Contents

About the Book

The Square Mile, Londons financial powerhouse, rose to prominence with the defeat of Napoleon in 1815. David Kynastons vibrant history brings this world to life, taking us from the railway boom of the 1830s to the Golden Age, when the legendary gold standard reigned supreme. Between the two World Wars the City was affected by the Wall Street Crash, pressured by politicians, trade unions and industrialists, but by the end of the twentieth century it had regained a precarious global might.

Woven throughout are the stories of four individuals who shaped the City in different ways Nathan Rothschild, Ernest Cassel, Montagu Norman and Siegmund Warburg. But the realm of great bankers and brokers is also the workplace of young clerks throwing paper darts, typists bringing in their sandwiches, and sad racketeers watching aghast as the markets fall. Above all, we see what it was like to work in the City the dress codes, eating habits, work hours, pay, humour, changing architecture and language that forged the unique culture of the Square Mile. Richly entertaining, full of vivid anecdotes, this is a story of booms, busts and bankruptcies from the Kaffir boom to the Marconi scandal, the Big Bang deregulation of 1986, and the Barings crash in 1995 bringing us to the brink of the modern age.

David Knaystons groundbreaking history of the City of London, published in four volumes between 1994 and 2001, is a modern classic. Skillfully edited into a single volume by David Milner, it tells a story as dramatic as any novel, while explaining the mysteries of the financial world in a way that we can all understand.

Also by David Kynaston

King Labour: The British Working Class, 18501914

The Secretary of State

The Chancellor of the Exchequer

Bobby Abel, Professional Batsman

Archies Last Stand: MCC in New Zealand, 192223

WGs Birthday Party

The Financial Times: A Centenary History

Cazenove & Co: A History

LIFFE: A Market and Its Makers

Phillips & Drew: Professionals in the City (with W. J. Reader)

Siegmund Warburg: A Centenary Appreciation

The City of London, Volume I: A World of Its Own, 181590

The City of London, Volume II: Golden Years, 18901914

The City of London, Volume III: Illusions of Gold, 191445

The City of London, Volume IV: A Club No More 19452000

City State: How the Markets Came to Rule our World

(with Richard Roberts)

Edited:

Henry James, London Stories and Other Writings

The Bank of England: Money, Power and Influence 16941994

(with Richard Roberts)

Tales of a New Jerusalem

Austerity Britain, 194551

Family Britain, 195157

Preface

This book is an abridgement of my four-volume history of the City of London published by Chatto between 1994 and 2001. The individual volumes comprise A World of Its Own, 181590; Golden Years, 18901914; Illusions of Gold, 191445; and A Club No More, 19452000. Back in 1987, when the idea of a history of the City began to take shape, I conceived it as a single volume before the addictive properties of research changed the projects dimensions. So almost a quarter of a century on, it is appropriate to have it at last in the form that my very patient publishers originally (and understandably) wanted.

Why, to continue for a moment in autobiographical vein, the City? Why in 1978 did I sign up at the LSE for what would become a doctoral thesis on the London Stock Exchange (18701914) and the start of a long journey? Part political, part literary, I think: political in that I was well aware of the lefts demonisation of the City following successive sterling crises since the mid-1960s, and was broadly sympathetic to this perspective, but intuitively felt that it was too abstract, with no really intimate understanding of the place itself and its inhabitants; literary in that as an adolescent I had been fascinated by the City clerk Mr Pooter, by Rex Mottram and his City friends in Brideshead Revisited, and above all by Henry Wilcox in Howards End, while more recently I had discovered George Gissing, who during the 1890s vividly pictured the City as the centre of a destructive whirlpool, sucking everyone in. There was also a personal element: an unsettled 27-year-old looking for a new direction, I was inspired by the example of E. P. Thompson, who in his 1976 book Whigs and Hunters had parachuted into the eighteenth century. I knew no one in the City, had no family connection with it, and indeed had barely set foot there. It felt time to make my own leap.

Many all-consuming years followed before in 2001 that phase of my working life ended. Ten further years on, I am not the person to write a detailed account of the latest instalment of the Citys fortunes the asset bubble, the crash in 2008, that extraordinary but not unpredictable apparent wriggling free from punishment and correction for the often devastating consequences of its actions. (Recommended accounts include Fools Gold by Gillian Tett, Whoops! by John Lanchester and, for a historians dispassionate, long-view analysis, Crises and Opportunities by Youssef Cassis.) Instead, I would like briefly to offer a handful of thoughts informed by an awareness of the Citys two preceding centuries.

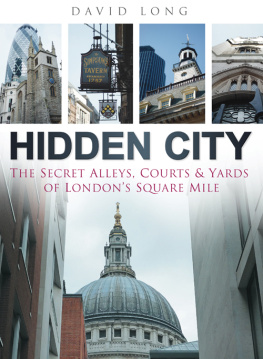

Starting with ecology and habitat. The old City was a heterogeneous place of thousands upon thousands of small or medium-sized firms, each satisfying particular, often niche demands; the new, supermarket-style City is far more homogeneous, dominated by vast conglomerates inevitably lacking touch and responsiveness. So too with the habitat, where not only has the Square Mile progressively lost much of its idiosyncratic charm not least with the ongoing erection of such overbearing, hubristic buildings as the Shard, the Cheesegrater and the Walkie Talkie, to name only three infantile, Americanised nicknames in the City of Wren and Soane but two miles downstream Canary Wharf is like a latter-day version of Fritz Langs Metropolis, conveying (to my eyes anyway) no humanity, no intimation of a continuum between past and present, and instead an overwhelming masters-of-the-universe syndrome, as it towers above some of the poorest, most deprived parts of London. Humans function better in an environment that is on a human scale: a simple truth, which we pay a high price for forgetting.

As comes across again and again in these pages, the old City was in many ways like a village, albeit a peculiarly important one. Many people knew each other; it was a place of countless chance encounters in an era before City workers spent whole days in large, self-contained silos; and, across a range of markets, there was the daily practice of face-to-face dealing, prior to the coming of the relentless, dehumanising computer screens. It may have been a strikingly unmeritocratic village, and it may have been riddled with cartels and restrictive practices, but crucially it was a way of life that encouraged trust and cohesion the very qualities that were so palpably absent when the credit crunch struck. From the 1920s the village also had, in the person of the governor of the Bank of England, an acknowledged leader, keeping up standards, banging heads together and generally doing his best to avert or minimise any serious troubles ahead. The opening up of the City with the Euromarkets in the 1960s and deregulation in the 1980s made that role increasingly problematic, but the removal of supervision from the Bank in 1997 meant it was impossible. No institution is perfect and there is plenty in this book critical of the Old Lady but the prospect now of a restoration of the Banks authority is welcome.

Next page