ForexRange Trading With Price Action

ForexTrading System

ByLaurentiu Damir

Copyright 2012 byLaurentiu Damir

All rights reserved. No part of this bookmay be reproduced or transmitted in any form or by any means, electronic ormechanical, including photocopying, recording, or any information storage andretrieval system, without prior written permission of the Author. Your supportof authors rights is appreciated.

Table of Contents

It is well known and generally accepted that in about 80%of the time, the financial markets are moving sideways. If you are a day traderthen you will probably not agree, but if you take the time and zoom out to a highenough timeframe you will find out that this is actually true. The financialmarkets just do not have it in their nature to make a new historic high or anew historic low too often. Most of the time they move up and down repeatedly,without going higher past the historic high or lower past the historic low.This is a range bound market.

Ranging markets are the things that give the most headachesto forex traders. The majority of traders out there trade with the trend, theyhave a trend following system and they wait for that system to provide themsignals or setups to enter into the market and trade. When the trend ends or stopsfor a period of time, those trend following systems start to give false signalsand the trader has a good change unfortunately to lose all the profitspreviously earned. Or, in a best case scenario, they can judge for themselveswhen the trend has ended and just decide to play it safe and stay out of themarket for a period of time. This is obviously better than the first option butit is still not good enough. A market moving sideways usually offers excellenttrading opportunities as long as you are able to identify in a very early stagethe trading range and then read the price action to enter and exit the market. Theability to recognize when the trend ends and a trading range is just beginningto develop can be the difference between success and failure in forex trading. Knowinghow to spot a trading range in its early stage will not only keep you out oflosing trades but it will also give you an edge as you will start to tradesuccessfully when the market moves sideways and often times make even moreprofits than trading with the trend.

This is what this book provides, a range trading systemfor the frequent time periods when the forex market moves sideways in a tightrange. The system is based solely or reading the price action, it doesnt useany technical indicators or anything resembling technical indicators. All ofthis being said, let us move on to the actual trading system.

First of all, in order to be able to do this you mustfirst have knowledge from a technical point of view of how to differentiatebetween a trending market and a ranging one.

Trending versus Ranging Market

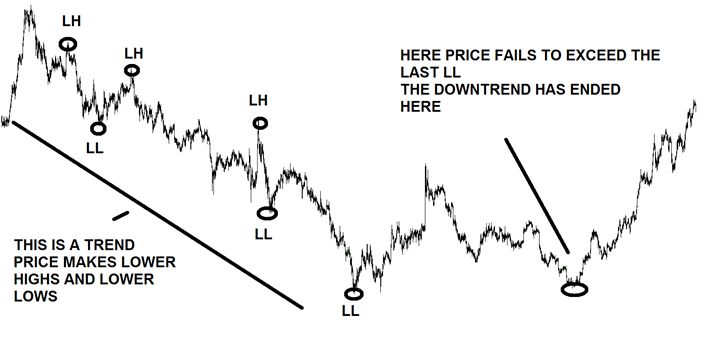

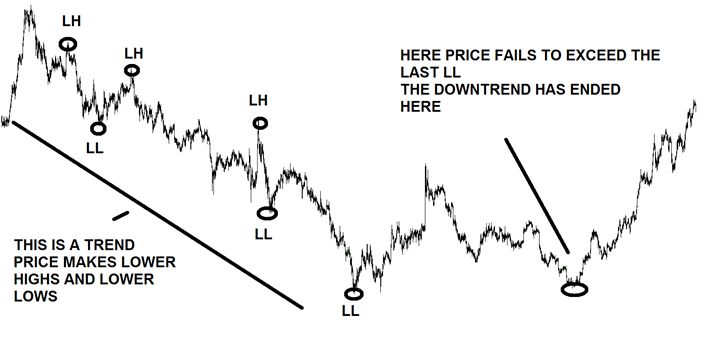

If you look at any forex pair on any timeframe you willsee that when price moves strong in one direction it makes strong impulsivemoves followed by smaller correctional moves that are pointing against thedirection of where the pair is clearly going. That is a trending market with aclear direction and determination of the pair to go up or down. Lets see anexample of such a trend.

