The author and publisher have provided this e-book to you for your personal use only. You may not make this e-book publicly available in any way. Copyright infringement is against the law. If you believe the copy of this e-book you are reading infringes on the authors copyright, please notify the publisher at: us.macmillanusa.com/piracy.

Contents

P ART O NE

P ART T WO

Afterword:

Appendix I:

Appendix II:

For Tamsin, Natasha, Shaun, and Bun

so you dont need to repeat my mistakes

P ART O NE

The Winning Investment Habits of Warren Buffett and George Soros

The Power of Mental Habits

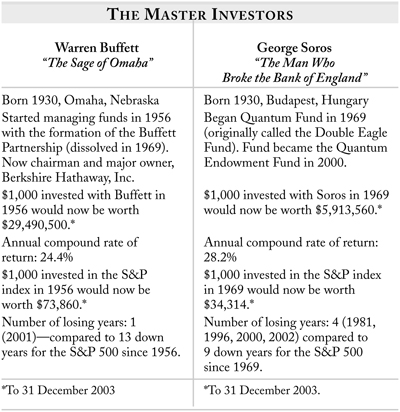

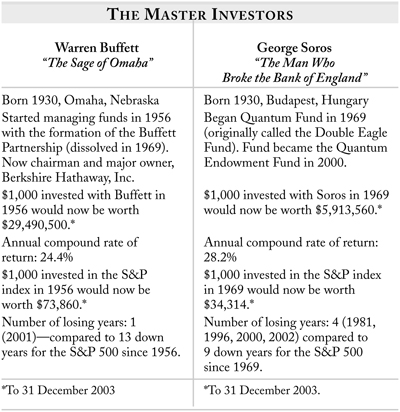

W ARREN B UFFETT AND G EORGE S OROS are the worlds most successful investors.

Buffetts trademark is buying great businesses for considerably less than what he thinks theyre worthand owning them forever. Soros is famous for making huge, leveraged trades in the currency and futures markets.

No two investors could seem more different. Their investment methods are as opposite as night and day. On the rare occasions when they have bought the same investment, it was for very different reasons.

What could the worlds two most successful investors possibly have in common?

On the face of it, not much. But I suspected that if there is anything Buffett and Soros both do, it could be crucially important perhaps even the secret behind their success.

The more I looked, the more similarities I found. As I analyzed their thinking, how they come to their decisions, and even their beliefs, I found an amazing correspondence. For example:

Buffett and Soros share the same beliefs about the nature of the markets.

When they invest theyre not focused on the profits they expect to make. Indeed, theyre not investing for the money.

Both are far more focused on not losing money than on making it.

They never diversify: they always buy as much of an investment as they can get their hands on.

Their ability to make predictions about the market or the economy has absolutely nothing to do with their success.

As I analyzed their beliefs, behaviors, attitudes, and decision-making strategies, I found twenty-three mental habits and strategies they both practice religiously. And every one of them is something you can learn.

My next step was to test these habits against the behavior of other successful investors and commodity traders. The match was perfect.

