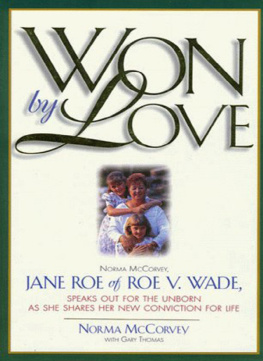

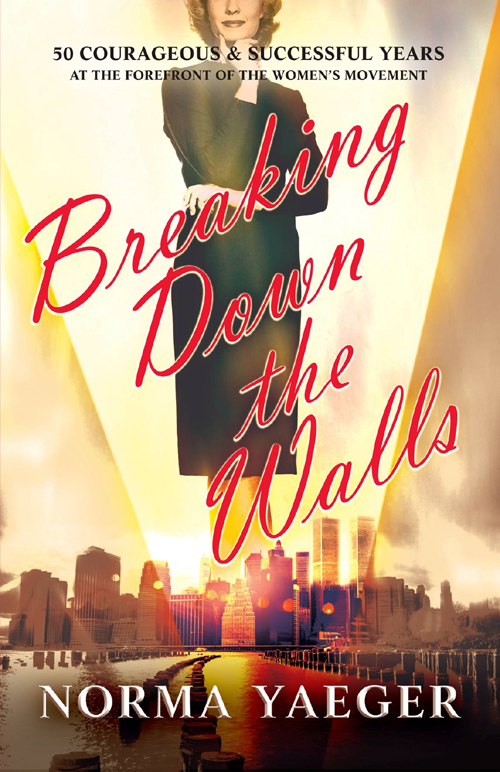

Breaking Down the Walls:

50 Courageous & Successful Years at the Forefront of the Womens Movement

by Norma Yaeger

Copyright 2012 VESST Publishing

Cover design: Monkey C Media

All rights reserved. No part of this book may be reproduced in any manner whatsoever without written permission except in the case of brief quotations embodied in critical articles or reviews.

ISBN 978-0-9857465-0-3

To My Husband Dr. Lawrence Yaeger

Thank you for your continuing support during my

successful and difficult times.

To My Children Victor, Stephen, Sheri, Elysa, & Tod

I am very proud of you and what you have

become as adults.

To my Grandchildren Stacey, David, Naomi,

Callie, & Seth

I adore each and every one of you.

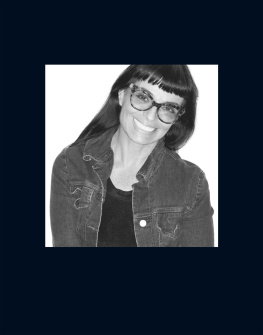

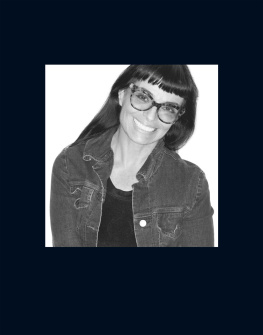

Norma Yaeger under the stock ticker in the Beverly Hills office of Drexel Burnham Lambert

INTRODUCTION

Michelle Morton

President and CEO, Pacific American Securities

May 2012

Norma was absolutely extraordinary in the financial industry and still is. I have never met her equivalent. It is hard enough to run counter to a culture that excludes women, as Norma did beginning in 1962. It is even more difficult to run counter to a culture that rewards questionable ethics. Norma maintained her integrity throughout her career and achieved financial success.

To understand how rare she is, you have to understand the financial industry. People are attracted to this industry because they can make a lot of money. A certain kind of personality gravitates to the money. Because there is so much of it available, the industry doesnt pull in the best people, in terms of their values, ethics, and character.

