Follow Price Action Trends

By Laurentiu Damir

Copyright 2012 Laurentiu Damir

Allrights reserved. No part of this book may be reproduced or transmitted in anyform or by any means, electronic or mechanical, including photocopying,recording, or any information storage and retrieval system, without priorwritten permission of the Author. Your support of authors rights isappreciated.

Table of contents

This is a forex systembased solely on reading the price action. It is a trend following system thatfocuses on points in the market where the trend is about to change itsdirection, enters the market trying to ride the newly formed trend all the wayto its finish line. By doing this in the correct way, this system has thepotential to deliver thousands of pips in the long run because shortly after atrend ends, usually another one emerges preceded by a small period ofconsolidation. It sounds simple, but the key component of this price actionsystem is to correctly identify the current trend, know when a change indirection of the trend is about to take place and then manage the newdeveloping trend in a way that allows you to ride it until it ends. All of thisis done by carefully reading the price action without the use of any technicalindicators, magical formulas and other nonsense like that.

This is not a veryeasy thing to do as you must pay great attention to every single detail of theprice action, but once you get the hang of it trading this way will make youvery profitable in the long run. This book explains with very great detail allof the above and gives you the complete trading system with clear entry, stoploss and exit rules, rules that if respected to the letter, can bring youhundreds of pips for every trade you make. Let us move on now to the core partof this forex system which is the trend.

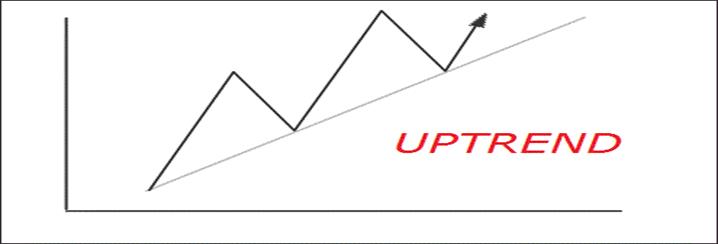

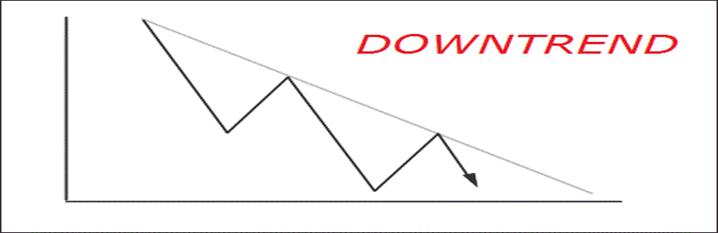

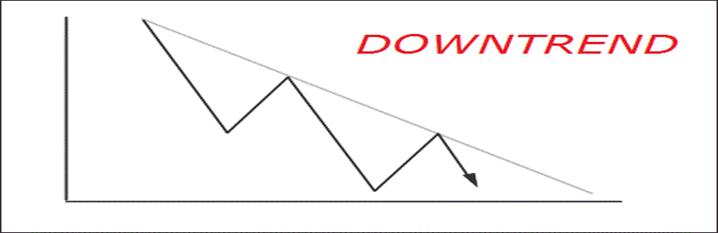

Youve probably hearda million times by now the saying the trend is your friend. Well, youveheard it because it is true, if you want to be profitable in trading you mustalways know what the trend is because the trend signifies strong convictionfrom the vast majority of market participants that the fair price, fair valueof a specific currency pair should be above or below the current level at thattime so they all join forces and push the price up or down creating a trendthis way. But let us see what a trend actually is from a technical point ofview. A trend is a series of impulsive strong moves in one direction, each ofthem followed by small corrections or retracements. Lets visualize a textbooktrend:

We have in the abovepictures an ideal uptrend and a downtrend. As you can see they consist ofstrong directional moves followed by smaller moves in the opposite directionwhich are in fact formed by traders taking some profit from their positions.This alternation of impulsive moves with correctional ones gives birth to whatare known as the highs and lows of a trend.

