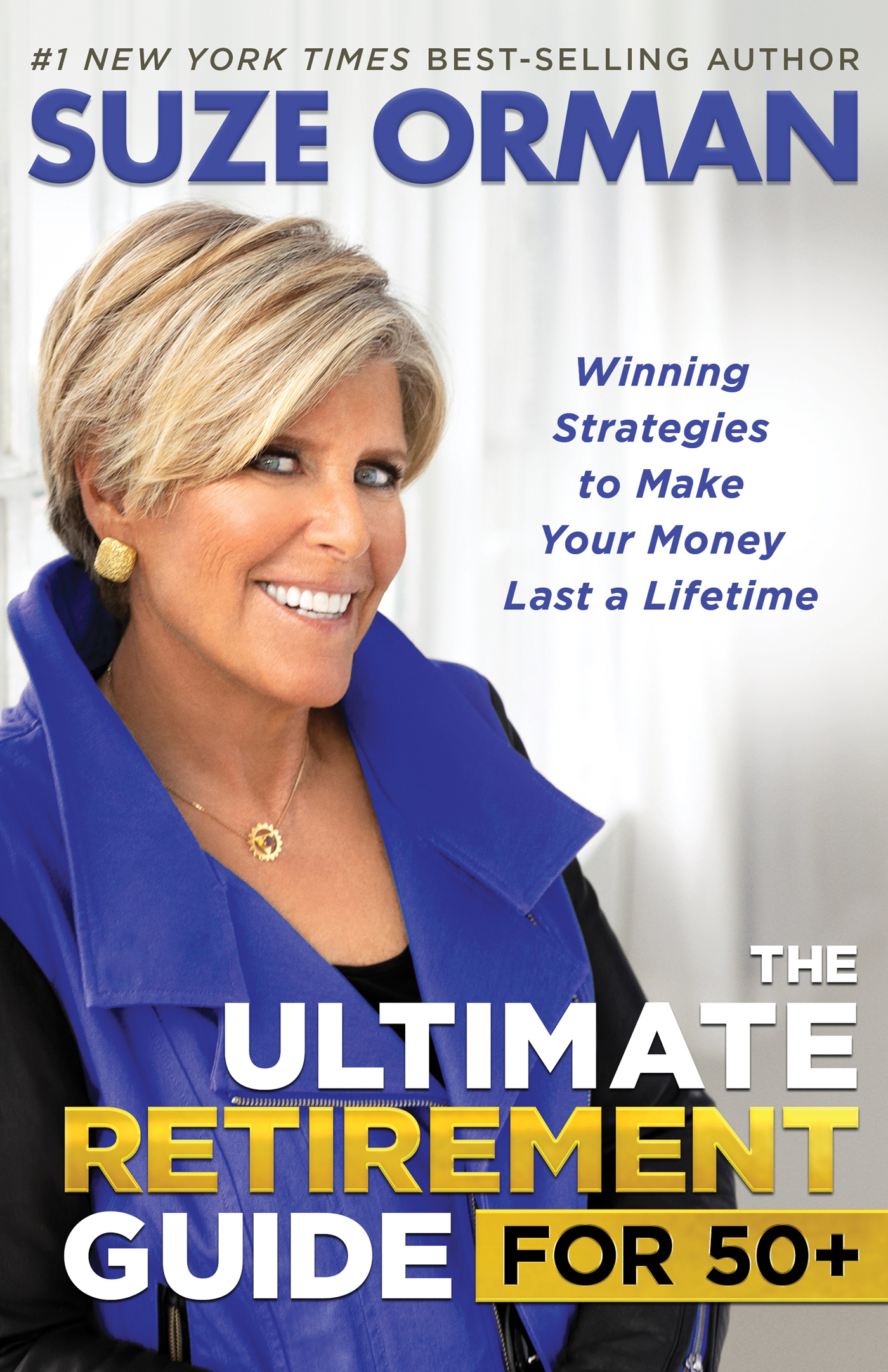

Suze Orman - The Ultimate Retirement Guide for 50+

Here you can read online Suze Orman - The Ultimate Retirement Guide for 50+ full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. City: S.I., year: 2020, publisher: Hay House, genre: Home and family. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:The Ultimate Retirement Guide for 50+

- Author:

- Publisher:Hay House

- Genre:

- Year:2020

- City:S.I.

