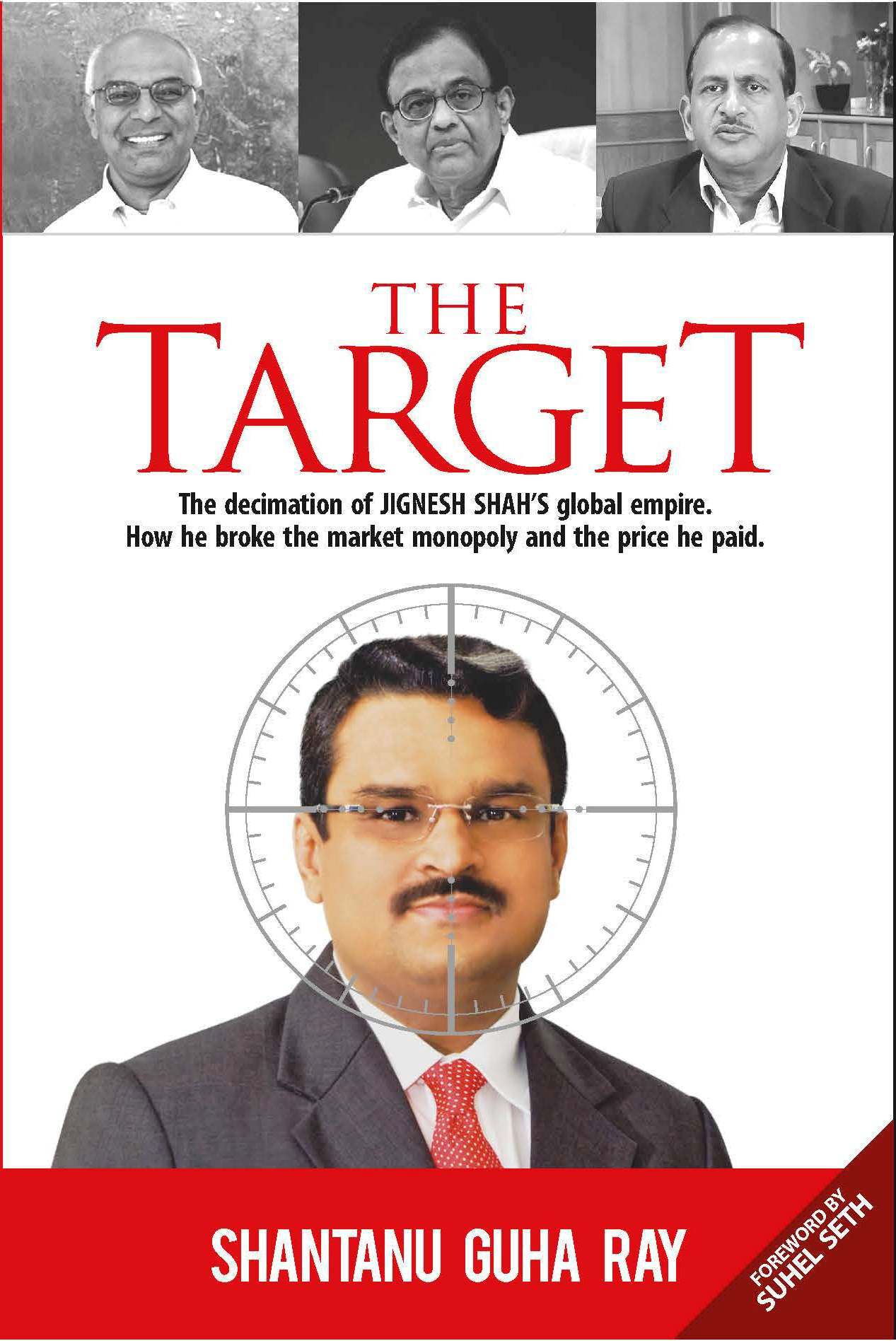

THE

T ARGE T

The decimation of JIGNESH SHAHS global empire.

How he broke the market monopoly and the price he paid.

BY SHANTANU GUHA RAY

FOREWORD BY SUHEL SETH

Contents

I have gone through Shantanus book. And I felt Jignesh Shah so closely resembles John Galt, the protagonist in Atlas Shrugged , Ayn Rands hugely popular novel of the mid-fifties. Galt, an innovator, quits a motor company, saying he will fight the system that punishes a man for using his mind, rewards complacency and failure and penalises innovation and success! Like Galt, Shah shook the most powerful unholy nexus of politicians, bureaucrats, crony capitalists and brokers to democratize the markets.

The sinister plot to annihilate Shah is part of a long-drawn strategy of powerful politicians, bureaucrats, rivals and some of the most influential industrialists who have huge interest in market operations.

As in the epic Mahabharata wherein the Kauravas ganged up to kill Abhimanyu by sheer deceit, Shah, too, was cornered by this powerful nexus to topple his empire.

The NSEL payment crisis was engineered by the FMC, the then regulator of commodities markets, since it suddenly recommended its abrupt closure in July 2013. The crisis was easily solvable but it was not solved and deliberately kept alive to target Shah and his FTIL Group.