For an uptrend thehigh is formed when the correctional move starts and the low is where the samemove ends and price resumes the trend. For a downtrend things work the otherway around meaning that a low is formed at the beginning of a correction and ahigh takes form at the end of the same correction and price resumes thedowntrend.

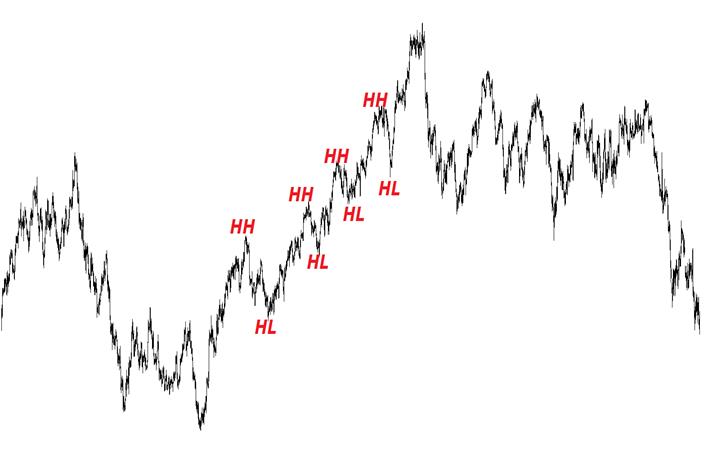

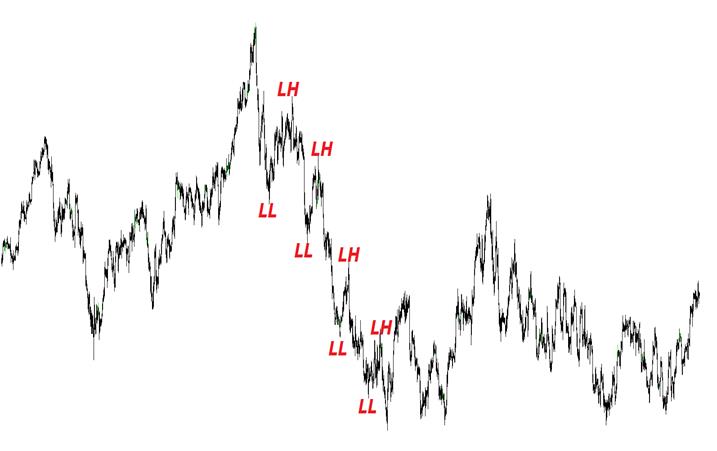

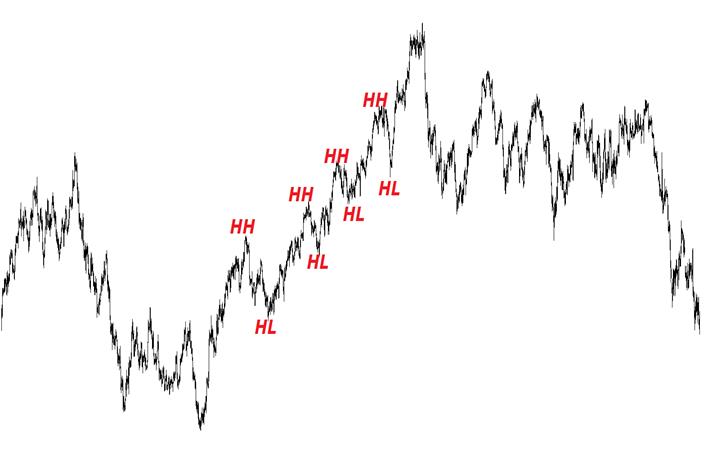

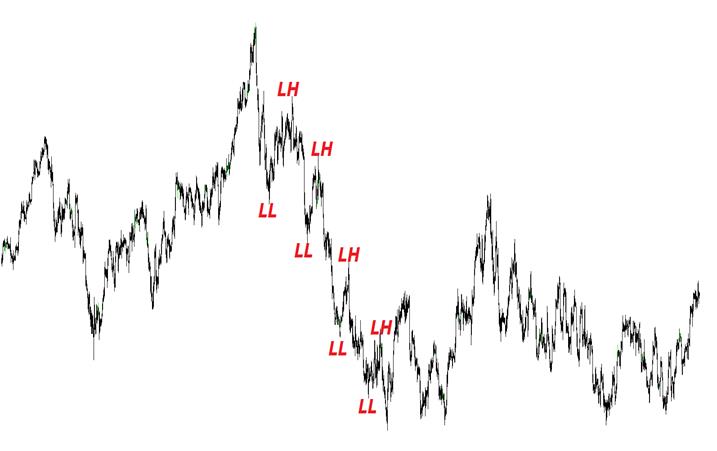

In the examples aboveyou can see that these highs and lows can easily be connected with a trend line.So, to conclude this, we have an uptrend when the price starts to make higherhighs (HH) and higher lows (HL) and we have a downtrend when price is makinglower highs (LH) and lower lows (LL) just like in the pictures above. Unfortunately,trends so simple and clear like those above are very rare in real marketconditions. Lets see some real trends:

