Fasten Your FINANCIAL SEATBELT

What Surviving an Airline Crash Taught Me

AboutRETIREMENT PLANNING

MONEY MYTHS

What people think they know about money is often wrong.

Thomas C. Scott saved a dozen lives as a crewmember on a Boeing 747 that crashed in 1974, killing 59 people. When he became a financial adviser he discovered that, like airline passengers who ignore preflight safety instructions, most people ignore the basics in handling their finances, make assumptions that are inaccurate, and leave themselves unprepared for disaster.

HUMAN FACTORS

How our nature works against us.

PREFLIGHT CHECKLIST

Life goals should come before financial goals.

Hes taken what hes learned about how we behave under stress and the common mistakes people make with their money and put it all together in this unique, inspiring, and personal look at how easily we can lose what we have when we forget to fasten our financial seatbelts.

Youll learn about:

The rear-view mirror investment trap

The difference between investing and speculating

The plumage trap

Why a big salary is not wealth

How shame and guilt keep us from seeking help

How to find a good investment sherpa

ELEMENTS OF SUCCESS

Make a plan, and resist your worst instincts.

PILOTS & CO-PILOTS

The right adviser is as important as the right investment.

www.FinancialSeatbelt.com

Thomas C. Scott

Tom Scott was a 23-year-old crew member on Lufthansa Flight 540 when it crashed on takeoff in Nairobi, Kenya on November 20, 1974. In the midst of the burning wreckage he kept his head and helped a dozen people barely escape with their lives from the first-ever fatal wreck of a Boeing 747.

Today, Tom is a seasoned financial planner and Forbes.com guest columnist who has rescued hundreds of people from economic catastrophe. He is founder and CEO of Scott Wealth Management Group, Inc. in Orange County, California, where he has been a financial planning professional since 1983.

His practice is affiliated with LPL Financial, one of the nations largest independent brokerage firms, where he is a member of LPLs Chairmans Council, an honor reserved for those advisers ranked in the most successful top two percent of nearly 12,000 financial advisors.

He lives in Irvine, California, and is the father of two grown daughters.

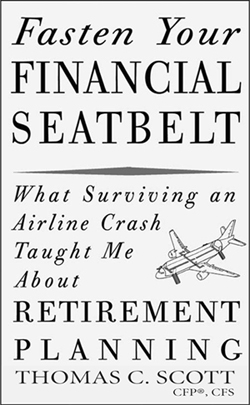

Fasten Your FINANCIAL SEATBELT

What does surviving a fatal airline crash have to do with retirement planning? Thomas C. Scott finds many parallels between his experience as a crew member helping people escape the burning wreckage of a Boeing 747 and what he has been doing the past quarter century: helping people escape the dangers that threaten their financial security.

Lessons learned include the value of planning and preparing for the worst. Like airline crashes, most of us think that financial disaster only happens to other peopleuntil it happens to us.

As in an airline crash, the survivors of a financial calamity are often paralyzed by fear and unable to see the way out of their predicament.

Like flying, our relationship with money is often emotional and tinged with anxiety. Its important to have a trusted adviser on your side, protecting you from those human instincts that interfere with our ability to make good financial choices.

This is the book youll wish youd had before the Crash of 2008, and the book that will prepare you for the next time, by explaining how you can fasten your financial seatbelt.

Copyright 2009 Thomas Chalmers Scott

All rights reserved.

Thomas C. Scott

www.FinancialSeatbelt.com

Tom.Scott@FinancialSeatbelt.com

Published in the United States by

Platform Press

The nonfiction imprint of

Winans Kuenstler Publishing, LLC

47 West Oakland Avenue

Doylestown, Pennsylvania 18901

www.wkpublishing.com

Platform Press and colophon are registered trademarks

ISBN: 978-0-9824117-1-1

Library of Congress Control Number: 2009927376

First Edition

All rights reserved under International and Pan-American Copyright Conventions. This book, or parts thereof, may not be reproduced in any form without permission, except in the case of brief quotations embodied in critical articles or reviews.

This publication is designed to provide accurate and authoritative information on the subject of personal finances. However, it is sold with the understanding that neither the Author nor the Publisher is engaged in rendering legal, accounting, financial, or other professional services by publishing this book. As each individual situation is unique, specific questions about your personal finances should be addressed to a qualified professional to ensure that the situation has been evaluated carefully and appropriately. The Author and Publisher specifically disclaim any liability, loss, or risk which is incurred as a consequence, directly or indirectly, of the use and application of contents of this work.

Dedicated to those investment

professionals who share a

passion for educating clients

about how money works,

how wealth is created and

preserved, and how to make

responsible financial decisions.

The saving man becomes

the free man.

Chinese Proverb

Preface

Mountains of books have been published about how to achieve financial goals, but little attention is paid to what happens when you reach them. Fasten Your Financial Seatbelt is the distillation of twenty-five years experience helping people define their goals, reach them, andthe hardest task of allstay there.

Ive been intrigued by the role money plays in our lives since I was a young man, working with my father in his elevator maintenance business, watching him achieve real financial success through hard work and integrity. I also watched with dismay as he then squandered it all, trying to grow richer quicker by investing in risky ventures and questionable schemes. It was both heartbreaking and instructive.

My father passed on to me a conscientious attitude about hard work and high standards. But my relationship with money couldnt have been more different. My mother called me her little old man. I was the pink-cheeked seven-year-old the tellers cooed over when she took me to the savings and loanat my insistenceand hoisted me up so I could see into the teller cage and hand over my well-thumbed savings passbook. The teller would stamp the number of pennies of interest my little balance had earned since the last time I was in. I loved looking at the account balance column and its long string of ever-increasing entries.