Note on the Ebook Edition For an optimal reading experience, please view large

tables and figures in landscape mode. |

This ebook published in 2011 by

Kogan Page Limited

120 Pentonville Road

London N1 9JN

UK

www.koganpage.com

Paul Barrow, 2004, 2009

E-ISBN 978 0 7494 5565 1

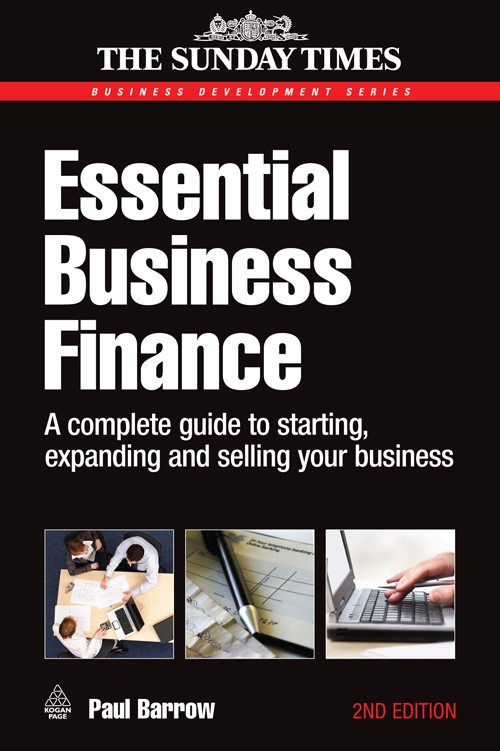

Contents

Please read the chapters in this book in any order you wish. It is not a novel, which relies on introducing the characters, building up the story and finally (hopefully) bringing it all to some exciting conclusion. Each chapter is complete in itself and does not rely on your having read an earlier chapter to make sense of it. I did think long and hard about the order of this book and maybe should have had the courage of my original convictions. However, I have opted for the more chronologically correct sequence of events: growing, grooming, selling . A large part of the book is devoted to grooming your business for sale and selling it. I make no apology for this because this is the logical end goal for most people who own a business. However, I have not entirely ignored using finance to fund value-adding growth activities.

My belief is that the best way to understand anything is to read a bit that explains how something is done, then see how another business did the same thing, and then finally reflect on your own business to see if this course of action is appropriate and how you will do it. A chapter may, for example, take as its theme equity funding. The first part of the chapter will discuss the issues, the options, the pros and cons, etc. This may then be illustrated with a real life example what they did, where it worked for them and maybe where it did not. Finally the chapter will be rounded off with a summary and advice for your business to follow.

At the back of this book you will find a Glossary, which defines and explains the more technical words or expressions used in the book just in case you have forgotten them. There is also a Sources of help section in which I have provided contact details for a whole raft of people and organisations that may be of use to you. You may feel confident to do most things yourself in the normal course of business but in some aspects of grooming and selling a business it does improve the process and increase your chances of success if you use the right specialists.

A few words of encouragement. I make my living helping owner-managers maximise the value in their businesses. One business that I had the pleasure of helping (it is mentioned in this book) had just over a year ago pulled out of negotiations to sell at the due diligence stage. It was a painful process and the asking price of 3 million was unachievable. Less than one year later with quite a small amount of help from me they had groomed the business for sale, prepared a killer information memorandum and sold the business for 8 million cash all paid on completion. The sale process took less than two months and due diligence was completed painlessly in 10 days. Let this example be an encouragement to you. If this book helps you to achieve what you want from you business then we both will be very happy people. Good luck.

I dont want this to sound like a gushy Oscar acceptance speech but I do want to thank three distinct groups of people who have helped me substantially in the preparation and writing of this book.

First I would like to thank all the presenters and delegates on both the numerous Warwick Business School and Cranfield University programmes that I have been involved with over the last 15 years. Over this period I have seen some 500 business people pass through such programmes as the Business Growth Programme, Management Development Programme, and more recently the Value Forum. They have all been an inspiration to me both in the expertise that they have shared and the insight that they have given into their respective businesses. They have all had stories to tell, some of which I have been able to use in this book.

Next I would like to thank the handful of businesses that have allowed me to use them as case studies throughout this book just over 20 in total. Some of these have provided me with some most intimate details of their business life. In many cases I have used their real names but in some cases I have felt it better to provide a degree of anonymity. However, all their experiences are relevant and help to illustrate many of the points and lessons to be learnt from the process of using other peoples money to grow and ultimately sell businesses.

Finally I would like to thank those closer to home who have had to put up with me writing what must have appeared like a never-ending series of books over the last 18 months or so in fact it has been only three books. Rachel, thank you for putting up with a husband who is forever bashing away on the laptop trying to make sure I get my daily quota of 2,000 words written. You have always been encouraging and supportive. To Mark, my son, I extend a massive thanks for telling all your mates, so proudly, about his dad the writer and getting them to beg, borrow or steal (or even buy) my books. Keep up the good work Im proud of you. For both of you I have some bad news though I feel another book (or two) coming on.

If you have suffered the misfortune of reading books on growth, finance and business planning (and for my sins I have written books on most of these) you may have wondered where the book is that shows you how to put together a strategy to grow the value of your business, and ultimately sell it. Not just a textbook that talks about the theory there are plenty of those but a book that tells you how it really is and how it has (or has not) been done by some real businesses. This book is almost a work of faction it mixes fact with fiction. The facts are the in-depth knowledge of how to raise money (every conceivable method legal and otherwise) at the right time for your business to grow its value (not just its size); how to groom your business for sale and sell it for the best price possible; the experiences of some real life businesses that have been down this route. The fiction is that the names (both company and individuals) have been changed mostly to respect their privacy otherwise they would never have spilled the beans to me.

There are three main threads to this book: growing, grooming and selling. The first is concerned with developing a financial strategy for your growing business (growing).

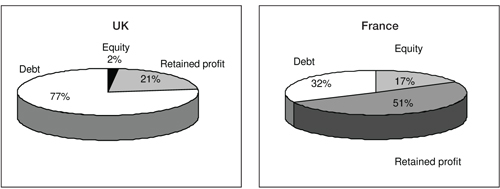

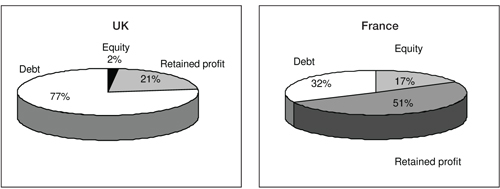

There is an old expression that says that any port in a storm will do. Many UK businesses find that the storm drives them towards the same old port for money the bank overdraft. But what do our European competitors do? Surveys have shown that they use a far wider range of finance. The survey data in were compiled by 3i/Cranfield European Enterprise Centre and compare how UK and French small and medium-sized enterprises (SMEs) were funded. They make very interesting reading.

The figures show quite clearly that while UK SMEs used predominantly bank borrowing (77 per cent) our French competitors were far less reliant on the banks (32 per cent). In difficult times, such as recessions, this gives the French a quite clear advantage far fewer loan repayments to make when profits are low.

Figure 0.1 How SMEs are funded in the UK and France