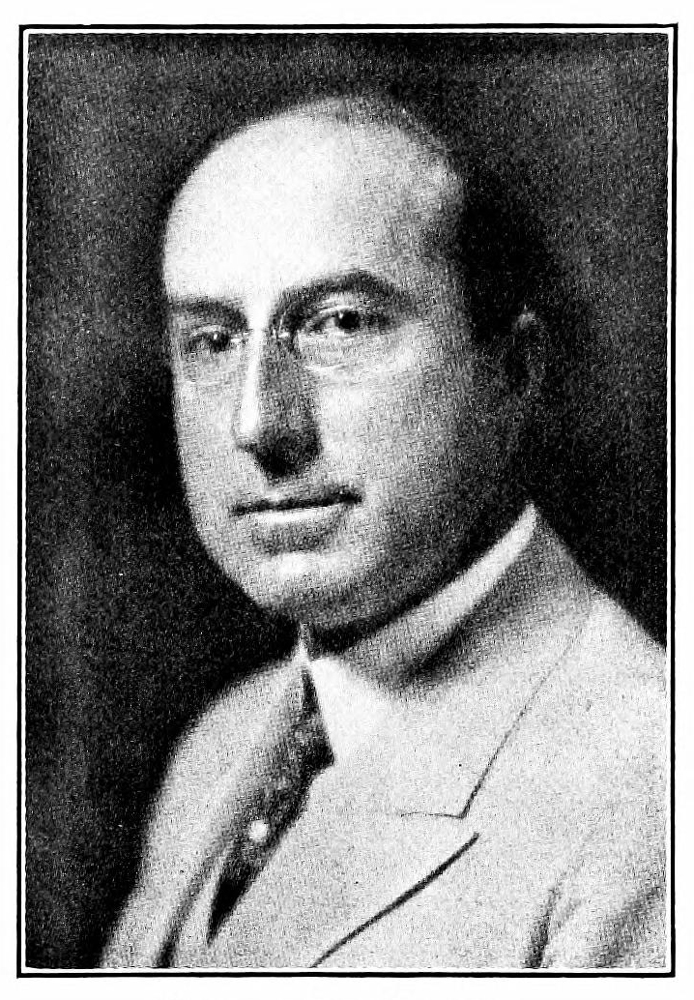

RICHARD D. WYCKOFF

Published by Left of Brain Books

Copyright 2021 Left of Brain Books

ISBN 978-1-396-32217-4

eBook Edition

All rights reserved. No part of this publication may be reproduced, distributed, or transmitted in any form or by any means, including photocopying, recording, or other electronic or mechanical methods, without the prior written permission of the publisher, except in the case of brief quotations embodied in critical reviews and certain other noncommercial uses permitted by copyright law. Left of Brain Books is a division of Left of Brain Onboarding Pty Ltd.

Table of Contents

Richard D. Wyckoff

We succeed in proportion to the amount of energy

and enterprise we use in going after results

Foreword

During the last thirty-three years I have been a persistent student of the security markets. As a member of several Stock Exchange firms, as a bond dealer, trader and investor, I have come into active contact with many thousands of those who are executing orders and handling markets, as well as those who deal in such markets, namely traders and investors.

For the past fifteen years I have edited and published The Magazine of Wall Street, which at this writing has the largest circulation of any financial publication in the world.

These experiences have given me an opportunity to study not only the stock and bond markets, but all those related thereto, and have enabled me to observe the forces which influence these markets and the human elements which contribute so largely to their activity and wide fluctuations.

Out of this experience I have evolved or adopted or formulated certain methods of trading and investing, and some of these I have collected and presented in the pages which follow.

My purpose in preparing this book has been two-fold. Primarily, I have in mind the thousands of new investors who find the securities market a vast, technical machine, too complex to be understood by many. It has been my effort to do away with this impressionto emphasize the fact that, in Wall Street as anywhere else, the chief essential is common sense, coupled with study and practical experience. I have attempted to outline the requirements for success in this field in a way that will be understandable to all.

