The Wit & Wisdom of Wall Street The Wit & Wisdom of Wall Street Compiled & Edited by Bob Thomas Bascom-Hall Publishing Co. Dallas, Texas Copyright 2011 by Bascom-Hall Publishing Co. All rights reserved. No part of this book may be reproduced or transmitted in whole or in part in any form without prior written permission of the publisher and author.The Wit & Wisdom of Wall Street Compliled & Edited by Bob Thomas Cover Design: Barton Damer Email: bartondamer@mac.com Website: www.alreadybeenchewed.net Publisher: Bascom-Hall Publishing Co. 9330 LBJ Freeway Suite 800 Dallas, Texas 75243 Email: info@bascom-hall.com Website: www.bascom-hall.com Additional copies of this book may be ordered from the publisher for $14.95. Please add $3.00 for postage and handling. Library of Congress Cataloging-in-Publication Data ISBN-13 978-0-9649201-4-9 IntroductionWall Street is much more than, as one cynic put it, a thoroughfare that begins in a graveyard and ends in a river.

The Wit & Wisdom of Wall Street The Wit & Wisdom of Wall Street Compiled & Edited by Bob Thomas Bascom-Hall Publishing Co. Dallas, Texas Copyright 2011 by Bascom-Hall Publishing Co. All rights reserved. No part of this book may be reproduced or transmitted in whole or in part in any form without prior written permission of the publisher and author.The Wit & Wisdom of Wall Street Compliled & Edited by Bob Thomas Cover Design: Barton Damer Email: bartondamer@mac.com Website: www.alreadybeenchewed.net Publisher: Bascom-Hall Publishing Co. 9330 LBJ Freeway Suite 800 Dallas, Texas 75243 Email: info@bascom-hall.com Website: www.bascom-hall.com Additional copies of this book may be ordered from the publisher for $14.95. Please add $3.00 for postage and handling. Library of Congress Cataloging-in-Publication Data ISBN-13 978-0-9649201-4-9 IntroductionWall Street is much more than, as one cynic put it, a thoroughfare that begins in a graveyard and ends in a river.

Rather, Wall Street is the heart of corporate finance in the U.S. and symbolic of investing in the stock market. For many investors, it has proven to be a street paved with goldwhile others have truly experienced a nightmare on Wall Street. Scores of books and magazine articles have been written over the years detailing how to get rich quick by playing the stock market using a variety of strategies and gimmicks. The truth is, there are no shortcuts and you will not outsmart the marketfor very long. But it is very possible to create wealth by investing in the stocks of some of the great companies in America.

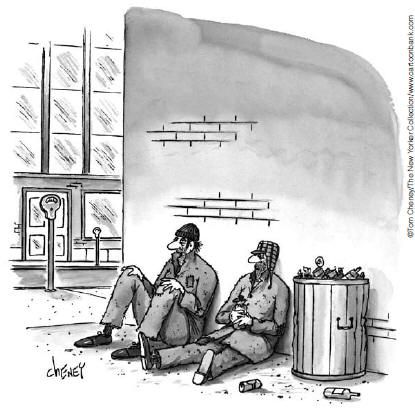

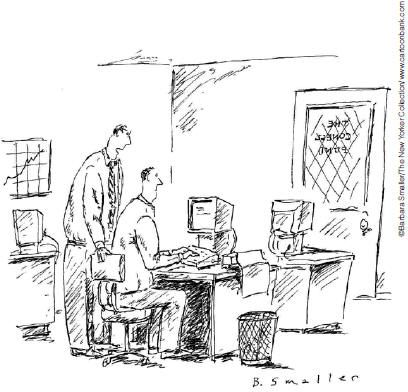

Warren Buffett, one of the richest men in the world, accumulated his tremendous wealth by being a savvy and patient investor in the stock market. In fact, he once described his investment philosophy as lethargy bordering on sloth. The Wit & Wisdom of Wall Street includes quotes from leading investment gurus such as Benjamin Graham, Warren Buffett, Peter Lynch, John Templeton, Jason Zueig, and many others, along with axioms, one-liners, and clever cartoons from the esteemed New Yorker magazine; all about investing on Wall Street. Hopefully, you will be entertained and amused by the witbut more importantly, you should become wealthier and wiser from the wisdom.  The stock market is like a beauty contest; you shouldnt necessarily pick the prettiest girlpick the one everyone else thinks is the prettiest. Warren Buffett Every time someone buys, someone sellsand both think theyre brilliant. Warren Buffett Every time someone buys, someone sellsand both think theyre brilliant.

The stock market is like a beauty contest; you shouldnt necessarily pick the prettiest girlpick the one everyone else thinks is the prettiest. Warren Buffett Every time someone buys, someone sellsand both think theyre brilliant. Warren Buffett Every time someone buys, someone sellsand both think theyre brilliant.

