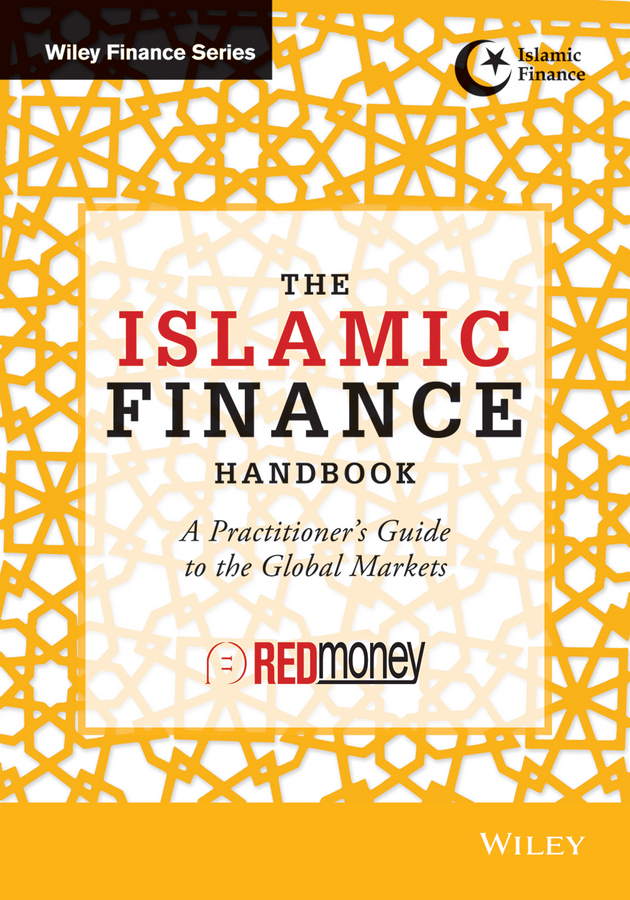

The Wiley Finance series contains books written specifically for finance and investment professionals as well as sophisticated individual investors and their financial advisors. Book topics range from portfolio management to e-commerce, risk management, financial engineering, valuation and financial instrument analysis, as well as much more. For a list of available titles, visit our Web site at www.WileyFinance.com.

Founded in 1807, John Wiley & Sons is the oldest independent publishing company in the United States. With offices in North America, Europe, Australia, and Asia, Wiley is globally committed to developing and marketing print and electronic products and services for our customers' professional and personal knowledge and understanding.

Cover image: pseudopixels/iStockphoto.com

Cover design: Wiley

Copyright 2014 by John Wiley & Sons Singapore Pte. Ltd.

Published by John Wiley & Sons Singapore Pte. Ltd.

1 Fusionopolis Walk, #07-01, Solaris South Tower, Singapore 138628

All rights reserved.

No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as expressly permitted by law, without either the prior written permission of the Publisher, or authorization through payment of the appropriate photocopy fee to the Copyright Clearance Center. Requests for permission should be addressed to the Publisher, John Wiley & Sons Singapore Pte. Ltd., 1 Fusionopolis Walk, #07-01, Solaris South Tower, Singapore 138628, tel: 65-6643-8000, fax: 65-6643-8008, e-mail: .

Limit of Liability/Disclaimer of Warranty: While the publisher and author have used their best efforts in preparing this book, they make no representations or warranties with respect to the accuracy or completeness of the contents of this book and specifically disclaim any implied warranties of merchantability or fitness for a particular purpose. No warranty may be created or extended by sales representatives or written sales materials. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Neither the publisher nor the author shall be liable for any damages arising herefrom.

Other Wiley Editorial Offices

John Wiley & Sons, 111 River Street, Hoboken, NJ 07030, USA

John Wiley & Sons, The Atrium, Southern Gate, Chichester, West Sussex, P019 8SQ, United Kingdom

John Wiley & Sons (Canada) Ltd., 5353 Dundas Street West, Suite 400, Toronto, Ontario, M9B 6HB, Canada

John Wiley & Sons Australia Ltd., 42 McDougall Street, Milton, Queensland 4064, Australia

Wiley-VCH, Boschstrasse 12, D-69469 Weinheim, Germany

ISBN 978-1-118-81441-3 (Hardcover)

ISBN 978-1-118-81442-0 (ePDF)

ISBN 978-1-118-81443-7 (ePub)

ISBN 978-1-118-93686-3 (oBook)

Foreword

Four decades ago, it was a strange thought, but now it has emerged as a wonderful reality. I am referring to Islamic finance.

