THE GREAT

AMERICAN

BANK

ROBBERY

THE GREAT

AMERICAN

BANK

ROBBERY

THE UNAUTHORIZED REPORT ABOUT WHAT REALLY

CAUSED THE GREAT RECESSION

by PAUL SPERRY

2011 by Paul Sperry

All rights reserved. No portion of this book may be reproduced, stored in a retrieval system, or transmitted in any form or by any meanselectronic, mechanical, photocopy, recording, scanning, or otherexcept for brief quotations in critical reviews or articles, without the prior written permission of the publisher.

Published in Nashville, Tennessee, by Thomas Nelson. Thomas Nelson is a registered trademark of Thomas Nelson, Inc.

Thomas Nelson, Inc., titles may be purchased in bulk for educational, business, fund-raising, or sales promotional use. For information, please e-mail SpecialMarkets@ThomasNelson.com.

Library of Congress Cataloging-in-Publication Data

Sperry, Paul (Paul E.)

The great American bank robbery : the unauthorized report about what really caused the great recession / by Paul Sperry.

p. cm.

Includes bibliographical references and index.

ISBN 978-1-59555-270-9

1. Mortgage loansUnited States. 2. Banks and bankingUnited States. 3. Housing policyUnited States. 4. Global Financial Crisis, 20082009. 5. United StatesEconomic policy2001-2009. I. Title.

HG2040.5.U5S64 2010

330.973dc22

2010046011

Printed in the United States of America

11 12 13 14 15 RRD 6 5 4 3 2 1

Dedicated to the memory of Paul Joseph McKinnon

CONTENTS

A NOTE OF CAUTION

TO READERS

T his book, at bottom, is an indictment. It does not seek to condemn the uncreditworthy minority borrowers who pursued the American dream of owning a home, even if prematurely. Rather, it accuses those who make a living exploiting these protected classes. Yes, the hardest-hit victims of the sub-prime sub-crime, as Jesse Jackson has dubbed it, are indeed low and moderate-income minorities, who were trapped in home loans beyond their means and have now lost everything. But they were not victimized as much by predatory lenders as by Washington social engineers and housing-rights activists who used lenders to integrate them into the economic mainstreamregardless of their financial wherewithal. In the final analysis, they merely resegregated poor minorities into neighborhoods that are now more blighted than ever.

As these housing-rights zealots watch their multicultural experiment self-destruct from the safety of their ivory tower and government corner offices, minority borrowers are watching their homes get boarded up, their credit and borrowing power go from bad to worse, and their dreams of viable homeownership crumbling. It will be years before they can qualify again.

This is the real scandal and tragedy of the sub-prime credit crisis. For as well-intentioned as they may have been, the zealots failedand are failing againto recognize the long-term benefit of prudent underwriting standards: greater assurance that a homeowner who buys a home, stays in the home.

PAUL SPERRY

I t is now official: According to the Federal Reserve Board, the financial crisis has wiped out $14 trillion in American household wealthan amount equal to the entire gross domestic product, and the worse loss of wealth since the Great Depression. This equates to an average loss of more than $123,000 per household. Yet Americans didnt lose it. It was taken.

Who took it?

The president blames fat cat bankers. Michael Moore and others on the left want them locked up. The filmmaker even wrapped crime-scene tape around landmark investment banks on Wall Street.

President Obama recently paid a visit to the famous Manhattan financial district and gave its denizens a tongue-lashing. The people on Wall Street still dont get it, he said. You guys caused the problem.

But the real scene of the sub-prime sub-crimethe biggest robbery in historyis Washington.

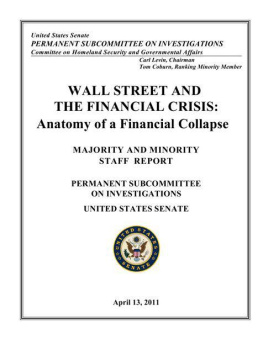

This book is the first careful and thorough analysis of public policys role in the crisis. It presents fresh new evidence that government social engineersfrom both the Democrat and the Republican Partiesmasterminded a massive bank heist with help from accomplices in the nonprofit sector. And now, under Obama, they are planning an even bigger heist. A 9/11-type commission has been impaneled to investigate.

But its a frame-up. Commissioners have set up Wall Street bankers to take the fall.

This book is the report they wont release, the truth they dont want you to know.

THE ANGELIDES

COMMISSION

Old civic activists never die, we just get recycled.

Philip Angelides, chairman of the Financial Crisis Inquiry Commission

I n 1933, during the trough of the Great Depression, Senate Banking Committee chief counsel Ferdinand Pecora led congressional hearings to examine the root causes of the epochal financial crisis. The aggressive, cigar-chomping exNew York prosecutor used the high-profile platform to demonize Wall Street bankers and agitate for New Deal financial reforms.

Commonly known as the Pecora Commission, his panel exercised subpoena power to drag fat cat bankers such as J. P. Morgan Jr. before Congress for public whippings. It pinned the stock market crash and Depression on Wall Street greed rather than bad Central Bank and other government policy, where many economists today believe it belongs.

The following year, President Roosevelt appointed Pecora commissioner of the newly formed Securities and Exchange Commission. Bitterly hostile was Wall Street to the enactment of the regulatory legislation, Pecora later wrote.

Fast-forward three-quarters of a century.

A new commission has put Wall Street on trial for market excesses. And the Obama administration is expected to use its findings to justify a new round of banking regulationsincluding another expansion of the Community Reinvestment Act, the controversial anti-redlining lawthat threaten to take the financial industryand possibly the economyback to the 1930s.

On January 13, 2010, the Financial Crisis Inquiry Commission kicked off its yearlong hearings by promising a thorough examination of the root causes of the Great Recession. It has conducted more than 500 interviews and presumably sifted through the full body of evidence. Now it is set to release its final report, which promises to hold the guilty accountable and recommend reforms to prevent another crisis.

But dont hold your breath.

The commission is supposedly modeled after the blue-ribbon panel that looked into the 9/11 terrorist attacks. But it looks more like the Pecora Commission.

While commission chairman Philip Angelides has pledged a full and fair inquiry, detractors say his hearings resembled more of an inquisition. They have a strong case: the bipartisan panel is made up of a majority of Democrats who clearly have it in for Wall Street.

Setting the tone was their witness list for the hearing curtain-raiser. Wall Street honchos from JPMorgan, Goldman Sachs, Morgan Stanley, and Bank of America landed in the pillories first, instead of Washington executives from Fannie Mae (Federal National Mortgage Association) and Freddie Mac (Federal Home Loan Mortgage Corporation) and officials from their federal regulator, the U.S. Department of Housing and Urban Development, who have far more to answer for. Under pressure from Washington, the congressionally chartered and taxpayer-subsidized agencies underwrote $1.8 trillion of the sub-prime and other toxic home loans that nearly KOd the financial system. (Subprime refers to home loans made to borrowers with relatively poor or unproven credit histories. These loans are therefore riskier than prime loans, which are made to borrowers with stronger credit.)

Next page