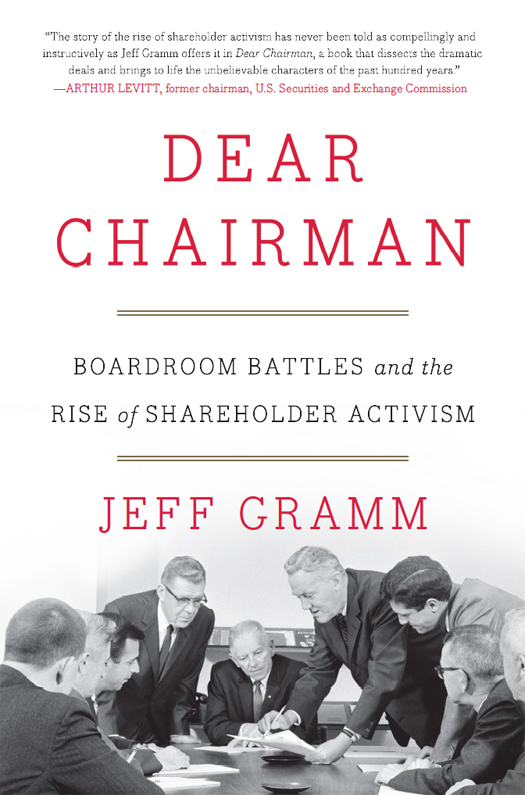

Jeff Gramm - Dear Chairman: Boardroom Battles and the Rise of Shareholder Activism

Here you can read online Jeff Gramm - Dear Chairman: Boardroom Battles and the Rise of Shareholder Activism full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2016, publisher: HarperBusiness, genre: History. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:Dear Chairman: Boardroom Battles and the Rise of Shareholder Activism

- Author:

- Publisher:HarperBusiness

- Genre:

- Year:2016

- Rating:3 / 5

- Favourites:Add to favourites

- Your mark:

Dear Chairman: Boardroom Battles and the Rise of Shareholder Activism: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "Dear Chairman: Boardroom Battles and the Rise of Shareholder Activism" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

A sharp and illuminating history of one of capitalisms longest running tensionsthe conflicts of interest among public company directors, managers, and shareholderstold through entertaining case studies and original letters from some of our most legendary and controversial investors and activists.

Recent disputes between shareholders and major corporations, including Apple and DuPont, have made headlines. But the struggle between management and those who own stock has been going on for nearly a century. Mixing never-before-published and rare, original letters from Wall Street iconsincluding Benjamin Graham, Warren Buffett, Ross Perot, Carl Icahn, and Daniel Loebwith masterful scholarship and professional insight, Dear Chairman traces the rise in shareholder activism from the 1920s to today, and provides an invaluable and unprecedented perspective on what it means to be a public company, including how they work and who is really in control.

Jeff Gramm analyzes different eras and pivotal boardroom battles from the last century to understand the factors that have caused shareholders and management to collide. Throughout, he uses the letters to show how investors interact with directors and managers, how they think about their target companies, and how they plan to profit. Each is a fascinating example of capitalism at work told through the voices of its most colorful, influential participants.

A hedge fund manager and an adjunct professor at Columbia Business School, Gramm has spent as much time evaluating CEOs and directors as he has trying to understand and value businesses. He has seen public companies that are poorly run, and some that willfully disenfranchise their shareholders. While he pays tribute to the ingenuity of public company investors, Gramm also exposes examples of shareholder activism at its very worst, when hedge funds engineer stealthy land-grabs at the expense of a companys long term prospects. Ultimately, he provides a thorough, much-needed understanding of the public company/shareholder relationship for investors, managers, and everyone concerned with the future of capitalism.

Jeff Gramm: author's other books

Who wrote Dear Chairman: Boardroom Battles and the Rise of Shareholder Activism? Find out the surname, the name of the author of the book and a list of all author's works by series.