Indeed, it is a newly born but very fast growing industry in comparison to its counterparts. Islamic banking does not have a history spread over centuries, but its core principles were entrenched in seventh century AD. In fact, its roots are as deep as the roots of humankind itself, because Islamic banking is based on divine valuesthe values of justice and fairness that the God Almighty has ordained no sooner than he created man.

Islamic finance has become a vital and growing reality and is based on divine guidance, which has no room for injustice, discrimination, nontransparency, and greed among human beings; it is fully in synch with the laws of nature.

The journey of Islamic finance is quite fascinating, and is indeed very beneficial as it is about applying a viable alternative to the conventional banking and finance industry, which is fast losing trust due to successive crises that are forcing people to write off their lending to conventional financial institutions.

Throughout this book, you will see the shining present and promising future of Islamic finance all over the world. Although there are regulatory issues (which were raised by some of the authors), political and economic challenges (as also highlighted by the respected authors), and lack of awareness and misconceptions by the general public, the future is bright and the opportunities outweigh the challenges as gathered by almost all of the authors.

On one hand, Michael T. Skully discusses in detail the potential of the Islamic finance industry in Australia, which has the fourth-largest fund management industry in the world and has recently started to offer Islamic products. On the other hand, Hatim El-Tahir presents Bahrain as a global leader in the cross-border international sukuk market.

With regard to Bangladesh, a Muslim-dominated country, Abdul Mannan establishes that the Islamic finance industry is experiencing faster growth than its conventional counterpart. He concludes that sukuk may constitute a strong and sustained capital market instrument for quickly transforming Bangladesh into a middle-income country.

A write-up on Brunei explores a few areas in which Islamic financial instruments can work efficiently; the authors of that chapter see a fresh impetus to rekindle the spirit of Islamic finance in the Abode of Peace.

Wang Yongbao Ahmed Musa describes the efforts made to introduce Islamic finance industry in China, and Jeffrey Graham establishes Islamic finance as one of the most rapidly growing segments in Canada, with Toronto possibly emerging as a North American center for Islamic finance.

Egypt had experienced some primitive form of Islamic banking in mid-1960s, but due to political reasons it did not continue, and Hegazy and Azmy discuss in detail the reasons behind such deadlock and conclude that the challenges in Egypt are not insurmountable.

The chapter on Hong Kong by Anthony Chan and Jee Lee suggests that participants in the Islamic finance market not overlook role of Hong Kong as being an excellent financial infrastructure and gateway to mainland China.

In India, the situation is different, as the potential for the industry to grow is immense and the existence of Shari'ah-based funds is very limited. Jayesh explores many positive factors for the growth of Islamic finance in India. I personally believe India will be the next big place for Islamic finance, although it may not be called as such.

In Indonesia, the Islamic banking industry is on a much higher growth trajectory than that of the rest of the world's Islamic banking industry, and Rifki Ismal discusses in detail the current situation of Islamic banking in that country.

Farhad Nili opines that Iran has been a pioneer in both the theoretical and the operational aspects of Islamic banking, but it has not been well introduced abroad due to the lack of constructive interaction of the country with the world's largest Muslim population.

Etsuaki Yoshida presents a comprehensive picture of Islamic finance in Japan.

Islamic finance in Jordan started in 1978 with 2 million dinars, which has increased to 125 million dinars. Khawla Al Nobani shares her analytical views toward this growing market.

While discussing the Islamic finance situation in Kazakhstan, Yerlan Alimzhanuly Baidaulet highlights the role of UAE as well as IDB Group in the empowerment of the Islamic finance industry in that country.

In Kenya, Islamic finance is a relatively new concept, but the country is looking to be the Islamic financial hub of East Africa. Rahma Hersi discusses many practical concerns, which must be given due consideration.

Next page