We have above oneuptrend and one downtrend. This is just about the closest that real markettrends can get to resemble those ideal textbook trends. It doesnt get anyeasier than this in real market conditions. However, trends like these twoabove are rare especially in the forex market which is known to be a veryvolatile market. Even in these clear trends you can see that there are somevariations, there are some smaller trends contained in the bigger trend. Letssee now how a more common trend for the forex market can look like:

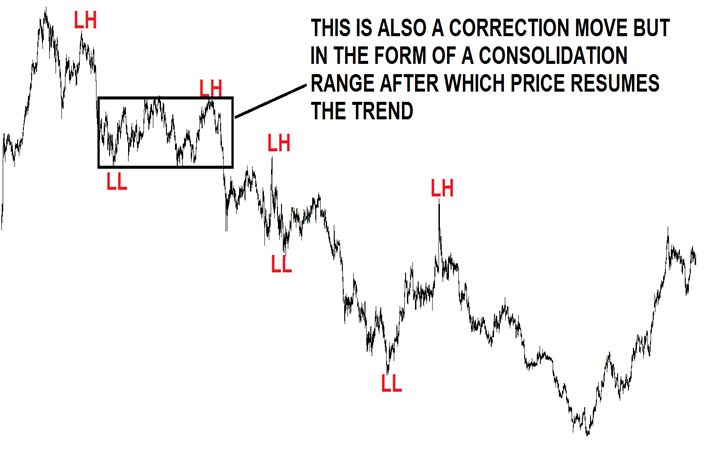

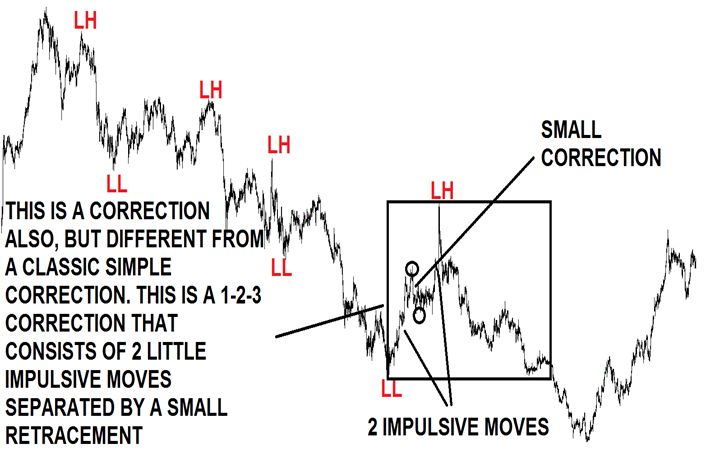

This is a downtrendbut you can tell it is more complicated than the previous ones just by lookingat it. There are some important rules I designed to help you correctly identifyand mark the components of a trend. Here is the first one.