- Rating:3 / 5

- Favourites:Add to favourites

- Your mark:

- 60

- 1

- 2

- 3

- 4

- 5

The Ultimate Retirement Guide for 50+: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "The Ultimate Retirement Guide for 50+" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

Suze Orman: author's other books

Who wrote The Ultimate Retirement Guide for 50+? Find out the surname, the name of the author of the book and a list of all author's works by series.

The Ultimate Retirement Guide for 50+ — read online for free the complete book (whole text) full work

Below is the text of the book, divided by pages. System saving the place of the last page read, allows you to conveniently read the book "The Ultimate Retirement Guide for 50+" online for free, without having to search again every time where you left off. Put a bookmark, and you can go to the page where you finished reading at any time.

Font size:

Interval:

Bookmark:

ALSO BY SUZE ORMAN

Youve Earned It, Dont Lose It

The 9 Steps to Financial Freedom

The Courage to Be Rich

The Road to Wealth

The Laws of Money, The Lessons of Life

The Money Book for the Young, Fabulous & Broke

Women & Money

Suze Ormans 2009 Action Plan

Suze Ormans Action Plan

The Money Class

The Adventures of Billy & Penny

Suze Ormans Will & Trust Kit

Suze Ormans Personal Finance Course

Suze Ormans 9 Steps to Financial Independence Online Course

Copyright 2020 by Suze Orman Media, Inc.

Published in the United States by: Hay House, Inc.: www.hayhouse.com Published in Australia by: Hay House Australia Pty. Ltd.: www.hayhouse.com.au Published in the United Kingdom by: Hay House UK, Ltd.: www.hayhouse.co.uk Published in India by: Hay House Publishers India: www.hayhouse.co.in

Indexer: Joan Shapiro

Cover design: Aaron Robertson

Interior design: Julie Davison

All rights reserved. No part of this book may be reproduced by any mechanical, photographic, or electronic process, or in the form of a phonographic recording; nor may it be stored in a retrieval system, transmitted, or otherwise copied for public or private useother than for fair use as brief quotations embodied in articles and reviewswithout prior written permission of the publisher.

In providing answers, neither Suze Orman Media nor Suze Orman is acting as a certified financial planner or advisor or certified financial analyst and economist, CPA, account accountant, or lawyer. Neither Suze Orman Media nor Suze Orman makes any recommendations as to any specific securities or investments. All content is for informational and general purposes only and does not constitute financial, accounting, or legal advice. You should consult your own tax, legal, and financial advisors regarding your particular situation. Neither Suze Orman Media nor Suze Orman accepts any responsibility for any loss which may arise from accessing or relying on information in this book. And to the fullest extent permitted by law we exclude all liability for loss or damages, direct or indirect, arising from the use of the information.

Cataloging-in-Publication Data is on file at the Library of Congress

Hardcover ISBN: 978-1-4019-5992-0

E-book ISBN: 978-1-4019-5993-7

Audiobook ISBN: 978-1-4019-5994-4

Autographed edition ISBN: 978-1-4019-6049-0

HSN edition ISBN: 978-1-4019-6078-0

This book is dedicated to Carla Fried.

For the past 15 years, every book, blog, and article I have published has been a true collaborative effort between myself and the brilliant Carla. It is not very often that a working relationship between two people lasts as long as ours has. But if I were to look back over the greatest gifts that I have ever been given, I would so put Carla near the top of that list.

Carla, I thank you for all you have given to this work. I know our words have truly made this world a better place for all. Thank you from the bottom of my heart.

It is my hope and suggestion that you will read every single page of this vital book. However, I also know that many of you will go directly to the chapter that best relates to your current financial situation.

