This publication is designed to provide competent and reliable information regarding the subject matter covered. However, it is sold with the understanding that the author and publisher are not engaged in rendering legal, financial, or other professional advice. Laws and practices often vary from state to state and country to country and if legal or other expert assistance is required, the services of a professional should be sought. The author and publisher specifically disclaim any liability that is incurred from the use or application of the contents of this book.

About the stories in this book: Stories that list a person by first and last name are stories of actual individuals who have agreed to share lessons they have learned with our readers. All other stories are fictional. Any resemblance to real persons, living or dead, is purely coincidental.

If you purchase this book without a cover you should be aware that this book may have been stolen property and reported as unsold and destroyed to the publisher. In such case neither the author nor the publisher has received any payment for this stripped book.

Copyright 2015 by Garrett Sutton, Esq. and Gerri Detweiler. All rights reserved. Except as permitted under the U.S. Copyright Act of 1976, no part of this publication may be reproduced, distributed, or transmitted in any form or by any means or stored in a database or retrieval system, without the prior written permission of the publisher.

Published by SuccessDNA, an imprint of Brisance Books Group LLC

Success DNA, Inc.

2248 Meridian Boulevard, Suite H.

Minden, Nevada 89423

The opinions of the authors reflect their judgment at the time of publishing and are subject to change. Neither the authors nor the publisher are responsible for the accuracy of this data. This book is distributed for informational use only; it does not constitute legal, tax or professional advice and should not be used as such.

Table of Contents

Acknowledgements

The authors would like to thank the following people for their insights and contributions to this book: Dave Archer, Grayson Bell, Libby Bierman, Robin Bramman, Ali Brown, John Cambier, Adam Cohen, Aaron and Kathy Corr, Jan Davis, Jeff Desich, Chris Kelley, Levi King, Shaun Merriman, Julia Pimsleur, Mark Pinskey, Emily Chase Smith, Tom Trafficante, Claudia Viek, Brian Ward, Michael Weiss, and Tom Wheelwright.

Your assistance is greatly appreciated.

