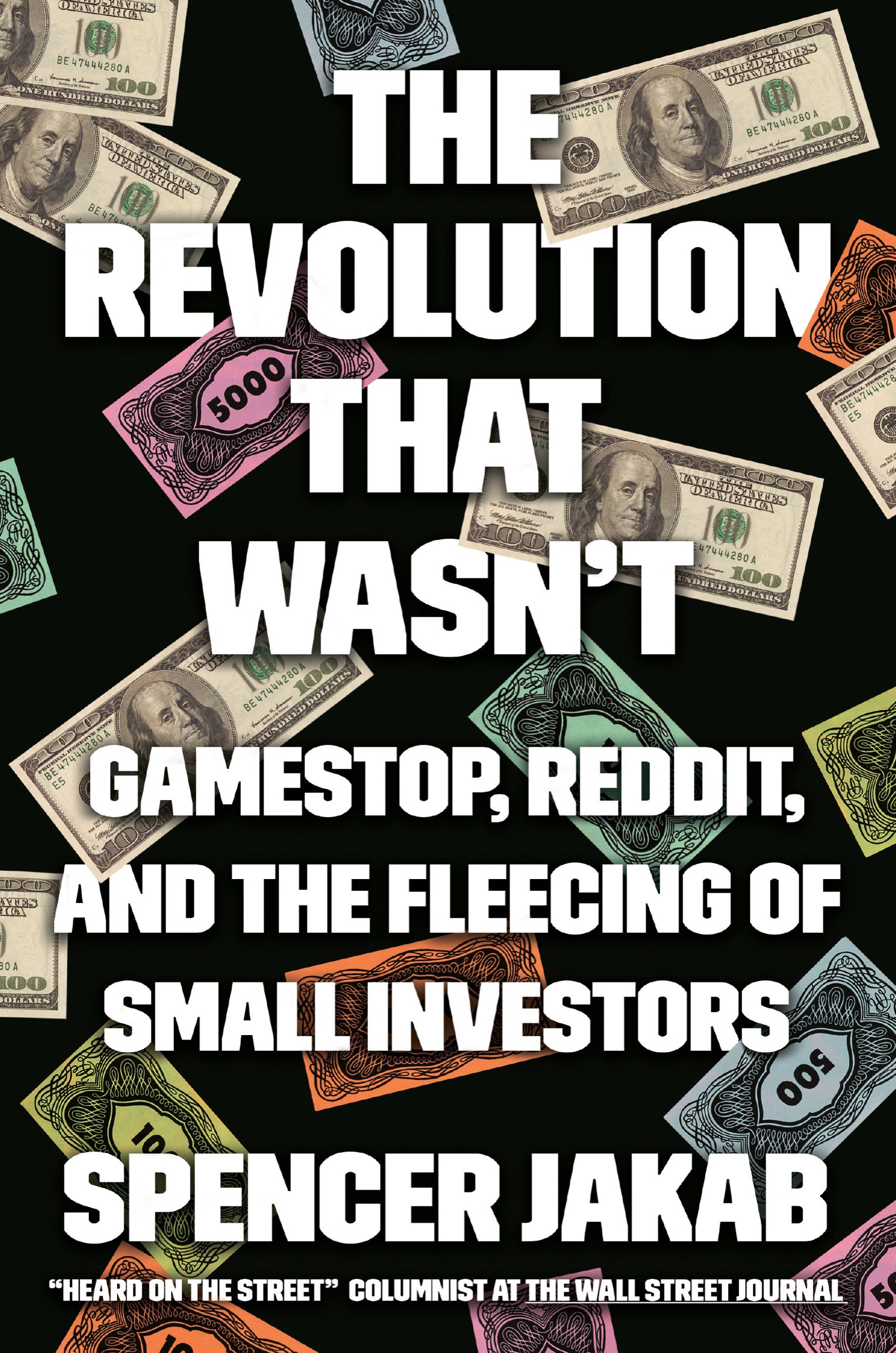

Spencer Jakab - The Revolution That Wasnt: Gamestop, Reddit, and the Fleecing of Small Investors

Here you can read online Spencer Jakab - The Revolution That Wasnt: Gamestop, Reddit, and the Fleecing of Small Investors full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2022, publisher: Penguin Publishing Group, genre: Detective and thriller. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:The Revolution That Wasnt: Gamestop, Reddit, and the Fleecing of Small Investors

- Author:

- Publisher:Penguin Publishing Group

- Genre:

- Year:2022

- Rating:3 / 5

- Favourites:Add to favourites

- Your mark:

The Revolution That Wasnt: Gamestop, Reddit, and the Fleecing of Small Investors: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "The Revolution That Wasnt: Gamestop, Reddit, and the Fleecing of Small Investors" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

From Wall Street Journal columnist Spencer Jakab, the real story of the GameStop squeezeand the surprising winners of a rigged game.

During one crazy week in January 2021, a motley crew of retail traders on Reddits r/wallstreetbets forum had seemingly done the impossiblethey had brought some of the biggest, richest players on Wall Street to their knees. Their weapon was GameStop, a failing retailer whose shares briefly became the most-traded security on the planet and the subject of intense media coverage.

The Revolution That Wasnt is the riveting story of how the meme stock squeeze unfolded, and of the real architects (and winners) of the GameStop rally. Drawing on his years as a stock analyst at a major bank, Jakab exposes technological and financial innovations such as Robinhoods habit-forming smartphone app as ploys to get our dollars within the larger story of evolving social and economic pressures. The surprising truth? What appeared to be a watershed momenta revolution that stripped the ultra-powerful hedge funds of their market influence, placing power back in the hands of everyday investorsonly tilted the odds further in the houses favor.

Online brokerages love to talk about empowerment and democratizing finance while profiting from the mistakes and volatility created by novice investors. In this nuanced analysis, Jakab shines a light on the often-misunderstood profit motives and financial mechanisms to show how this so-called revolution is, on balance, a bonanza for Wall Street. But, Jakab argues, there really is a way for ordinary investors to beat the pros: by refusing to play their game.

Spencer Jakab: author's other books

Who wrote The Revolution That Wasnt: Gamestop, Reddit, and the Fleecing of Small Investors? Find out the surname, the name of the author of the book and a list of all author's works by series.