Heikin Ashi Trader - Forex Trading 1-2: 2 Manuscripts: Book 1: Practical Examples Book 2: How Do I Rate My Trading Results?

Here you can read online Heikin Ashi Trader - Forex Trading 1-2: 2 Manuscripts: Book 1: Practical Examples Book 2: How Do I Rate My Trading Results? full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2018, publisher: Dao Press LLC, genre: Science fiction. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:Forex Trading 1-2: 2 Manuscripts: Book 1: Practical Examples Book 2: How Do I Rate My Trading Results?

- Author:

- Publisher:Dao Press LLC

- Genre:

- Year:2018

- Rating:5 / 5

- Favourites:Add to favourites

- Your mark:

Forex Trading 1-2: 2 Manuscripts: Book 1: Practical Examples Book 2: How Do I Rate My Trading Results?: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "Forex Trading 1-2: 2 Manuscripts: Book 1: Practical Examples Book 2: How Do I Rate My Trading Results?" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

This Forex Trading book includes 2 books.

Book 1: Practical examples

Scalping is the fastest way to make money in the stock market. There is hardly another method that can be found that increases a traders capital more effectively. The Heikin Ashi Trader explains why this is so in this four-part series on scalping.

In this first book, he explains his setup with many practical examples. You will learn how to interpret Heikin-Ashi charts correctly, when to get into a market and when to get out. Also, you will learn how to combine the setup with important principles of technical analysis.

This highly effective scalping strategy can be applied in a short time frame; for instance, a 1-minute chart in addition to other higher time frames. You can trade using this universal method in equity indices and in the currency markets. Typical instruments, however, are futures and currencies.

Book 2: How do I rate my Trading Results?

In this second book, the Heikin Ashi trader answers the question of how the trading results of a scalper are analyzed and correctly evaluated. Based on the weekly results of a single trader, he examines what factors matter to having long-term success in the stock market. The analysis of the trading journal for 12 weeks allows an inside look at the learning curve of a budding professional.Table of Contents

Book 1: Forex Trading, Practical Examples

1. Scalping with Technical Analysis

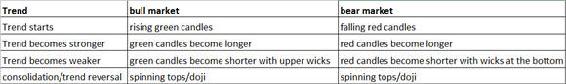

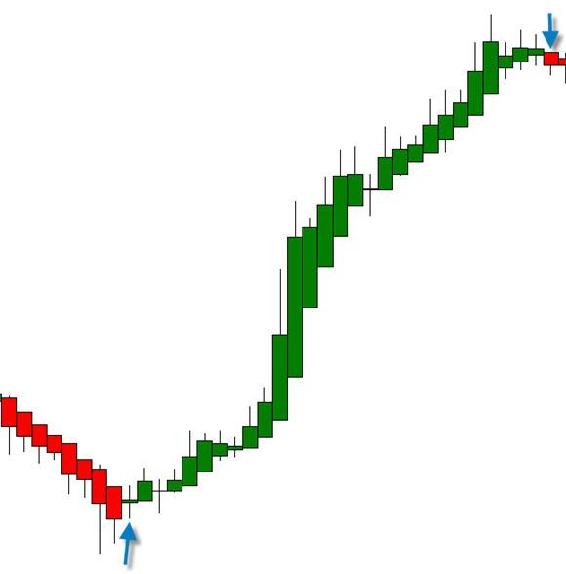

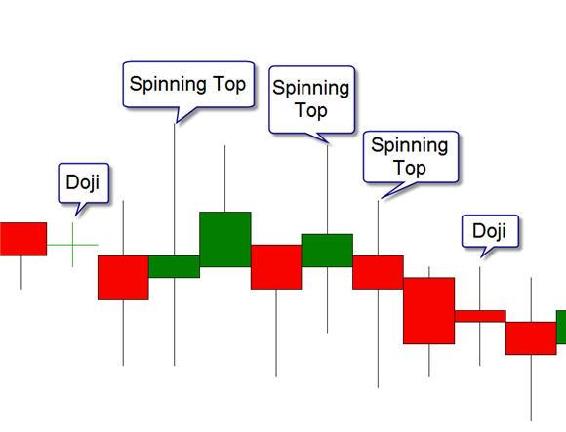

2. How do I Interpret Heikin Ashi Charts?

3. When Do I Get In?

4. When Do I Get Out?

5. Working with Price Objectives

6. Heikin Ashi Scalping in Practice

7. Does Technical Analysis Help While Heikin Ashi Scalping?

A. Support and Resistance

B. Swing High and Swing Low of the Previous Day

C. The Importance of the Round Number in Forex

8. How Do I Recognize Trend Days?

9. How Do I Scalp Trend Days?

10. Conclusion

Book 2: How Do I Rate my Trading Results?

1. The Trading Journal as a weapon

2. The first 12 weeks of a new Scalper

- Week 1

- Week 2

- Week 3

- Week 4

- Week 5

- Week 6

- Week 7

- Week 8

- Week 9

- Week 10

- Week 11

- Week 12

3. How is Jenny doing now?

4. Scalping is a Business

More Books by Heikin Ashi Trader

About the Author

Imprint

Heikin Ashi Trader: author's other books

Who wrote Forex Trading 1-2: 2 Manuscripts: Book 1: Practical Examples Book 2: How Do I Rate My Trading Results?? Find out the surname, the name of the author of the book and a list of all author's works by series.