T o Mom, for teaching me to stand up for what I believe.

T o Paula, my love and best friend.

T he authors proceeds from this book are being donated to charity.

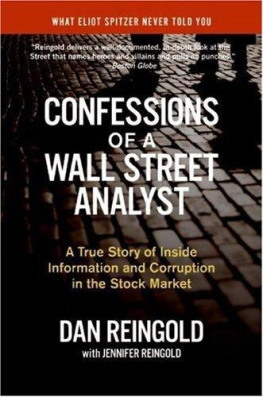

M ANY PEOPLE NEED TO BE THANKED for helping Jennifer and me with this book and also for helping me during my career. Inevitably, some must remain anonymous because they served as confidential sources for some of the material presented in this book. You know who you are. Thank you.

Others, however, can and should be thanked loudly. Ed Greenberg convinced me to leave MCI for Wall Street. Without his persistenceand confidence in meI doubt I would have made the move. Most important, Ed taught me that a Wall Street analyst can and should operate with integrity, independent from the myriad conflicts of interest inherent in the brokerage and investment banking businesses. I still stand in awe of the example he set. Thank you, Ed.

I also thank the talented and dedicated members of my research teams at Morgan Stanley, Merrill Lynch, and Credit Suisse First Boston. Each helped this book in some immeasurable way. Their memories helped to flesh out and corroborate mine. Just as they did when we worked together, they identified passages in need of more explanation and those that needed to be cut down or omitted. In particular, I thank Megan Kulick, Mark Kastan, Ehud Gelblum, and Ido Cohen for critiquing draft chapters and for adding details that I had forgotten. I also thank Connie Marotta, my loyal executive assistant for ten years, for keeping me organized and on schedule through most of my Wall Street career and for her uncanny ability to anticipate and thereby avoid disasters in the making. Several other members of my research team deserve mention as well: Marty Dropkin, especially for his insights on policy matters; John Sini, for his often-appropriate cynical view of Wall Streets devious ways; Julia Belladonna, for her calm wit, brains, and stamina; and John Doughty, Michael Winston, and Michael Shrekgast, for their good humor and hard work, especially during the depressing years of 20002002, when the bubble was deflating and the analyst profession was being vilified in the press.

Patricia Coronado, a former buy-side client now running a hedge fund, convinced me that it was imperative that the Wall Street she and I had experienced in the nineties be documented and that I should be the one to do it. David Pesikoff, former buy-side client and now a friend, read the manuscript thoroughly and provided numerous insightful suggestions. My friend and neighbor, Eric Hemel, a former Wall Street research director and number onerated analyst, offered comments that cut to the core of my thesis and, in so doing, forced me to rethink several points made in the prologue and several policy suggestions in the afterword. Matt Bowman, also a friend and neighbor, read several chapters and offered several key corrections.

Jim Hayter, my former boss at MCI, read several chapters and provided highly detailed memories of our time in the MCI investor relations department. Jim also shared his impressive photo collection and several key documents from his files. Jeff Jacobs, my friend and Merrill Lynch stockbroker, clarified and sparked many memories.

In the course of this project, I have also consulted numerous attorneys. David Fein of Wiggin and Dana; David Korzenik and Jeff Miller of Miller, Korzenik, Sommers; and Mark Reingold, my brother, read and commented on the manuscript. Their suggestions have proven extremely helpful and insightful, on both legal and nonlegal issues. My brother Mark deserves a special appreciation for serving as a trusted advisor and valuable sounding board throughout the book-writing process.

The last reader to mention is Bob Atkinson. Bob is a veteran of the telecom wars, an attorney who was general counsel at Teleport and is now director of policy research at the Columbia Institute for Tele-Information (CITI) at the Columbia Graduate School of Business. I thank Bob and CITIs longtime director and professor of finance and economics at Columbia, Eli Noam, for convincing me to join the Institute when I left CSFB in 2003. This book, especially the policy recommendations in the Afterword, benefited immensely from the lively discussions we have had at various CITI conferences on corporate governance and telecom recovery. Bob read the entire book in two days, just as we were about to submit the final manuscript. He raised several very important questions and issues that led to important clarifications.

Special thanks also go to the great crew at HarperCollins. Leah Nathans Spiro and Marion Maneker championed our project from the minute Jennifer called Leah, her old Business Week colleague. Their enthusiasm has been inspirational at critical moments in the process. Leah did a marvelous job of helping us see the forest for the trees. She masterfully sculpted away portions of chapters that were too long or lacked a connection to our larger themes. Leah is an uncompromising perfectionist, and there is no doubt that this book, and Jennifer and I, have been the beneficiaries of Leahs truly exceptional talents and drive. Thank you, Leah. Also at HarperCollins, much appreciation goes to our lawyer, Kyran Cassidy; Libby Jordan, Collins associate publisher; our cover designer, Georgia Morrissey; D. S. Aronson, copy chief; our copyeditor, Cecilia Hunt; and Alexandra Kaufman, the summer intern who so adroitly helped shepherd the manuscript and especially its photos through production.

Also deserving of thanks are Michael Martinez, our outstanding factchecker, who endured this project and its time pressures with enthusiasm, and my agent, Anne Sibbald, of Janklow & Nesbit, who instantly got what this book was about and encouraged us throughout.

Without Jennifer Reingold, my writer and my niece, this project would never have been started, let alone completed. When it came time for me to contemplate writing a book about my time on Wall Street, she was the obvious collaborator. Jennifer and I had discussed the analyst-conflict issue for years, and we greatly respected each others knowledge and perspective. And Jennifer had just finished writing Final Accounting, so she was experienced in exactly the kind of project I envisioned: a first-person, nonfiction narrative in the context of business fraud and scandal. Jennifer navigated through agent picking, proposal writing, and proposal pitching. And then, she magically converted my 600 pages of typewritten stream-of-consciousness memories into a readable manuscript. Jennifer probed me relentlessly, and her tenacity and investigative rigor yielded a narrative that is far more personal, revealing, and, I hope, useful than I ever imagined possible. Jennifer forced me to learn things about Wall Street, about investing, about human temptation, and about myself that I didnt know when we started this project. Jennifers husband, Randall Lane, and their daughter, Sabrina, deserve special thanks; Randall for patiently tolerating Jennifers late nights at the computer and for his incisive comments on the manuscript, and Sabrina for sharing her moms time with this book project.