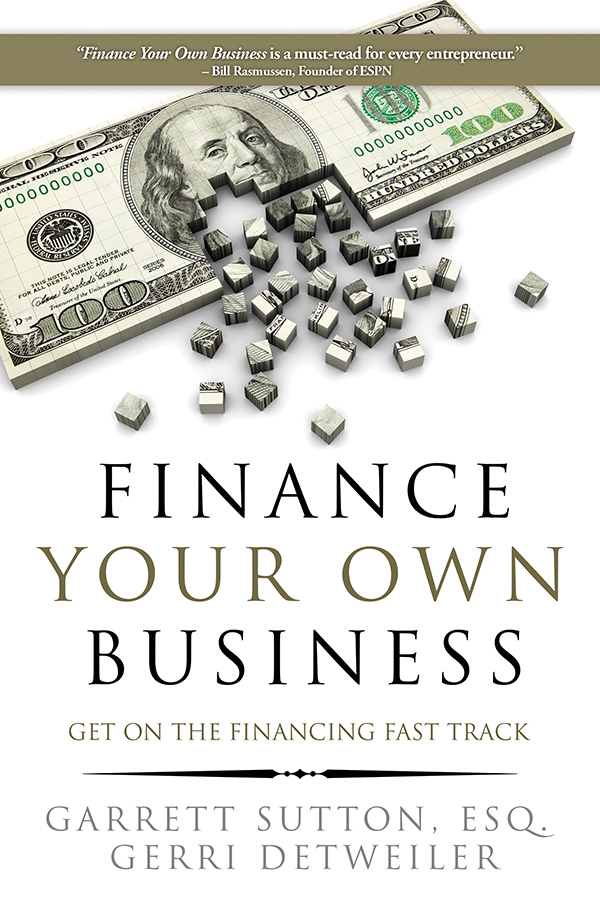

Books by the Authors

Garrett Sutton

Start Your Own Corporation

Run Your Own Corporation

The ABCs of Getting out of Debt

Writing Winning Business Plans

Buying & Selling a Business

Loopholes of Real Estate

How to Use Limited Liability Companies and Limited Partnerships

Gerri Detweiler

Debt Collection Answers: How to Use Debt Collection Laws to Protect Your Rights

Reduce Debt, Reduce Stress: Real Life Solutions for Solving Your Credit Crisis

The Ultimate Credit Handbook

Invest In Yourself: Six Secrets to a Rich Life

Foreword

By Ali Brown

When I started my business in New York in 1999, I was broke. My credit was terrible, and I had tons of debt. But it didnt stop me. In fact, I believe it helped propel me to success. Why? Because I had no other choice. Not only did I want to make money fast, I needed to!

And that drive led me to an incredibly successful entrepreneurial career as well as an Inc 500 ranked enterprise sharing leadership and business strategies with other women business owners.

By definition, entrepreneurs are risk takers. Just by picking up this book, I know something about you: You have dreams that are probably much bigger than your bank account. You know you are more than your credit score. And you are ready to turn your dreams into reality no matter what they say.

You dont have to get a small business loan to start a business, but there are times when access to credit can be an asset. If you are going to get a loan or raise money through crowdfunding, you want to be smart about it. And thats what this book will help you do.

Since launching my business over fifteen years ago, Ive had the privilege to work with thousands of entrepreneurs from all kinds of backgrounds. One thing Ive learned and share with them is that it is critical to have mentors and coaches; smart people who can help you fill in the gaps and avoid pitfalls.

Garrett Sutton is one of those people in my network. Hes a corporate attorney with a passion for helping entrepreneurs. With his co-author Gerri Detweiler, a nationally recognized credit expert, he has created this guide to help you navigate the sometimes rough waters of financing a business.

If you are like me, you arent willing to wait until conditions are perfect for starting your business. You want to dive in now. Finance Your Own Business will give you lots of strategies for raising the money you need to get off the ground or take your business to the next level. I wish I had this kind of information when I got started!

~Ali Brown, Leading Entrepreneur, Mentor, Angel Investor, www.AliBrown.com

Part One: Finding Financing

Overview

A Tale of Two Business Start Ups

Mike, Jan and Liz had worked their way up the ladder at the PR firm where they landed after college.

Talented and hardworking, they loved their jobs in the beginning. But as the company grew and they moved up the ranks, they found themselves in endless meetings, scheduling more endless meetings. When a much larger agency acquired the firm, they pictured more endless meetings. All three of them decided to take their severance money and pursue other opportunities.

Starting with his $50,000 severance pay Mike built his PR firm into a boutique agency billing over $5 million a year. Creative and personable, Mikes reputation and company grew quickly. As it did, he found himself constantly putting out firesand all too often, they were financial fires.

Many of his clients were Fortune 500 companies that paid well, but slowly. Sometimes, it took six months to collect from them. The larger the client company, it seemed, the longer it took to get paid. In the meantime, he had to keep paying salaries and overhead. More than once, he threw expenses onto his personal credit cards. And he missed a payment more than once because he was too busy to notice when the bills were due. His interest rates on his credit cards were now all in the double digits.

One day, Mike was contacted by a company that told him they could factor his firms receivables. The pitch was attractive: Get paid for work right away, and let someone else worry about collecting on the invoice. The cut he had to give the factoring firm shaved a little more off his already thin margins, but at least he was making payroll.

Then the bank where he held his business accounts, including his operating line of credit, was sold. The line of credithis lifelinewas cut, because he didnt meet the new banks credit criteria. Now he didnt have the funds he needed to float him between client payments, and it looked like his business might not make it. In his moment of desperation, he received a call from one of the bigger firms. They were looking for companies to acquire and were interested in his.

Like Mike, Jan and Liz joined together to start their own PR firm at the same time. They each took $15,000 from their severance pay and parked the $30,000 in their business bank accounts, agreeing not to spend it except in an absolute emergency. Both women had excellent credit ratings, and wanted to keep them strong. On advice from their CPA, they carefully researched the business credit building process so they wouldnt run into the cash flow problems the CPA had seen so many of his clients encounter.