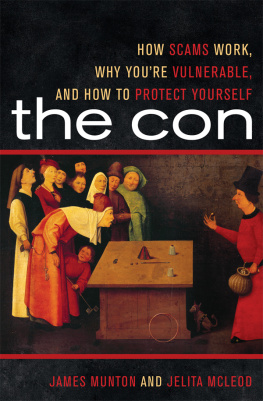

First, while this book is dedicated to informing and educating seniors about scams, it is not intended to replace legal or investment advice from licensed professionals. The world is complicated enough without practicing do it yourself in matters that require expert attention.

Second, much of this book centers around information available on the Internet. The Internet is a fluid community; Web sites come and go with disquieting regularity, and some of what you find on the Internet is speculative and misleading. I have made every attempt to recommend only Web sites that appear legitimate and useful and long-running. But like everybody else working the Internet, I recognize that things change, and whats golden today is dross tomorrow. Plus the fact that I, too, am fallible (yes, folks, I do make occasional mistakes). So whatever you doand I cant emphasize this enough check and double-check any information source before you make a decision affecting your health or your pocketbook.

Finally, my purpose in writing this book is to show you how to look out for scams so that youll feel comfortable exploring the Internet and other sources on your own. Awareness is the first line of defense against scams.

How well prepared are you to avoid common scams, the kind that you pay for in the currency of money and grief? Think youre doing all right? Well, lets find out. Take this short nine-question true-or-false test to see how vulnerable you are to attack from everyday scammers. At the end of the test, score yourself according to the Scam-Savvy Scale.

- Boomers, followed by seniors, is the demographic group most commonly targeted for scams because they have the largest concentration of money and material possessions, a prime attraction for scammers.

- Low-to-moderate use of ATM machines lessens ones chances of being robbed or scammed.

- The homes of affluent people are the usual choice of burglars to ply their craft because thats where the money is.

- With all the problems associated with online identity theft, its much safer to bank in person or by mail and receive your cancelled checks and bank statements by mail.

- Variable annuities are one of the worst investments seniors can make.

- In this age of uncertainty when anything can go wrong, from disrupted travel plans to terrorist attacks, as much insurance as you can afford is a necessity.

- Because hackers and identity thieves constantly roam the Internet, you need to minimize your time online.

- When selling anything from an old set of golf clubs to your car, accept nothing less than cash, and failing that, certified checks or money orders.

- Although there is a charge associated with it, an unlisted telephone number is one of the few methods available to disguise your telephone number from crank callers and telemarketers.

Hey, you having fun? Okay, now check the answers below:

- False. The demographic group most commonly targeted for scams is seniors. There are five reasons. Read about them in Sooner or Later Youre Going to Get Scammed.

- False. Low-to-moderate use still unduly exposes you to the insidious devices of scammers who will empty your bank account faster than a hungry robin swallowing a worm. Try not to use ATMs except in cases of emergency. Find out more in ATM Machines.

- False. The way the statement reads is deceptive (and, I must admit, tricky). It disguises the fact that seniors are frequently burglarized because theyre perceived as people with a great deal of wealth and the easiest marks. Read Casing Your Home.

- False. Its a matter of the lesser of two evils. The most frequently used method to steal your bank account numbers is from bank statements sitting in your exposed mailbox. Banking online is safer if you follow a few basic rules. See Banking Online.

- True. Consumer writer Jane Bryant Quinn says variable annuities are products she dreams of blowing to smithereens. Find out why in Variable Annuities.

- False. It depends on the type of insurance. Some kinds are needed, others are unnecessary. Go to Unnneeded Insurance Policies and learn the difference.

- False. There are better ways to prevent hacker intrusions on the information superhighway without curtailing your time online. Find out what they are in Bogus Web Sites, Dangerous Spam E-mail, and Phishing for Your Credit Card Number.

- False. You cant accept even certified checks or money orders at face value because counterfeiters know how to make fakes practically indistinguishable from the real thing. Find out how to make sure you dont get snookered. Read Money Orders.

- False. Your unlisted telephone number, for which you pay a premium fee, is for sale on the Internet. Discover how to prevent unwanted telephone calls using a technique that wont cost you a nickel. Read Unlisted Telephone Number.

Okay, now add up the number of questions you got right and multiply that by ten. Thats your Scam-Savvy Score. Check your score against the scale shown below to see how really and truly adept you are at avoiding scams.

The Scam-Savvy Scale

If your Scam-Savvy Score is in this range: 90

Heres how good you are at avoiding scams : Youre dead-on perfect.

And heres what you should do about it : Help me write the next book on scams.

If your Scam-Savvy Score is in this range: 7080

Heres how good you are at avoiding scams : Up to 20% of the scams working against you are going to be successful. Not good.

And heres what you should do about it : Read this book and follow its advice.

If your Scam-Savvy Score is in this range: 5060

Heres how good you are at avoiding scams : Youre about average, which means youre going to get scammed frequently.

And heres what you should do about it : Carry this book with you wherever you go and refer to it often.

If your Scam-Savvy Score is in this range: 40 and under

Heres how good you are at avoiding scams : You have much to learn.

And heres what you should do about it : Pack your bags and leave town before the next scammer spots you.

All kidding aside, if you scored sixty or below, this book is really going to be an eye-opener, one that may save you many dollars that otherwise would be lost to scammers, not to mention being spared tons and tons of headaches.

If you scored eighty or ninety, it shows youre on the right track, but can still improve your ability to thwart those dastardly scammers. So, read on.

Allow me to introduce myself. My name is Ron Smith. Im a senior in my early seventies whos been there, done that. So I understand your problems, your anxieties, and your vulnerabilities. But just so theres no misunderstanding, Im not a heath-care professional, a financial advisor, an insurance agent, a lawyer, or a priest. What I do is expose scams against seniors. Thats why Im called the Scam Doctor.

The purpose of this book is to alert seniors like you to the more common scams perpetrated on older people. Each of the sections of the book describes a scam, shows how to spot it in action before the scam artist reaches a hand deep inside your pocketbook, and explains how to prevent it from happening in the first place.

As a senior, youre a target, a big, juicy one. The kind that makes scam artists salivate. When they see you coming, theyre ready to concoct any number of nefarious schemes to defraud you and rob you of your hard-earned money. Its an unconscionable act, but who ever claimed scam artists are highly moral people?

There are several reasons crooks consider you easy pickings. First, youre part of the fastest-growing demographic age segment, so just on numbers alone it falls to reason youre going to be increasingly targeted. According to the 2000 census, there are 45 million people age sixty and older living in the good old USA.

![Dorian Ritter (2023) - The Strength Training Workouts Bible for Seniors 60+: [7 in 1] The Most Complete Guide of 200+ Simple Exercises that Elderly of Any Level Can Do Step by Step at Home](/uploads/posts/book/451362/thumbs/dorian-ritter-2023-the-strength-training.jpg)