the

MR. X INTERVIEWS

Volume 2

WORLD VIEWS FROM A

FICTIONAL US SOVEREIGN CREDITOR

LUKE GROMEN

The Mr. X Interviews, Volume 2: World Views from a Fictional US Sovereign Creditor

Copyright 2020 by Luke Gromen. All rights reserved.

Published by:

Aviva Publishing

Lake Placid, NY

(518) 523-1320

www.AvivaPubs.com

All Rights Reserved. No part of this book may be used or reproduced in any manner whatsoever without the expressed written permission of the author.

Address all inquiries to:

Luke Gromen

info@fftt-llc.com

440-732-0764

www.FFTT-LLC.com

ISBN: 978-1-890427-28-3

Library of Congress Control Number: 2018912681

Editor: Tyler Tichelaar/Superior Book Productions

Design & Layout: Birte Kahrs

Every attempt has been made to source all quotes properly.

First Edition

To my wife and my three sons,

my mom and dad,

Kathy McGinnis,

and to everyone Ive met on this journey.

Thank you.

Contents

Acknowledgments

Mr. X is a composite of a number of historical figures and modern-day people. A heartfelt thank you to you all.

Disclosures

FFTT, LLC (FFTT, Forest for the Trees) is an independent research firm. FFTTs reports are based upon information gathered from various sources believed to be reliable but not guaranteed as to accuracy or completeness. The analysis or recommendations contained in the reports, if any, represent the true opinions of the author. The views expressed in the reports are not knowingly false and do not omit material facts that would make them misleading. No part of the authors compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views about any and all of the subject securities or issuers. However, there are risks in investing. Any individual report is not all-inclusive and does not contain all of the information you may desire in making an investment decision. You must conduct and rely on your own evaluation of any potential investment and the terms of its offering, including the merits and risks involved in making a decision to invest.

The information in this report is not intended to be, and shall not constitute, an offer to sell or a solicitation of an offer to buy any security or investment product or service. The information in this report is subject to change without notice, and FFTT assumes no responsibility to update the information contained in this report. The author, company, and/or its individual officers, employees, or members of their families might, from time to time, have a position in the securities mentioned and may purchase or sell these securities in the future. The author, company, and/or its individual officers, employees, or members of their families might, from time to time, have financial interests with affiliates of companies whose securities have been discussed in this publication.

Its important to understand many important stories are always hiding in the open.

Seymour Hersh, Pulitzer Prize Winning Reporter

Chapter 1: Chinese Yuan Bears Seem to Be Missing Something Critical

OCTOBER 2017

My iPhone rang; I turned it over to see a familiar foreign country code. It was Mr. X.

Hello, my friend! I greeted him, excited to hear his voice.

Luke, how are you?

Im well, Mr. X. And you?

Im excellent. Listen, I hate to be brief, but I am going to be in New York next week. I apologize for the short notice, but would you be able to join me for dinner next Thursday? There is much to discuss.

I quickly toggled over to my Outlook calendar and found it wide open. Im available. Thursday night, same place as usual? What time? I asked.

Seven oclock? Mr. X suggested.

Perfect, I replied. See you then.

When the day came, I touched down at LaGuardia in the morning, met a dear friend for lunch, and saw clients before heading downtown to the restaurant in Chelsea. Mr. X was waiting for me, and he rose to meet me when I walked in.

Luke: Thank you for inviting me to dinner. Its great to see you again.

Mr. X: Youre welcome; thank you for joining me. Ive been excited to catch up.

Luke: You usually have provocative observations about global markets you are willing to shareanything grabbing your attention these days?

Mr. X: Yes. A number of high-profile investors are negative on China and the Chinese yuan (CNY), based on analyzing China using traditional Emerging Market (EM) Balance of Payments (BoP) metrics. However, in one critical aspect, China is no longer an EM, yet these investors are analyzing China as if it still is; that may prove to be a grave error.

Luke: What do you mean? In what critical aspect is China no longer an EM?

Mr. X: Historically, under the petrodollar system, EMs had to run current account surpluses (earn USDs on net) in order to buy oil and other commodities and to service any USD-denominated debt. In instances where EMs began to run deficits, they had to sell FX reserves to support their currencies; when they ran out of FX reserves, they suffered a currency crisis where their currency fell sharply versus the US dollar (Russia 1998, SE Asia 1997, Argentina 2001, etc.)

If oil and commodities are only priced in USDs, the only way for the EMs to move from a current account deficit to a surplus once they run out of FX reserves to support their currency is by devaluing their currency. China/CNY bears are looking at China through this lens, but they are missing something very important in my view.

Luke: Which is what?

Mr. X: The bear case on CNY rests squarely on the assumption that China is subject to that same aforementioned EM calculus. China imports a lot of oil, and it will likely need to import even more in the coming years.

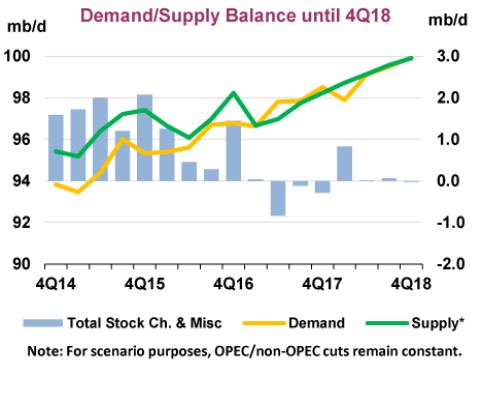

Furthermore, the IEA (International Energy Agency) recently increased global oil demand estimates [See chart below, source: IEA].

Importantly, all of this will be happening in the context of global energy industry capital spending having been slashed by more than $1 trillion over the past 2-3 years during the oil downturn.

[Mr. X passed to me the following article:]

Global oil industry capex cuts top $1T 6/15/16

https://www.cnbc.com/2016/06/15/global-oil-industrys-retrenchment-tops-a-staggering-1-trillion.html )

Given the above factors, if we look at China through the traditional EM lens as CNY bears do, we see that as Chinese oil imports and the price of oil begin to rise, China will move toward running a current account deficit, in the presence of a highly-levered banking system, which will force China to bleed down FX reserves to below some critical level, at which point China will then have to significantly devalue the CNY. We have seen numerous EMs go through this exact situation during the last 30-40 years.

Luke: That seems to make sense to mebut I take it you disagree?

Mr. X: Oh, yes. In my opinion, this analysis ignores a critical development.

Luke: How?

Mr. X: Its only valid if oil is only priced in USDs. Then the CNY bears may very well be proven rightChina could suffer the traditional EM currency crisis, necessitating the CNY devaluation the CNY bears are looking for.

However, if oil begins being priced in CNY, then the CNY bears will likely be waiting a long, long time for the big CNY devaluation they think is imminent.

Luke: Why?

Mr. X: Because the upcoming CNY oil contract in the presence of what is essentially a reopened Bretton Woods gold window at a floating price through CNY will give China a second lever to manage its current account witha second lever that no other EM in history has ever had to manage its current account with. This is the critical aspect most CNY bears are missing that I mentioned earlier. They appear to be totally ignoring the implications of this reality.

Next page