As you can see, in a trending market, in this case wehave a down trending pair, the trend has a clear down direction but after thoseimpulsive moves down, it stops to take a breath and correct itself. Thisgenerates smaller counter trend moves. After the correction phase, the trenddown resumes and goes further down. This type of price movement generates swinghighs and swing lows in the market. The points in the diagram above marked asLH are the lower highs or swing highs of the trend and the points marked as LLare the lower lows or swing lows of the trend. An impulsive move in thedirection of the main trend is every strong move down in this chart that startsat a LH and ends at a LL. A correction move is every small counter trend movein the chart above that starts at every LL and finishes at every LH. Lets seethe same trend again to illustrate this.

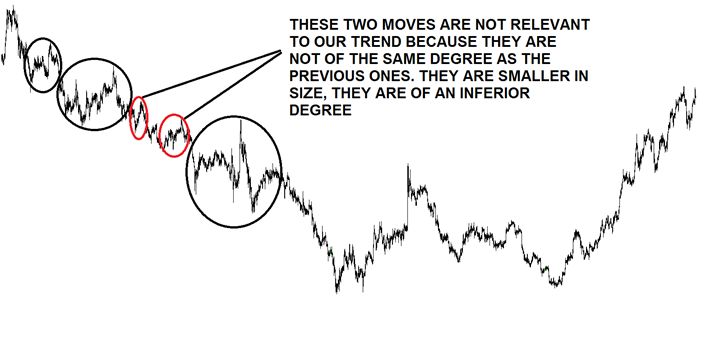

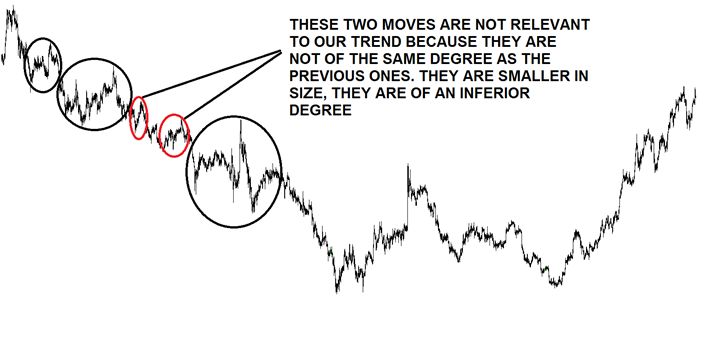

An important thing to always consider when judging atrend and trying to correctly label its highs and lows is the degree of themoves. Please notice in the example above that I have only labeled as LH and LLthe price moves of roughly the same size or amplitude or degree. Those smallermoves inside the bigger moves are not relevant to our main trend. Let me illustratethis.

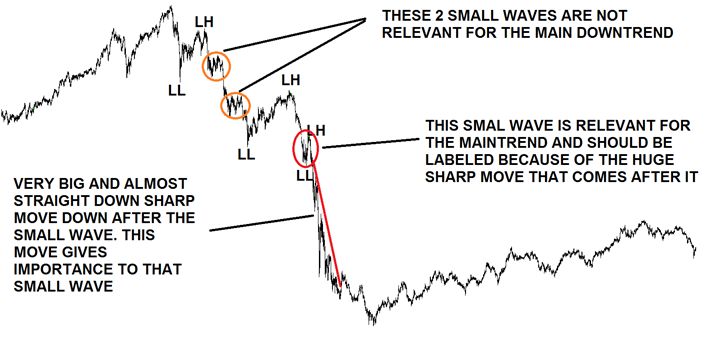

In the same downtrend you can see there two smallcorrection moves that do not qualify to be taken into consideration. They couldbe relevant for a downtrend on a smaller timeframe, but for this 4 hourstimeframe trend they do not matter because they are of an inferior degree.There is however one exception to this rule. Small waves like the one aboveshould be taken into consideration when labeling the trend only if theimpulsive move that follows that wave is huge in length and very sharp or steep.Please look at the chart below.