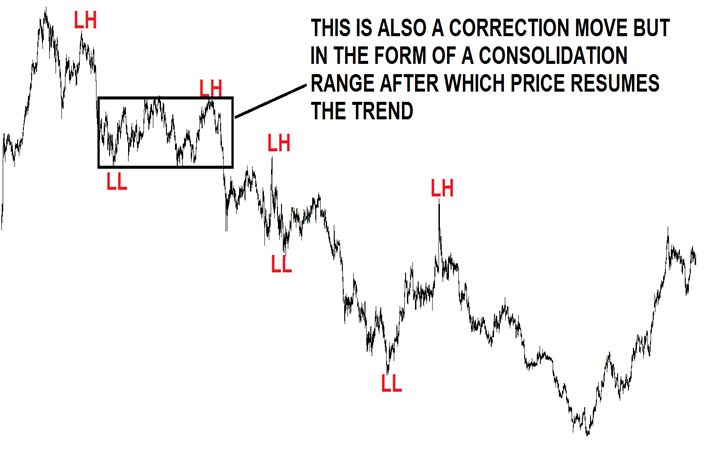

Corrections or retracements can also exist in the form of a trading range that has an upperand a lower boundary where price stalls for a period of time and takes a breathbefore resuming the trend.

As you learned before,a correction move happens when traders start to take some profit out from themarket and, as a consequence of that, price goes for a short period of time inthe opposite direction only to resume the trend later on. In this particularexample we have a downtrend and the people that are short are starting to takeprofits. When these sellers start to do this, the people that are convincedthat this pair will go upwards from here decide that this is a good level forthem to buy this pair. So, in general, a correction move begins because sometraders decide to mark some profits and at the same time other traders enterthe market in the opposite direction. In the case above, there werent manypeople buying this pair at the level where the correction started to unfold andso price did not make a classic correction. When a correction looks like aconsolidation range it means that the current trend in very strong and it isvery likely that it will continue further.

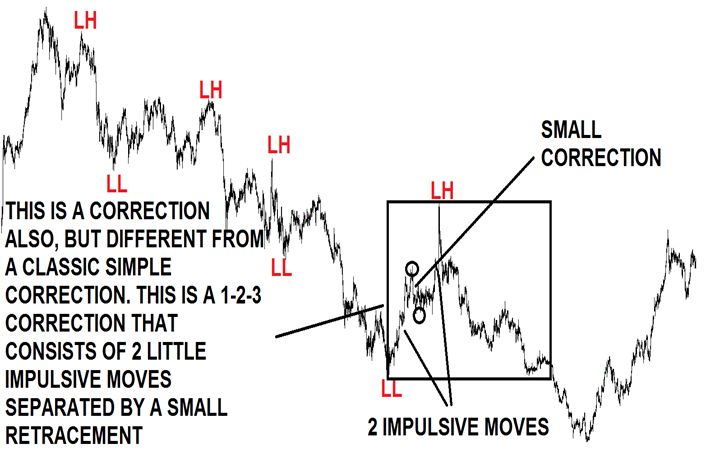

In the above exampleyou can see that in the same trend further down we have a different form ofcorrection that basically has its own highs and lows. It has a first impulsivemove opposite to the trend direction and at that point you could very well saythat this is a classic correction but, as you can see it makes a smallcorrection and then another impulsive move upwards. Because this correction hasits own highs and lows you could make the mistake to consider it as a trendchange. However, it stays very well confined into the territory of the lastimpulsive move down of our trend. It stays well below the last lower high ofour trend so it is still a correction even if it develops a higher high. Butyou will learn more about this we get to the change of trend section.Corrections can take a lot of forms, these are just the most common ones, theimportant thing to remember is that for a correction move to be valid it mustnot be bigger than its impulsive move, it must not surpass the beginning of theimpulsive move. Lets see some examples:

Next page