Kristi L. Waterworth - Quicklet on Michael Lewis the Big Short: Cliffnotes-like Book Notes

Here you can read online Kristi L. Waterworth - Quicklet on Michael Lewis the Big Short: Cliffnotes-like Book Notes full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2012, publisher: Hyperink, genre: History. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

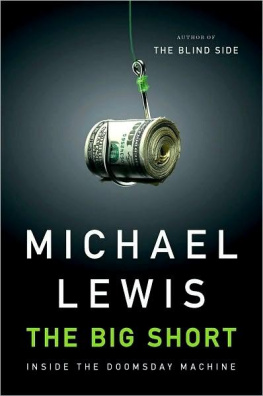

- Book:Quicklet on Michael Lewis the Big Short: Cliffnotes-like Book Notes

- Author:

- Publisher:Hyperink

- Genre:

- Year:2012

- Rating:5 / 5

- Favourites:Add to favourites

- Your mark:

Quicklet on Michael Lewis the Big Short: Cliffnotes-like Book Notes: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "Quicklet on Michael Lewis the Big Short: Cliffnotes-like Book Notes" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

ABOUT THE BOOK

I became a Realtor in 2000, when an opportunity presented itself. I had been a journalist, slaving away at a small and insignificant newspaper in a small and insignificant town when I was offered a position creating marketing materials for a Real Estate company in a not-too-distant city. I had no idea that taking that job would thrust me in the middle of the worst financial crisis my generation would know. From that marketing position, I went to work for a Realtor and was licensed shortly thereafter. The rest, as they say, is history. When I first saw The Big Short appear at the bookstores, I was delighted. Finally, someone could explain what the hell had happened during that crazy time period that began about the time I was licensed and ended when the market exploded in middle America. At the same time, I was secretly a little afraid that there would be a list tucked inside with the names of Realtors who had sold subprime mortgages. At the time, I didnt really understand what was happening; all I knew was that the sky was falling at an accelerated pace. Michael Lewis did the research and has put the whole story together in one place. In The Big Short, he manages to turn credit default swaps, collateralized debt obligations and subprime mortgage bonds into things that will make sense to most people. If theyre anything like me, theyll finish the book weeping.

MEET THE AUTHOR

Kristi L. Waterworth is an experienced writer and a member of the Hyperink Team, which works hard to bring you high-quality, engaging, fun content. Happy reading!

EXCERPT FROM THE BOOK

The Big Short isnt simply a follow up to Liars Poker, as some reviewers (and even its author) have claimed, it is the tale of the result of the world that Liars Poker documents. The 1980s were an unrestrained era of greed that continued to build quietly until Wall Street collapsed into a broken heap in the mid 2000s. Michael Lewis was in a unique position to document the fall of the system in The Big Short, being a former inside man now on the outside. Using the stories of the few traders who came out on top of the mess, Lewis follows the subprime mortgage disaster from its more recent roots straight to its end. Men like Michael Burry, Steve Eisman and Charles Ledley didnt know what they were seeing when they first caught wind of subprime mortgage bonds, but they each had a feeling that something sinister was lurking beneath the exotic products that were being created from these risky investments. This New York Times Best Seller is worthy of the accolades it has claimed, considering that it manages to be a cautionary tale while clearly explaining financial instruments that werent even as clear to the people who were buying and selling them at their height. Lewiss combination of terror, education and the brief joy of the underdog succeeding in an apocalyptic landscape creates a sort of road map to the destruction of the subprime mortgage markets, as well as the bruising of a substantial chunk of the global financial markets. Buy a copy to keep reading!

CHAPTER OUTLINE

Quicklet on Michael Lewis The Big ShortMichael Lewis The Big Short+ The Disaster at the End of This Book+ About the Author+ About the Book+ Overall Summary for The Big Short+ ...and much more

Kristi L. Waterworth: author's other books

Who wrote Quicklet on Michael Lewis the Big Short: Cliffnotes-like Book Notes? Find out the surname, the name of the author of the book and a list of all author's works by series.