By ignoring the losers and taking profits in the winnersyou eventually end up with a portfolio of losers. The stock market depends about as much on stock market analysts as the weather does on weather forecasters. Fundamental analysis will tell you what stocks to buytechnical analysis will tell you when to buy them. If youre compulsively checking up on the prices of your investments, youre not only hurting your financial returns, youre unnecessarily taking precious time away from the rest of your life. Jason Zweig The least risky long-term style of buying stocks is to buy the stocks that refuse to go down on bad news. Justin Mamis The one single thought that sustains me is that the fundamentals are good. 75% of the risk in any stock is the market and the sector.

The one single thought that sustains me is that the fundamentals are good. 75% of the risk in any stock is the market and the sector.

Having live streaming quotes on your computer is like having a slot machine on your desk. Take your money seriously. You shouldnt have fun investingthats a trap; it makes you too active. A bull must be fed every day with good newsbut a bear needs only to be fed once in a while. Many times a buy-and-hold investment is a short-term trade that went wrong. A market decline should be viewed as an opportunity to buy high quality stocksnot a disaster.

The longer a stock trades in a very narrow range, the more explosive it will move when it ultimately breaks outin either direction. Bull markets are born in pessimism, grow in skepticism, mature in optimism, and die in euphoria. John Templeton The chief losses to investors come from the purchase of low-quality securities at times of favorable conditions. Benjamin Graham When bad news cant take the market downits good news. Never buy a stock that didnt rise in a bull marketsmart investors are out of it. If it looks too good to be true you havent read the prospectus carefully enough.

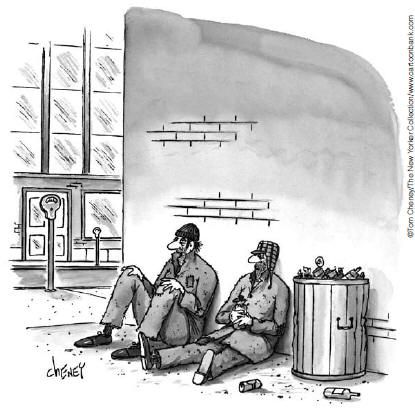

Good investment advice is expensivebad investment advice is very expensive. When the covers of major business magazines feature an investment trend in a bearish light it is very likely that the trend is at or near its bottom.  Be that way, Marilyn. You werent sneering at me when I was managing your portfolio. The key to making money in stocks is not to get scared out of them. Peter Lynch Its wise to remember that too much success in the stock market is in itself an excellent warning. Gerald Loeb Never confuse brilliance on your part with a bull market.

Be that way, Marilyn. You werent sneering at me when I was managing your portfolio. The key to making money in stocks is not to get scared out of them. Peter Lynch Its wise to remember that too much success in the stock market is in itself an excellent warning. Gerald Loeb Never confuse brilliance on your part with a bull market.

Most portfolios do worse than the averages over the long term. Why is it that if you can buy all you want of an IPO, you dont want anyand if you cant obtain any, you want to buy all you can get? Markets can remain irrational longer than you can remain solvent. John Maynard Keynes Investors turning to technical analysis is roughly analogous to consulting a fortune teller. Laszlo Birinyi, Jr. For those properly prepared in advance, a bear market in stocks is not a calamityits an opportunity. John Templeton When hamburgers go down in price, we sing the Hallelujah Chorus in the Buffett household; when hamburgers go up we weep. Warren Buffett What actually registers in the stock markets fluctuations are not the events themselvesbut the human reactions to those events. Bernard Baruch Get inside information from the President and youll probably lose half of your moneyget it from the Chairman of the Board and youll lose all of it. Jim Rogers When in doubtsell. Jim Rogers When in doubtsell.

Always buy and sell at the market. Dont hold losersswap bad stocks for good ones. Never buy a stock just after a significant rise or sell one just after a significant drop. An extraordinarily high dividend rate may indicate an eventual dividend cut. Dont buy the sympathy stockbuy the stock of the company that is actually moving higher. Peter Lynch Bad days in the market precedes rallies more often than declines. Peter Lynch Bad days in the market precedes rallies more often than declines.

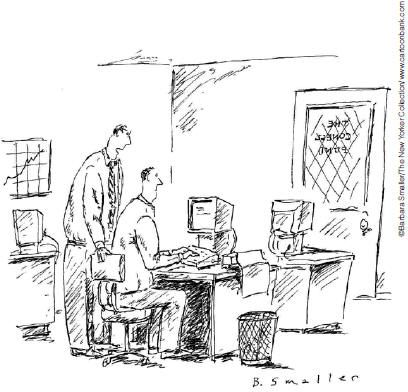

If an abnormal return is promised there must be an abnormal risk. Dont be fooled by these four deadly wordsIts different this time.  Up a hundred and sixteen points! If only wed had the foresight to invest ten minutes ago. The worse mistake investors make is taking their profits too soon and their losses too long. Michael Price A diminishing number of new highs, as the DJIA keeps chugging higher, warns of a forthcoming top. Justin Mamis Start investing now, not later. Dont worry about whether the market is high or low just begin investing.

