To Emerson and Owen

While you were only recently brought into this world, I share the stories in this book with the hope that you will someday embrace their lessons to realize your own investment successes, and that your success provides you with the financial independence and means to enact positive changes on your world.

Learn to take big risks. Learn to survive big failures. But most importantly, learn how to win big in lifeso you can give back even bigger.

To learn about Chris Camillos ongoing commitment to charitable giving, visit ChrisCamillo.com.

Contents

Investments of a Twelve-year-old

Zoning Out the Financial Experts and Professionals

Trading a Life of Financial Mediocrity for Financial Prosperity

How to View Your World Through Investors Glasses

Investigative Due Diligence for the Math and Finance Impaired

Outsmarting Wall Streets Brightest

Monetizing Your Virtual Network

How Stock Options Can Super-Size Your Investment Returns

Preface

People may doubt what you say, but they will believe what you do.

LEWIS CASS

From September 2007 to the completion of this book in April 2010, the value of my self-managed investment portfolio appreciated from $83,752 to $2,388,311. A schedule of my investment returns for this period of time, as confirmed by the independent accounting firm Wagner, Eubank & Nichols, LLP, are available for public viewing on ChrisCamillo.com.

Introduction

Does the idea of investing in the stock market intimidate you?

Do you change the channel every time a financial talking head appears on the TV screen and regurgitates some meaningless Wall Street jargon?

Do business cable networks put you to sleep?

If you are at all like me, your answers to these three questions are yes, yes, and yes!

But heres a much more important question for you: Do you feel that you dont have enough time, money, knowledge, or skill to start investingso you dont?

If your answer to that question is also yes, I am here to change that answer.

I am not a stockbroker. Nor am I a financial analyst, a Wall Street trader, or a hedge fund manager. In fact, aside from two briefly held college internships, I have never even worked in the financial industry. I dont hold an MBA, I have never attended an Ivy League school, and, despite many offers, I certainly have never received money for financial advice.

What I am is a self-directed or amateur investor. Yet I dont crunch numbers, I dont study charts, and I dont analyze the balance sheets of the companies whose stocks I buy. I rarely even read the Wall Street Journal .

I bought and sold my first stock at the age of twelve, by picking a ticker symbol at random from the Business section of my dads morning newspaper. That was more than twenty years ago. Today, using a more refined and sensiblebut nearly as simplestock-picking methodology, I manage for myself one of the worlds top-ranked personal investment portfolios.

Over the past three years the value of my self-managed personal stock portfolio has grown twentyfold from less than $100,000 to over $2 million. This includes a period from 2008 to 2009 commonly referred to as the Great Financial Collapse, when the value of the stock market, along with most all publicly traded stocks, was cut in half.

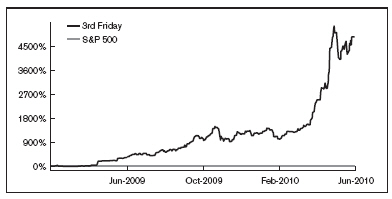

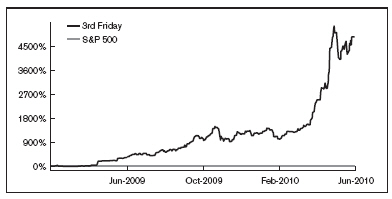

Snapshot of the authors portfolio taken on June 2, 2010, as verified by Covestor.com.

The steep ascending line in this graph represents the twelve-month performance of my personal stock portfolio from June 2009 through June 2010. (The label 3rd Friday refers to my Internet alias; youll learn about its meaning later.) The flat line at the bottom of the graph represents the performance of the S&P 500 stocksbasically the performance of the stock market as a wholewhich nearly mirrors the performance of most professionally managed portfolios.

If the difference between the two lines seems extreme, thats because it is. In 2010, of the forty thousand-plus portfolios tracked globally by Covester.com (the worlds largest portfolio tracking service), my portfolio was ranked number one among all those with a value exceeding $250,000.

So, if an ordinary guy like me, who despises traditional, mind-numbing financial analysis, is able to outdo the Wall Street experts, my question is, why cant you?

You say you dont like math? No problem! Short on time? Who isnt? Whether you are a schoolteacher, a physician, a retail clerk, or a creative type with zero financial literacy, I will show you how you can help your family and improve your long-term financial future by becoming a successful self-directed investor.

Documented studies have proven again and again that there is no correlation between ones ability to pick winning stocks and ones level of financial knowledge or experience. In more than a hundred contests held by The Wall Street Journal since 1988, professional money managers have not been able to outperform either the stock market at large or stocks chosen by darts thrown by Journal staff members at a newspapers financial pages.

Fortunately, my recipe for success centers on you, and not on your scholarly degree or level of financial expertise.

Do you watch TV, read magazines, connect with friends on Facebook, or surf the Web? Do you frequent the mall, eat out, or shop for groceries? Do you have children in your family or extended family? Do you spend your daytime hours anywhere other than a Wall Street trading room?

If you answered yes to any of these questions, you have what it takes to become a successful self-directed investor. You might very well be an outsider to Wall Street and all things financial, but unlike the Wall Street suits who spend their days staring at flashing ticker symbols on computer screens, you have your feet deeply planted in the real world. Because of that, you have firsthand exposure to the companies, products, and trends that shape winning investments in both good times and bad.

Have you ever waited forty minutes to get seated at a newly opened P.F. Changs or a Cheesecake Factory restaurant in the suburbs? It can be a frustrating experience, I know. That is, unless you own stock in either of these companiesin which case you would welcome the long wait times and have ample profits to afford their $8 cocktails.

Do you have a teenage daughter who has begged you for a pair of overpriced (at least so I think) Ugg boots or True Religion jeans because everyones getting them? How about a teenage son who spends all hours of the day and night playing Guitar Hero?

If you dont have those very typical teenagers living in your home, Im willing to bet that you have a family member, friend, or colleague at work who doesmeaning that you have had an opportunity to spot these emerging youth trends long before they became evident to the overworked investment analysts on Wall Street who are preoccupied with examining every number that corporations can throw at them.

If you watch nightly entertainment news programs or read weekly tabloids, you might recall seeing or reading about Michelle Obama mentioning on The Tonight Show that she and her children love to shop at J.Crew. Her public endorsement of the brand caused sales to spike. The retailers stock price soon followed.

Did you happen to visit an amusement park or state fair during the summer of 2006? If so, Ill bet you noticed more than a family or two sporting brightly colored rubber Crocs sandals. You may have been wearing a pair yourself at the time. As bright as those rubber sandals were, the sharply dressed tycoons on Wall Street never saw them cominguntil they read about the companys record sales in the Business pages.