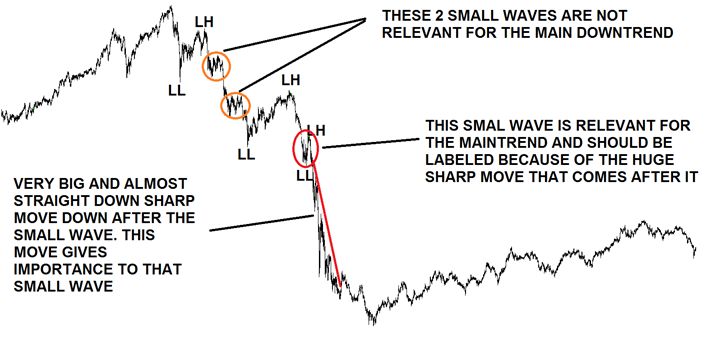

Please note that all three small waves in this chart areof the same degree or size. The difference between the first two and the lastone is made by what price does after them. In the case of the first two smallwaves circled in orange price behaves rather normally after making them in thesense that the impulsive moves that follow are small themselves and match theirpreceding waves. These two are not to be taken into consideration when decidingon how to label the trend. The third small wave circled in red is differentbecause of the huge and very sharp move down that follows. That move validatesthe small wave and gives it importance. As a consequence, this small wave isrelevant to the main trend and should be labeled as a new pair of lower highand lower low in the downtrend above. As guidance, you should label the wavesof an inferior degree like the one in the above chart if the impulsive movethat follows after it is at least 4-5 times greater in length than the waveitself. You can see if that is the case just by looking at the chart, you donot have to measure exactly the number of pips. This is the only exception thatyou should make with small waves when labeling your trend.

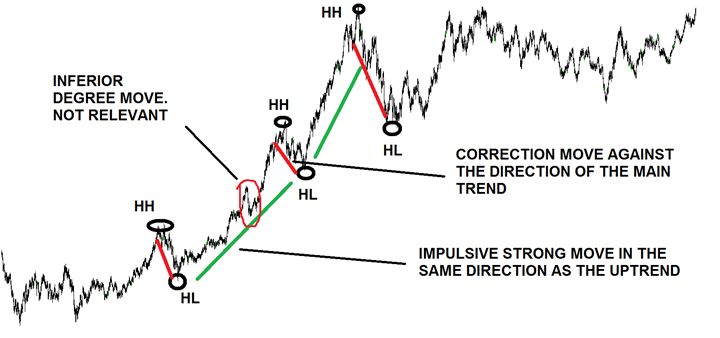

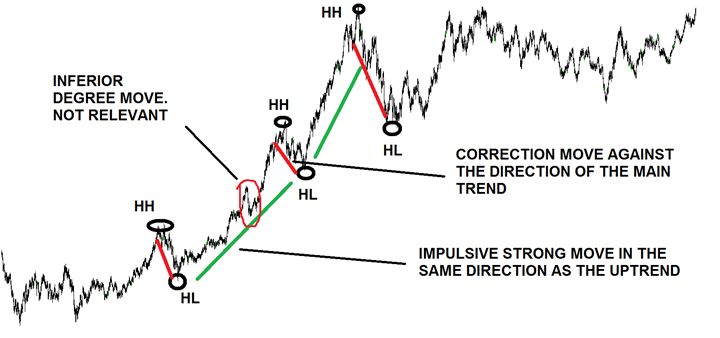

An up trending market looks the same way, the onlydifference being that the trend is up and, as a consequence, the big impulsivemoves within the trend are pointing upwards and the correctional small movesare pointing downwards against the trend. Let me illustrate this.

In this example you can see an uptrend. Price is movingup alternating impulsive moves in the same direction as the trend withcorrection moves against the direction of the uptrend. The price moves markedwith green lines are the impulsive moves and the red ones are the correctionmoves. The small move circled with red is of an inferior degree and it shouldnot be labeled as a HH-HL pair because it is too small when compared to theother ones to mean something for this big 4 hours timeframe trend. This is atrending market from a very technical point of view. The trends move in wavescreating highs and lows in the market. You should always label your trendshighs and lows as this will become important when judging if a trading range isstarting to develop.

Next page