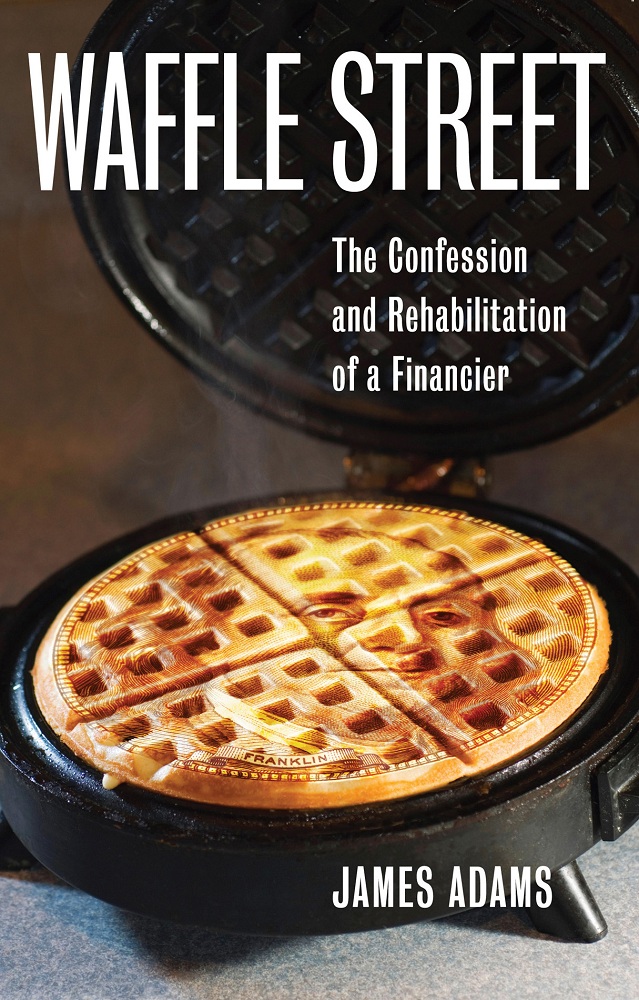

Waffle Street

The Confession and Rehabilitation of aFinancier

James Adams

Copyright 2011, Sourced Media Books. All rights reserved.

Sourced Media Books, LLC

San Clemente, CA

www.sourcedmediabooks.com

This publication is designed to provide information for educational purposes only and is sold with the understanding that the publisher is not engaged in rendering legal, accounting, or other professional advice of any kind. If legal advice or other expert assistance is required, the services of a competent professional person should be sought.

-From a Declaration of Principles jointly adopted by aCommittee of the American Bar Association and a Committee of Publishers and Associations

For Rebecca

DEBT

Etymology: Old French dette , ultimately from Latin debita , plural of debitum , from neuter of edebitus , past participle of debere; to owe.

-noun

- Something that is owed or that one is bound to pay to or perform for another: a debt of $50.

- A liability or obligation to pay or render something: My debt to her for advice is not to be discharged easily.

- The condition of being under such an obligation: His gambling losses put him deeply in debt.

- Theology. An offense requiring reparation; a sin; a trespass.

ACKNOWLEDGEMENTS

The author wishes to thank the following individuals:

- His wife, Becky, for her unflagging support throughout this quixotic endeavor.

- His parents, Jim and Jane Adams, for providing feedback on several economic essays.

- Benjamin Gibbs, for suggesting the books title.

- Gregory Osmond, for introducing him to Amy Cook at Sourced Media Books.

- Jean-Baptiste Say, whose reputation this volume hopes to reclaim.

BONDn1

-noun

- Something that binds, fastens, confines, or holds together.

- Law. A written promise of a surety.

- Finance. A certificate of ownership of a specified portion of a debt due to be paid by a government or corporation to an individual holder and usually bearing a fixed rate of interest.

BONDn2

-noun

- A serf or slave.

Preface

William Edward Preston, Junior, wasborn on September 18, 1899 in Perth Amboy, New Jersey. In 1908 his father, tiredof his twenty years as a butcher, sold his business to a local competitor andrelocated his family to a 135-acre farm in Morganville, Marlboro Township, NewJersey. William Sr. relished his newfound life as a produce farmer. He not onlyharvested his crops but also managed their distribution to consumers in New YorkCity.

