Bad History, Worse Policy

Distributed by arrangement with the Rowman & Littlefield Publishing Group, 4501 Forbes Boulevard, Suite 200, Lanham, Maryland 20706. To order, call toll free 1-800-462-6420 or 1-717-794-3800. For all other inquiries, please contact AEI Press, 1150 Seventeenth Street, N.W., Washington, D.C. 20036, or call 1-800-862-5801.

Library of Congress Cataloging-in-Publication Data

Wallison, Peter J.

Bad history, worse policy : how a false narrative about the financial crisis led to the Dodd-Frank Act / Peter J. Wallison.

p. cm.

Includes bibliographical references and index.

ISBN 978-0-8447-7238-7 (cloth) ISBN 0-8447-7238-0 (cloth) ISBN 978-0-8447-7239-4 (pbk.) ISBN 0-8447-7239-9 (pbk.) ISBN 978-0-8447-7240-0 (ebook) ISBN 0-8447-7240-2 (ebook)

1. FinanceGovernment policyUnited States. 2. United States. Dodd-Frank Wall Street Reform and Consumer Protection Act. 3. Federal National Mortgage Association. 4. Federal Home Loan Mortgage Corporation. I. Title.

HG181.W283 2012

332.7'20973--dc23

2012033490

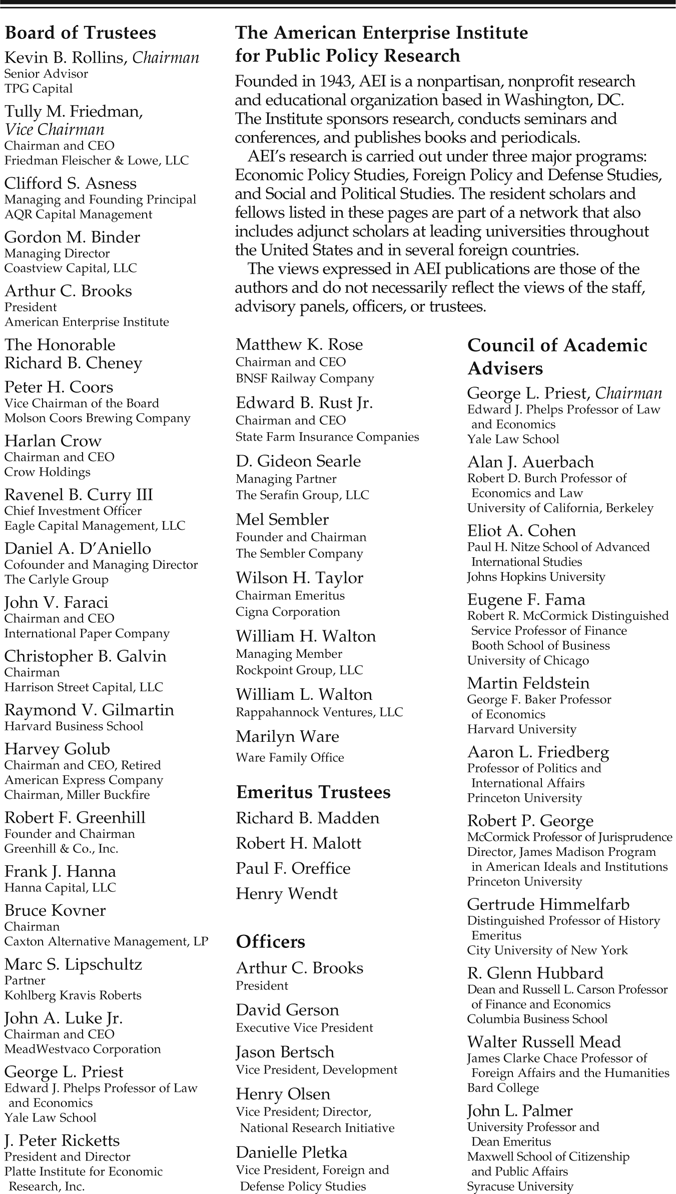

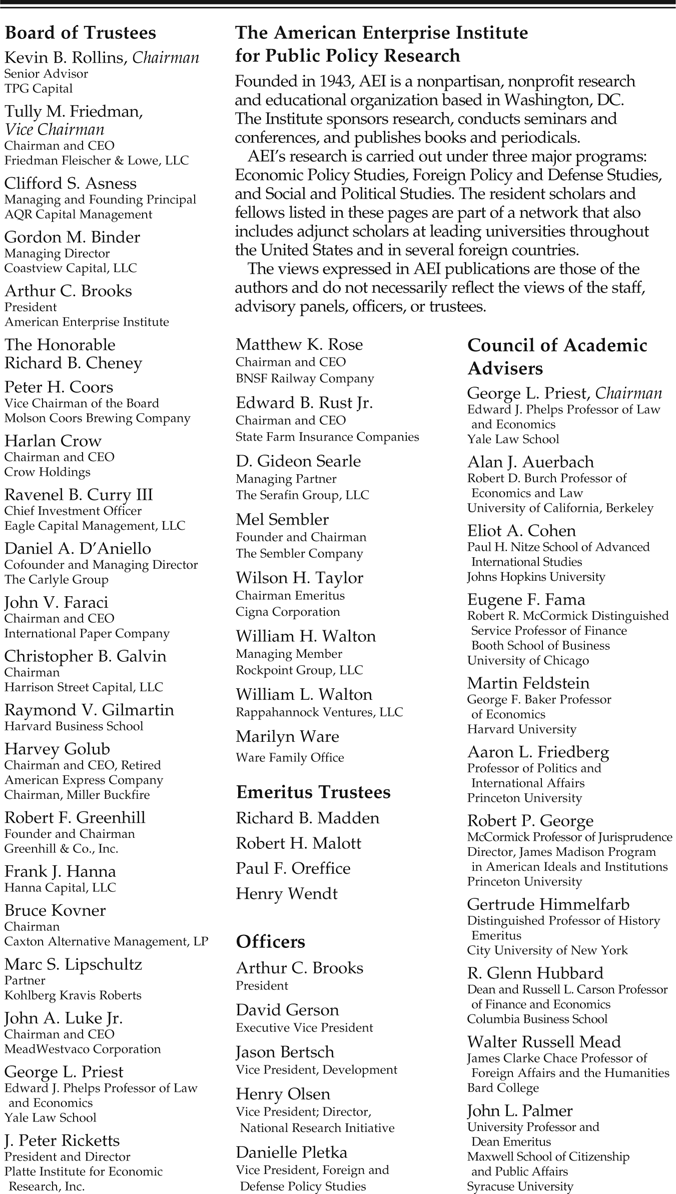

2013 by the American Enterprise Institute for Public Policy Research, Washington, D.C. All rights reserved. No part of this publication may be used or reproduced in any manner whatsoever without permission in writing from the American Enterprise Institute except in the case of brief quotations embodied in news articles, critical articles, or reviews. The views expressed in the publications of the American Enterprise Institute are those of the authors and do not necessarily reflect the views of the staff, advisory panels, officers, or trustees of AEI.

Printed in the United States of America

Preface

The winners write the history, so a contemporary and contrary view is essential. With their victory in the elections of 2012, Barack Obama and the Democrats put themselves in a position to cement the Dodd-Frank Act into law. As this is written, more than two years after the act was passed, fewer than half of all the regulations required by the act had been finalized, but the election provided the Obama administration with four more years in which to get the job done. Sadly, the result will be much slower growth for the U.S. economy and a decline in the significance of the U.S. financial industryformerly the world leaderin the global economy.

At some point in the future, scholars will wonder why the United States tied its own hands and limited its economic growth in the early 2000s. They will look back at the period after the second World War and note that until the second decade of the 21st century the United States led the world in innovation and economic growth, with startling advances particularly evident in the living standards of the middle class. Then, in 2008, there was a financial crisis, and in 2010 the Dodd-Frank Act, a financial reform law; after that, the wheels of the U.S. economy just turned more slowly.

I hope this book, made possible by a generous grant from the Templeton Foundation, will help future scholars sort it all outthat it will be seen as a chronicle of why and how the U.S. crushed the life out of one of its most successful industries, impeded the growth of its economy and hobbled improvement in the lives of its own citizens. It is made up principally of 30 essays, beginning in 2004 and extending through 2012, in which I chronicled the underlying causes of the crisis and how the left developed a false narrative both to deny the governments role in the crisis and to provide a foundation for legislation that would place the U.S. financial system under the governments control. These essays, called Financial Services Outlooks, are included in substantially the form in which they were originally published by the American Enterprise Institute.

