Connectedness and Contagion

Protecting the Financial System from Panics

Hal S. Scott

The MIT Press

Cambridge, Massachusetts

London, England

2016 Hal S. Scott

All rights reserved. No part of this book may be reproduced in any form by any electronic or mechanical means (including photocopying, recording, or information storage and retrieval) without permission in writing from the publisher.

This book was set in Palatino LT Std by Toppan Best-set Premedia Limited. Printed and bound in the United States of America.

Library of Congress Cataloging-in-Publication Data

Names: Scott, Hal S., author.

Title: Connectedness and contagion : protecting the financial system from panics / Hal S. Scott.

Description: Cambridge, MA : The MIT Press, 2016. | Includes bibliographical references and index.

Identifiers: LCCN 2015039900 | ISBN 9780262034371 (hardcover : alk. paper)

eISBN 9780262332149

Subjects: LCSH: Financial crisesHistory21st century. | Global Financial Crisis, 20082009Government policy. | Global Financial Crisis, 20082009.

Classification: LCC HB3722 .S385 2016 | DDC 339.5/3dc23 LC record available at http://lccn.loc.gov/2015039900

10987654321

To all of those who so successfully fought the panic created by the financial crisis of 2008

Acknowledgments

This book has been made possible through the efforts of many individuals. C. Wallace DeWitt, Eric M. Fraser, John Gulliver, Brian A. Johnson, Jacqueline C. McCabe, each a former Research Director of the Committee on Capital Markets Regulation, and Jacob Weinstein, Senior Advisor to the Committee, worked on early drafts of a paper from which this book evolved. Matthew Judell and Megan Vasios, each a Research Fellow at the Committee on Capital Markets Regulation, also contributed to this book.

I particularly appreciate the significant support and outstanding work provided by the following research assistants, each of whom assisted in drafting significant portions of earlier versions of this book: Ledina Gocaj, Adam Jenkins, Conor Tochilin, Yuli Wang, and Peter Zuckerman. In addition, research assistants Pam Chan, Weiwei Chen, Elaine Choi, Joseph Costa, Michael DiRoma, Katrina Flanagan, Brent Herlihy, Carys Johnson, Paul Jun, Tsz hin Kwok, Hye Kyoung Lee, Steven Li, Brice Lipman, Sai Rao, Jeffrey Scharfstein, and David Willard provided general assistance. Also thanks to Roel Theissen for his work on the European Union.

This study arose from a broader review of issues in financial regulatory reform conducted by the Committee on Capital Markets Regulation in the wake of the 2008 financial crisis, the first stage of which resulted in a report (The Global Financial Crisis: A Plan for Regulatory Reform) released in May 2009. The views expressed in this book are my own and do not necessarily represent the views of the Committee on Capital Markets Regulation or any of its individual members. Any errors are, of course, mine.

Introduction

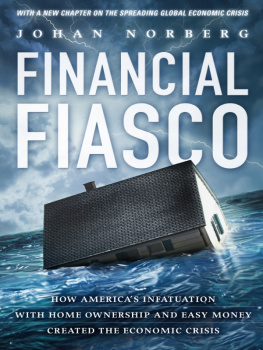

This book is concerned with the fundamental stability of our financial system upon which the viability of our economy, and ultimately our polity, rests. In the 2008 financial crisis we witnessed a severe plunge in real estate pricesthe Case Shiller National Home Price Index stood at 184.62 in July 2006, but by September 2008 it had fallen to 161.95. It eventually fell as low as 134.03 in 2012.

This book demonstrates that contagion, not connectedness, was the most potentially destructive feature of the 2008 financial crisis. Connectedness occurs when financial institutions are directly overexposed to one another and the failure of one institution would therefore directly bankrupt other institutions, resulting in a chain reaction of failures. Contagion is a different phenomenon. It is an indiscriminate run by short-term creditors of financial institutions that can render otherwise solvent institutions insolvent due to the fire sale of assets that are necessary to fund withdrawals and the resulting decline in asset prices triggered by such sales.