William Jr. assisted his father in hisagricultural endeavors until he enlisted in the Army in 1917. Upon arriving inFrance, he trained as an aircraft mechanic and was fortunate enough to capture aprivate photograph of General John J. Pershing, commander of the AmericanExpeditionary Force during World War I. In 1918, Preston survived a bout ofSpanish influenza (which would go on to kill at least 50 million less fortunatepeople), and returned home to New Jersey after the armistice was declared inNovember.

While he could have resumed work on the familyfarm, William instead elected to go to work for the manager of a small, privatesavings bank in New York City. In 1923, he married Alta Mae Walling, a girl two years his junior. Thenewlyweds resided in the Flatbush section of Brooklyn for a brief period,then relocated to Keyport, New Jersey after their first child was born in1924. William continued to work for the bank until 1925 but sought greenerpastures after his manager departed. He eventually landed at a much largerfinancial institution, situated at 55 Wall Street: The National City Bank ofNew York.

Founded in 1812, National C ity Bank of New York (not to be confused withCleveland-based National City Bank) had grown to in excess of $1billion in assets by 1919. In 1921, Charles E. Mitchell was electedpresident of National City Bank. In a separate action, he also becamepresident of its investment banking affiliate, National City Company. UnderMitchells leadership, both the commercial bank and investment bank grew ata torrid pace. By 1930, National City Bank (the commercial bank) hadestablished 100 branches in 23 countries outside the U.S., making it thesecond-largest commercial bank in the Unite d States. National City Company (the investmentbank) had become the worlds largest underwriter of stocks and bonds.

Mitchell capitalized on his unique position asthe only U.S. bank with a considerable overseas presence to underwrite bondson behalf of Latin American governments. He used his large domestic salesforce to distribute the debt to American retail investors.

William Preston, Jr. was one of the salesmen,selling the bond certificates for cash right out of his briefcase. Eightyyears later, his children recounted that their father never really enjoyedhawking those Latin American bondshe never felt they were a safe bet. Buthe made such good money selling them, how could he not? After all, he hadtwo kids to feed.

As f ate would have it, Prestons instincts wereeventually vindicated. Many of the securities he sold defaulted as theDepression spread from the United States to Latin America in the early1930s. Fortunately, he was able to retain his employment with National CityBank, becoming a commercial loan officer in the foreign creditdepartme nt.

For his part,Sunshine Charlie Mitchell remained chairman until 1933, when he wasarrested and indicted for tax evasion. Though acquitted of all criminal charges,he paid the government a million dollars in a civil settlement. For Mitchell,the sum was not terribly onerous; National City had paid him in excess of amillion dollars in each of the years 19271929.

William Preston was never indicted on civil orcriminal charges for his role in the proliferation of dubious securities. Hedid, however, perform several acts of restitution to the community. In an erawhen bankers were reticent to extend credit to anyone, he was able to keepseveral small businesses alive by authorizing their credit lines. He counseledfriends in managing their businesses as the banking crisis unfolded in the early1930s. In one expression of gratitude, Prestons wife Alta was given a mink coatby a fur clothing retailer who had narrowly avoided financial ruin thanks toWilliams admonition.

William retained his role as a loan officer forNational City Bank for the remainder of his career. While not an avidchurchgoer, he was considered to be a man of integrity. He succinctly describedhis moral code with the phrase, I carry the Golden Rule in my pocket. Indeed,the Prestons consistently used their means during the Depression years to easethe suffering of the less fortunate. Alta frequently kept a large pot of soup onher stove in their Keyport home; anyone who solicited a meal was never refused.Word of their generosity spread. Homeless people marked the sidewalk outsidetheir residence with chalk to indicate the presence of a compassionate matron.On several occasions, the Preston girls found their winter coats missing. Altahad given them away to less fortunate children in the neighborhood.

The Golden Rule, as originally stated by Jesus,reads, Therefore all things whatsoever ye would that men should do to you, doye even so to them. Colloquially, we truncate the expression to Do unto othersas you would have them do unto you. A Wall Street version might read: Neversell a customer a stock or bond that you wouldnt buy for your personalaccount. Of course, that ethic would be laughed off a trading desk in a NewYork minute. But its the version that William must have realized that heviolated by selling Argentine debt to hapless clients early in his career.