Up a hundred and sixteen points! If only wed had the foresight to invest ten minutes ago. The worse mistake investors make is taking their profits too soon and their losses too long. Michael Price A diminishing number of new highs, as the DJIA keeps chugging higher, warns of a forthcoming top. Justin Mamis Start investing now, not later. Dont worry about whether the market is high or low just begin investing.

Next page

The Wit & Wisdom of Wall Street The Wit & Wisdom of Wall Street Compiled & Edited by Bob Thomas Bascom-Hall Publishing Co. Dallas, Texas Copyright 2011 by Bascom-Hall Publishing Co. All rights reserved. No part of this book may be reproduced or transmitted in whole or in part in any form without prior written permission of the publisher and author.The Wit & Wisdom of Wall Street Compliled & Edited by Bob Thomas Cover Design: Barton Damer Email: bartondamer@mac.com Website: www.alreadybeenchewed.net Publisher: Bascom-Hall Publishing Co. 9330 LBJ Freeway Suite 800 Dallas, Texas 75243 Email: info@bascom-hall.com Website: www.bascom-hall.com Additional copies of this book may be ordered from the publisher for $14.95. Please add $3.00 for postage and handling. Library of Congress Cataloging-in-Publication Data ISBN-13 978-0-9649201-4-9 IntroductionWall Street is much more than, as one cynic put it, a thoroughfare that begins in a graveyard and ends in a river.

The Wit & Wisdom of Wall Street The Wit & Wisdom of Wall Street Compiled & Edited by Bob Thomas Bascom-Hall Publishing Co. Dallas, Texas Copyright 2011 by Bascom-Hall Publishing Co. All rights reserved. No part of this book may be reproduced or transmitted in whole or in part in any form without prior written permission of the publisher and author.The Wit & Wisdom of Wall Street Compliled & Edited by Bob Thomas Cover Design: Barton Damer Email: bartondamer@mac.com Website: www.alreadybeenchewed.net Publisher: Bascom-Hall Publishing Co. 9330 LBJ Freeway Suite 800 Dallas, Texas 75243 Email: info@bascom-hall.com Website: www.bascom-hall.com Additional copies of this book may be ordered from the publisher for $14.95. Please add $3.00 for postage and handling. Library of Congress Cataloging-in-Publication Data ISBN-13 978-0-9649201-4-9 IntroductionWall Street is much more than, as one cynic put it, a thoroughfare that begins in a graveyard and ends in a river. The stock market is like a beauty contest; you shouldnt necessarily pick the prettiest girlpick the one everyone else thinks is the prettiest. Warren Buffett Every time someone buys, someone sellsand both think theyre brilliant. Warren Buffett Every time someone buys, someone sellsand both think theyre brilliant.

The stock market is like a beauty contest; you shouldnt necessarily pick the prettiest girlpick the one everyone else thinks is the prettiest. Warren Buffett Every time someone buys, someone sellsand both think theyre brilliant. Warren Buffett Every time someone buys, someone sellsand both think theyre brilliant. The one single thought that sustains me is that the fundamentals are good. 75% of the risk in any stock is the market and the sector.

The one single thought that sustains me is that the fundamentals are good. 75% of the risk in any stock is the market and the sector. Be that way, Marilyn. You werent sneering at me when I was managing your portfolio. The key to making money in stocks is not to get scared out of them. Peter Lynch Its wise to remember that too much success in the stock market is in itself an excellent warning. Gerald Loeb Never confuse brilliance on your part with a bull market.

Be that way, Marilyn. You werent sneering at me when I was managing your portfolio. The key to making money in stocks is not to get scared out of them. Peter Lynch Its wise to remember that too much success in the stock market is in itself an excellent warning. Gerald Loeb Never confuse brilliance on your part with a bull market. Up a hundred and sixteen points! If only wed had the foresight to invest ten minutes ago. The worse mistake investors make is taking their profits too soon and their losses too long. Michael Price A diminishing number of new highs, as the DJIA keeps chugging higher, warns of a forthcoming top. Justin Mamis Start investing now, not later. Dont worry about whether the market is high or low just begin investing.

Up a hundred and sixteen points! If only wed had the foresight to invest ten minutes ago. The worse mistake investors make is taking their profits too soon and their losses too long. Michael Price A diminishing number of new highs, as the DJIA keeps chugging higher, warns of a forthcoming top. Justin Mamis Start investing now, not later. Dont worry about whether the market is high or low just begin investing.