After the crisis, different investigative agencies like the EOW-Mumbai and the Enforcement Directorate established the entire money trail of Rs 5,600 crore to the 24 defaulting brokers of NSEL.

No money trail was established to NSEL, FTIL or its promoters as observed by the Hon. Bombay High Court in Shahs bail order after studying the charge-sheet and the Special Leave Petition challenging the same was dismissed by the Hon. Supreme Court.

However, all concentrated actions were directed only at Shah and the FTIL Group subsequently to eliminate them out of Exchange space.

In order to hide and protect their own sins, the brokers used the entire crisis to tear away Shahs lifetime of work and dream.

The quantum of black money that was infused by the brokers at NSEL through bogus KYCs, forgery and mis-selling of products could actually be unveiled if investigated well and the broker-side frauds for money-laundering would be exposed. It can unearth the biggest modus operandi of conversion of cash to bank by intermediaries. Exchange transactions were bank to bank. These are the same brokers who have misused the Securities Transaction Tax (STT) based profit and loss. It is noteworthy that STT was introduced and implemented by P Chidambaram.

On the defaulting broker side, it is an open and shut case as investigations revealed that they have converted from bank to cash and the entire money trail has been established to them as stated in the Parliament.

The STT-based misuse has happened at the stock exchanges and particularly on equity derivatives segment of the National Stock Exchange (NSE). It resulted in the biggest ever revenue loss to the exchequer by way of profit and loss bills. It is hard to believe that this activity and manipulation of Participatory Notes (PNs), FII money flow, Singapore Nifty trading, etc. happened without Exchange blessings, planted regulatory chief and involvement of higher-ups to the last dot.

The powerful lobby of brokers which includes the defaulters that laundered this black money was up against Shah in connivance with certain bureaucrats and the higher-ups in the Finance Ministry of the then UPA-2 government.

The high-power committee appointed by the Hon. Bombay High Court has found numerous instances of client code modifications by the brokers. Also, recently, the SEBI, too, issued show-cause notices to top five brokerages in this regard.

Shah and his flagship FTIL Group set up 10 world class Exchanges across a variety of asset classes such as commodities, equity, currency, bond and electricity in just 10 years right from Africa, Middle-East to South-East Asia. All these successful Exchanges are No. 1 in India and No. 2 in the world.

MCX, the first listed Exchange to put India among top global Commexes, has become the second largest commodity Exchange in the world having created 1 million jobs in the country besides contributing 1% to Indias GDP in less than a decade.

Shahs companies were original IP-based innovations that did not involve any subsidy from the government or the banks for land, labour or taxes. For Shah, excellence was the only currency.

The financial market infrastructure and the ecosystem created by Shah not only converted his Made in India ventures into global multinational corporations (MNC) but had they been allowed to continue and develop exponentially, India would have become the Manhattan of the East as per his dreams.

The destruction of Shah by the political class and its favourite bureaucrats would prove fatal for the 108 new-generation entrepreneurs seeking to develop IP institutions and realize the Prime Ministers dream of Make in India .

These first-generation entrepreneurs alone would make India compete effectively in the global market and rise to numero uno position. By killing Shahs ventures a wrong precedent has been set that could drive away young entrepreneurs and foreign investors also.

As a result of all these motivated actions, FTIL, a real Made in India story, was killed much before Make in India came into the picture. Its not only FTIL and its founder, Jignesh Shah, a first-generation entrepreneur, but what has been killed is the spirit of innovation and entrepreneurship.

It is a heinous crime in the new war-free world of economic prosperity achieved through excellence to kill competition in entry-barrier regulated industries that will result in depriving Indias 100 million youth from access to capital through modern new generation financial markets. This is as good as depriving electricity to manufacturing units in an industrial economy and data to enterprise in digital economy. Any such act of deprivation is nothing but an act of sedition.

It takes a lifetime to create one successful exchange but Shah created the countrys financial market infrastructure and tech-IP ecosystem that included 18 IP technology institutes/organisations within a short span of just 18 years.

The growing exchanges and the financial infrastructure that was envisioned and delivered by him were national assets and as such, certainly, there will always be a vacuum felt.

Shah was ahead of his times.

The country will have to pay an unmatched price for actions of the then UPA-2 government to annihilate Shah, something that is unknowingly being carried forward even today.

In this book, Shantanu has very effectively narrated the entire saga of how Indias indigenous growth story was killed due to some vested interests in corporate and bureaucratic circles much before Make in India was ushered in.

The book is a great read for all those who want to understand what went wrong with a success story called FTIL and the immense value of IP-based institutions of global scale and how they were crookedly demolished.

Suhel Seth is a social commentator, who has co-authored the book Mantras for Success: Indias Greatest CEOs Tell You How to Win. As a columnist, Seth frequently writes for The Financial Times (London), The Hindustan Times and The Indian Express. A passionate orator, Seth is a regular speaker at industry meets and a visiting faculty at various Indian Institutes of Management .

On April 12, 2016, Ravish Kumar, arguably one of the finest television journalists in India, walked into the offices of the Indian Express to meet three editors who had worked on the Panama Files investigation report, which took the world by storm.