What is character? Its how you behave when no ones looking over your shoulder. In this business, as in all business, there is corruption; temptation is always in front of you. You learn fast that you can pay to play. For example, when you own a brokerage firm, you can use political connections to increase your business. You can take advantage of influence-peddling. You can contribute to political fundraising campaigns, then make sure that the elected official sets you up with golden opportunities. You can sit on the board of a pension plan and bring them business, and theyll pay you off in trading. Clients frequently make it clear to stockbrokers that they expect something beyond just good service, and brokers frequently comply. Worshipping the dollar and playing by the rules tend to be mutually exclusive.

Norma followed the rules. She had the discipline to regulate herself. She was completely honest regardless of the consequences. She did not allow the system to dictate her behavior. And she was able to build her two brokerage firms and successfully compete against companies with more technology, more seasoned traders, and more products on offer, on a playing field made uneven by backroom deals. People dont realize you can make a profit by doing the right thing. Thats such a foreign concept, but it shouldnt be, and Normas success proves that.

Normas influence and her basic business values had a profound effect on me. I had worked at BNY Mellon Asset Management on their marketing team, providing investment management services to high net worth individuals. Then I became Interim President of Meyers Capital Management, LLC, working with Shelly Meyers who was quite brilliant. I was helping her and honing my skills at the same time, in anticipation of someday owning my own firm. After I had been there about a year, Shelly introduced me to Norma.

When I worked with Norma to buy her firm and transition Yaeger Capital Markets into Pacific American Securities, I realized that I was a kid. After seventeen years in the business, I still had a lot to learn. I was so lucky to have Norma to learn from. She helped me craft my identity as a professional, placing the fact that Im a woman and a minority second, so that I would never just be a figurehead for the firm. She modeled for me how to have a clear vision and how to maintain my integrity. She taught me to know my craft and to understand all aspects of the industry.

That was rare, too. Most people in the industry have an area of expertise, but Norma understood the financial, client, and marketing sides of the industry, the complexity of the regulations, and all the different products being offered. She is a Renaissance woman.

I really dont know how she did it. My upbringing had prepared me to aim high and be assertive. My parents believed in possibility. I had a great-aunt, Emily Waters, who was one of the first Black women to be admitted to Julliard. My aunt, Cicely Tyson, was a trailblazer in Hollywood. I was taught that change could and should happen, and that I should be part of it. When I graduated in 1982 from Hood College for Women (a sister school for the U.S. Naval Academy), it was expected that we would either be mothers or have careers and if you were going to choose motherhood, you had better be engaged by October of your senior year and wedded the following June. However, at least we could choose to have careers if we wanted them.

Norma was raised without that choice, without anyone teaching her that she had that choice. I know that I still face racism and sexism its not prevalent but it exists but Norma had to deal with doors slamming in her face and people not taking her seriously for decades. There werent organizations for women to help her. She had to take mentoring where she could find it to gain the education she needed.

These days, the financial industry is full of Ivy League graduates and MBAs. Anyone with political connections can open a brokerage firm, and if they know the right people, theyll succeed. Norma had to fight her way up. She persevered, survived difficult times, and worked hard.

And she did it all while raising children who are successful and bright, responsible, contributing members of society. I own and manage a brokerage firm, too, but I just have a dog. I cant believe I know somebody who achieved both a successful career and having a wonderful family. Its amazing to even do one.

Norma is still known; people in the industry still remember who she is, even though she has been retired for over a decade. I think people responded so well to her because she was authentic and uncompromising. She was a little bit of a spitfire, but it was her confidence in herself and her abilities (confidence in a woman is not a bad thing) that attracted clients and colleagues to her. She was also a good marketer and wouldnt take no for an answer. She instilled the highest values in her employees I think of her as the proverbial iron fist in a velvet glove.

I wish that her influence on the industry could survive and spread. We need more people with her willpower and values. The culture of the industry has changed over the course of my career. The system has always been set up to invent different ways to make money. The nature of investing is innovation so you get invented products like the bundling and re-selling of mortgages, but the system also invented mutual funds so that people who dont have a lot of money can participate in the market. Like anywhere, people have good ideas and bad ideas. Unfortunately, there havent been a lot of good ideas lately.