I have tried to provide some context for these essays with accompanying commentary that places them in the political and economic background that existed at the time they were written. If, in retrospect, there are errors in the essays, I thought it best to leave them uncorrected, as evidence of what was known, or what I thought, at a particular time. Similarly, as I was writing the commentary, regulations were being proposed, modified and in some cases issued in final form; these changes could not be incorporated into the book before its publication in early 2013.

Introduction: Obamacare for the Financial System

The Great Depression persuaded the public that private enterprise was a fundamentally unstable system, that the Depression represented a failure of free market capitalism, that the government had to step in.... The widespread acceptance of these views sparked the enormous growth in the power of government... that is still going on. We now know, as many economists knew then, that... the truth about the Depression was very different. The Depression was produced, or at the very least, made far worse by perverse monetary policies followed by the U.S. authorities.... Far from being a failure of free market capitalism, the Depression was a failure of government. Unfortunately, that failure did not end with the Great Depression.... In practice, just as during the Depression, far from promoting stability, the government has itself been the major single source of instability.

Milton Friedman, A Monetary History of the United States

The 2008 financial crisis was the most serious shock to the U.S. economy since the Great Depression. It triggered a lengthy recession, deepened a painful housing market collapse, and set the stage for massive taxpayer bailouts. Perhaps most serious, the 2008 crisis triggered a viewnever far below the surface on the leftthat capitalism itself was at fault. Wall Street greed, private sector irresponsibility, and regulatory failure quickly became the heart of the narrative pushed by the left and embraced by the Obama administration and the mainstream media. This narrative helped to shackle public opinion behind the Dodd-Frank Act (DFA), a modern analog of New Deal legislation like the National Industrial Recovery Act and the Agricultural Adjustment Act, both of which were eventually declared unconstitutional.

Instead of a thorough study of the causes of the financial crisis, we got the lefts perennial prescription for the economys illsmore government controls. Like its health care twin, popularly known as Obamacare, the DFA leaves the financial system nominally in private hands but subjects it to so many controls that it will no longer be able to function independently of the government. In this book, I will attempt to show how this was brought about through the development, propagation, and acceptance of false narrativesfirst about the government sponsored enterprises (GSEs) the Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Mortgage Corporation (Freddie Mac) and then about the financial crisis itself.

The DFA is yet another example of the aphorism that the speed and scale of a government prescription is directly proportional to the vapidity of its diagnosis. In effect, the most serious U.S. financial crisis in at least eighty years has never been thoroughly investigated, nor its causes fully debated. From the moment in the 2008 presidential debates that President Obama called it the result of Republican deregulation, no serious consideration was given by his administration or the Democratic Congress to the real causes of the financial crisis. Together, in the DFA, they enacted far-reaching legislation that will likely hobble one of the most successful industries this country has ever produced, and they will have done it on the basis of nothing more substantive than a half-baked political slogan.

Next page