I have made it easy for you to do just that: If you have not yet retired, (How and Where to Invest) will make the most sense as you map out your investment strategy. However you choose to read this book, know that each chapter is a complete unit unto itself.

Also, as we were going to press, a bill with far-reaching impacts on retirement plans was signed into law. This bill is known as the SECURE Act. We have done our best in this book to cover the legal changes that will most likely affect you in your retirement years. But you can also visit my website, suzeorman.com/retirement, for the most up-to-date information about the SECURE Act.

Just know that I want you to use this book for the rest of your life. I have filled it with information to help you in every stage of your retirement and written it with clear and concise guidance on every page.

I know it will guide you to your Ultimate Retirement years, so please enjoy reading it as much I enjoyed writing it.

When I first started my career as a financial advisor, 40 years ago, I knew right away that I would specialize in retirement planning. I had a kinship with clients who walked into my office full of fear and anxiety as they neared retirement. They knew they had some seriously consequential decisions to makeones that would affect their quality of life in retirementand they were wary of placing their future in the hands of an outsider who couldnt possibly know what kept them awake at night and what mattered most to them, and who likely couldnt relate to the momentous life change they were facing.

Well, they were right about the last thingI was just at the beginning of my career and had no intention of slowing down anytime soon. But I could absolutely relate to the trepidation and vulnerability they felt about placing their lifetime savings in the hands of a stranger. Why? Because I had been taken advantage of by a broker earlier in my adult life, when I was working as a waitress. I had a $40,000 loan from customers and friends that was meant to help me start my own restaurant. I entrusted that vast sum to a hotshot young broker who put it all in a high-risk investment product without warning me of the potential downside. And guess what? I lost it all. It was devastating to me; it wasnt even my money to lose! It felt like the end of my dreambut it also ignited the fire in me to become a financial advisor who would earn the trust of her clients. It became my mission to help people on the verge of retirement keep their earnings safe and secure.

As I write this today, I am 68 years old. Theres no question anymore about whether I can relate to people nearing retirement, because I too have decades of my working life behind me. The time in the future when I will no longer work is not all that far away. I have plenty of expertise in the psychological and emotional tugs that take hold as we age, and I have empathy in spadesfor your hopes, your fears, and your wishes for the generations ahead of you and the loved ones in step beside you. The advice I have to share in this book comes from a heart that knows money decisions are never just about money. And I have an appreciation that what you must figure out is far more complicated than what my clients and I had to contend with back in the 1980s.

Back then, for those who didnt want stock market risk in their portfolio, I would recommend 30-year Treasury bonds that paid up to 15.5% interest. I have to tell you, it was one of the best investments I ever made for my clients. Money market accounts were paying more than 18% interest, so it was easy to park money there while you came up with an investment strategy. Inflation was high as well, but not as high as the yields my clients could earn on safe savings. If they worried about the volatility of stocksthere were three bear markets between 1968 and 1982they could just stick with their safe income investments.

Perhaps the biggest difference was that back then the 401(k) and defined-contribution plans had yet to upend retirement planning. Most people did not have to decide what to do with large lump sums of money. Most of my clients were retiring from a company where theyd worked for 30 years or more. And that meant they were retiring with solid pensions that reflected a lifetime of service. The guaranteed monthly income from their pension (and for many, Social Security income too) provided enough to live on comfortably. Moreover, most companies offered retirees health care benefits to supplement Medicare. Today, very few do. It really was a simpler time back then. People did not fear retirement. They looked forward to it.

Font size:

Interval:

Bookmark:

Similar books «The Ultimate Retirement Guide for 50+»

Look at similar books to The Ultimate Retirement Guide for 50+. We have selected literature similar in name and meaning in the hope of providing readers with more options to find new, interesting, not yet read works.

Discussion, reviews of the book The Ultimate Retirement Guide for 50+ and just readers' own opinions. Leave your comments, write what you think about the work, its meaning or the main characters. Specify what exactly you liked and what you didn't like, and why you think so.