Contagion indeed remains the most virulent and important part of systemic risk still facing the financial system today. This is because, as set forth throughout this book, our financial system still depends on approximately $7.4 to $8.2 trillion of runnable and uninsured short-term liabilitiesdefined as liabilities with a maturity of less than one month, with about 60 percent of these liabilities held by nonbanks.

The losses and the impact on our economy and country in September 2008 would have been much worse but for the response of our government to halting the contagion that broke loose following the bankruptcy of Lehman Brothers. However, since then the Congress has dramatically weakened the Federal Reserve, FDIC, and Treasurys ability to respond to contagion, leaving our financial system sharply exposed to another contagion.

The Federal Reserve was created in 1913 to stem such panics, which were rife in the nineteenth century and culminated in the panic of 1907, by acting as a lender of last resort. After the bank runs experienced in the Depression of 1933, Congress created the Federal Deposit Insurance Corporation (FDIC) to guarantee deposits. These two powers were used extensively during the 2008 crisis. The Fed supplied liquidity to the banking and nonbanking financial sector, the latter through its authority under Section 13(3) of the Federal Reserve Act. The FDIC expanded the scope and amount of deposit insurance. In addition, the US Treasury offered temporary guarantees to money market funds. And finally, TARP was enacted to infuse public capital into the banking system, beginning with the nine largest banks. In the aftermath of the crisis, the use of these powers has been called into question as contributing to moral hazardgiving institutions the incentive to take on riskand as constituting undesirable public bailouts of insolvent institutions. In fact some members of Congress believe that public funds in any form should not be used to support the private sector, including financial institutions.

As a result of these concerns, the Feds and FDICs powers were pared back by the DoddFrank Act of 2010, and in the case of the Treasurys temporary guarantee to money market funds, by TARP. The Feds powers to loan to nonbanks under 13(3) can now only be used with the approval of the Secretary of Treasury, the Fed can only loan to nonbanks under a broad program (not to one institution as it did in the case of AIG), and nonbanks must meet heightened collateral requirements. The Fed now ranks fourth to its central bank peersthe Bank of England, the European Central Bank, and the Bank of Japanin its powers to act as lender of last resort. The FDIC and the Treasury cannot on their own, without prior congressional approval or new authority, expand guarantees. The authority to make public capital injections, even to address widespread insolvency that could seize up the banking system and real economy, has expired with the expiration of TARP.

The contraction of powers, which former Secretary Timothy Geithner calls barely adequate in his book Stress Test, puts us at severe risk in dealing with the next financial crisis. Secretary Geithner states: We went into our crisis with a toolbox that wasnt exactly empty, but also wasnt remotely adequate for our complicated and sprawling modern financial system. What should be in the toolbox? The vital tools are: an ability to extend the lender-of-last-resort authority to provide liquidity where its needed in the financial system; resolution authority and, along with deposit insurance broader emergency authority to guarantee other financial liabilities.

Or consider this quote from former Secretary of the Treasury Paulson:

DoddFrank falls short in other areas . Congress has also removed some of the most creative and effective tools used to stave off collapse. In order to provide greater Congressional control, DoddFrank limits regulator discretion in times of crisis. In one respect, of course, thats all to the good. Congress is responsible to our citizens, so its encouraging to see the focus on taxpayer protection. The bank rescues were a source of public outrage, so it is understandable that Congress would take steps to ensure that failing institutions not be propped up in their present form. But some of the powers that Congress limited or constrained, such as some Federal Reserve lending authorities or the FDIC guarantee authority, were rarely used, if ever. Emergency measures such as we used to stem the crisis should be employed only when we are facing the economic equivalent of war, and the president and two-thirds of the Fed and the FDIC make a financial emergency declaration to protect the American people. Why give up these tools and disarm when there is no assurance that policy makers will not need such flexibility again?