Furthermore, as I learned in preparing my first book, Studies in Tape Reading, it is of great personal advantage for me to write out and thus clarify and crystallize in my own mind the principles upon which I endeavor to operate. And so, from both standpoints it seemed to me well worth while to arrange my impressions in methodical and coherent order.

Richard D. Wyckoff .

Great Neck, L. I.

March, 1922.

I hold that a man who is long headed, who foresees and judges accurately, has an advantage over his neighbor, and it is not accounted immoral for him to use that advantage because he is individually better fitted for the business; and it inheres in him by a law of nature, that he has a right to the whole of himself legitimately applied. If one man, or twenty men, looking at the state of the nation here, at the crops, at the possible contingencies and risks of climate, at the conditions of Europe; in other words, taking all the elements that belong to the world into consideration, be sagacious enough to prophesy the best course of action, I dont see why it is not legitimate.

Henry Ward Beecher.

I

First Lessons

At the suggestion of my first employer in Wall Street, I began the study of railroad and other corporation statistics about the time my trousers were being lengthened from knee to ankle and I was receiving the munificent sum of $20 per month. This was in 1888.

With numerous interruptions my studies continued until 1897, when I began to put them into practice by purchasing one share of St. Louis & San Francisco common at $4 per share. At that time some of the other leading stocks were selling at the following prices: Union Pacific 4, Southern Pacific 14, Norfolk & Western 9, Atchison 9, Northern Pacific 11. Reading 17. To put it mildly, prices were very low. Many roads were just emerging from, or were still in, receivership, and Irish dividends were the rule.

As I saved a little money I began to buy more one share lots and finally I became such a pest in this respect that the Stock Exchange firm which I favored with my orders said they didnt care for the business, whereupon I decided to buy more shares, of fewer varieties.

This is the way most people begin their operationsby purchasing outright, believing that they are safe. It is true they are safe in the possession of their certificates once they have them in their safe deposit boxes, but in no other respect. They are not safe against fluctuations or shrinkages in value or earning power. Nevertheless, if their securities are well selected, and bought at the right time, the chances are strongly in favor of their making money.

It was my practice about that time to sit up nights, read the financial papers, and study probably future values of securities, and when I didnt have money enough to buy, I would make my selections just the same and write my imaginary purchases in a book with reasons alongside why they should ultimately be worth more money. Two of these I still retain in my memory, viz., Chicago, Burlington & Quincy at 57, and Edison Electric Illuminating of New York, at 101.

I mention these incidents because they illustrate a very good way for anyone to begin to learn the business of trading and investing in securities. Just as in any other line it is practice that makes perfect, and most of the fatalities in Wall Street can be traced to lack of practice. You dont have to risk real money when you are learning, and I always advocate two or three years not two or three months, mind youof this kind of study and paper practice when one is seriously considering participation in this greatest of all games.

But study and practice are the two things farthest removed from the minds of the majority. Everyone knows that people who engage in speculation for the first time do not want to bother with such details. The average man who comes to Wall Street comes to speculate, although he may pay in full for his purchases. All he asks is to be told something good. That is not speculation, it is gambling; for speculation, to quote Thomas F. Woodlock, involves the use of intelligent foresight. Most people use neither foresight nor intelligence.

It might seem to the reader a long while to wait, but in my case I did not begin to invest until eight years after I started to study, and I did not commence trading for six years after that, so it may be admitted that I went to school and got a foundation knowledge which has been of inestimable value.

In connection with my one share purchases I found that although I had correctly figured financial conditions and earning power of the companies whose securities I held, their prices would often fluctuate widely as a result of general market conditions. In other words, a stock might go down, although everything in the way of intrinsic value and future possibilities pointed upward; so I made up my mind that there were other factors to be considered and found that these were principally three, viz., manipulation, technical conditions and trend of the market.

Next page