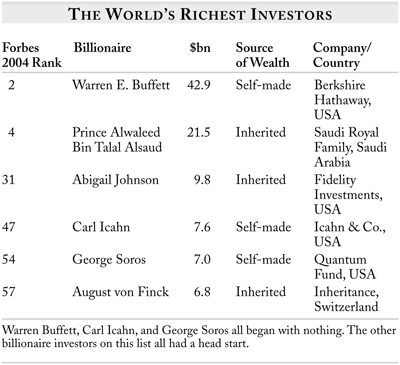

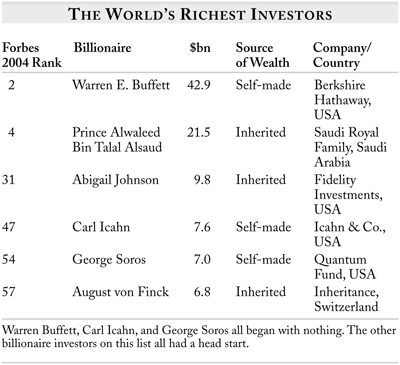

The feared company raider Carl Icahnwhose net worth leapt an amazing 52 percent in 2003 to rocket him past George Soros on the Forbes list of the worlds richest people; Peter Lynch, who produced an annual return of 29 percent during the years he ran the Fidelity Magellan Fund; legendary investors such as Bernard Baruch, Sir John Templeton, and Philip Fisher; and every one of dozens of other highly successful investors ( and commodity traders) Ive studied and worked with, all practice exactly the same mental habits as Buffett and Soros, without exception.

Cultural background makes no difference. A personally dramatic moment came when I interviewed a Japanese investor living in Hong Kong who trades futures in Singapore, Tokyo, and Chicago using Japanese candlestick charts. As the conversation proceeded, I checked off one habit after another from my list until I had twenty-two ticks.

And then he asked whether I thought he was liable for any tax on his profits from trading. That completed the list. (Thanks to Hong Kongs liberal tax regime, it was easy for him to legally do what he wanted: trade tax-free.)

The final test was to discover whether these habits are portable. Can they be taught? And if you learned them, would your investment results change for the better?

I started with myself. Since I used to be an investment advisor, and for many years published my own investment newsletter, World Money Analyst, its embarrassing to admit that my own investment results had been dismal. So bad, in fact, that for many years I just let my money sit in the bank.

When I changed my own behavior by adopting these Winning Investment Habits, my investment results improved dramatically. Since 1998 my personal stock market investments have risen an average of 24.4% per yearcompared to the S&P, which went up only 2.3% per year. Whats more, I havent had a losing year, while the S&P was down three out of those six years. I made more money more easily than I ever thought possible. You can, too.

It makes no difference whether you look for stock market bargains like Warren Buffett, trade currency futures like George Soros, scour the markets for undervalued takeover targets like Carl Icahn, use technical analysis, follow candlestick charts, buy real estate, buy on dips or buy on breakouts, use a computerized trading systemor just want to salt money away safely for a rainy day. Adopt these habits and your investment returns will soar.

Applying the right mental habits can make the difference between success and failure in anything you do. But the mental strategies of Master Investors are fairly complex. So lets first look at a simpler example of mental habits.

Why Johnny Cant Spell

Some people are poor spellers. They exasperate their teachers because nothing the teacher does makes any difference to their ability to spell.

So teachers assume the students arent too bright, even when they display better-than-average intelligence at other tasksas many do.

The problem isnt a lack of intelligence: its the mental strategies poor spellers use.

Good spellers call up the word they want to spell from memory and visualize it. They write the word down by copying it from memory. This happens so fast that good spellers are seldom aware of doing it. As with most people who are expert at something, they generally cant explain what they do that makes their success possible even inevitable.

By contrast, poor spellers spell words by the way they sound. That strategy doesnt work very well in English.

The solution is to teach poor spellers to adopt the mental habits of good spellers. As soon as they learn to look for the word they want to spell instead of hearing it, their spelling problem disappears.

I was amazed the first time I showed a poor speller this strategy. The man, a brilliant writer, had gotten a string of Bs in school all with the comment: Youd have gotten an A if only youd learn how to spell!

In less than five minutes, he was spelling words like antidisestablishmentarianism, rhetoric and rhythm, which had confounded him all his life. He already knew what they looked like; he just didnt know that he had to look.

Such is the power of mental habits.

The Structure of Mental Habits

A habit is a learned response that has become automatic through repetition. Once ingrained, the mental processes by which a habit operates are primarily subconscious.

This is clearly true of the good speller: he is completely unaware of how he spells a word correctly. He just knows that its right.

But doesnt most of what the successful investor does take place at the conscious level? Arent reading annual reports, analyzing balance sheets, even detecting patterns in charts of stock or commodity prices conscious activities?