Published by Greenleaf Book Group Press

Austin, Texas

www.gbgpress.com

Copyright 2013 Empyrion Wealth Management, Inc.

All rights reserved.

No part of this book may be reproduced, stored in a retrieval system, or transmitted by any means, electronic, mechanical, photocopying, recording, or otherwise, without written permission from the copyright holder.

Distributed by Greenleaf Book Group LLC

For ordering information or special discounts for bulk purchases, please contact Greenleaf Book Group LLC at PO Box 91869, Austin, TX 78709, 512.891.6100.

Design and composition by Greenleaf Book Group LLC

Cover design by Greenleaf Book Group LLC

Article on pages 12-13 reprinted with permission by The Auburn Sentinel

Ebook ISBN: 978-1-60832-574-0

Ebook Edition

This book is dedicated in loving memory to my parents, George and Gloria Foss, who inspired me and taught me the most important lesson in life: Do the right thing first for all concerned, and the restincluding wealthwill follow.

I love and miss you both, and I will see you again soon.

CONTENTS

Introduction

October 10, 2008

STEP 1

Discovering and Setting Your Goals

STEP 2

Planning Your Investments

STEP 3

Committing to Your Plan

STEP 4

Assessing Your Plan

STEP 5

Keeping Your Plan Flexible

Conclusion

The Highest Reward

Appendix A

Questions to Ask a Prospective

Financial Advisor

Appendix B

Six Portfolio Allocation Strategies

INTRODUCTION

OCTOBER 10, 2008

OCTOBER 10, 2008, is a day thats burned into my memory. Just as many people can tell you exactly where they were when they heard about JFKs assassination or when they first saw the images of the airliners hitting the Twin Towers on 9/11, I can clearly recall where I was and what I was doing on October 10, 2008.

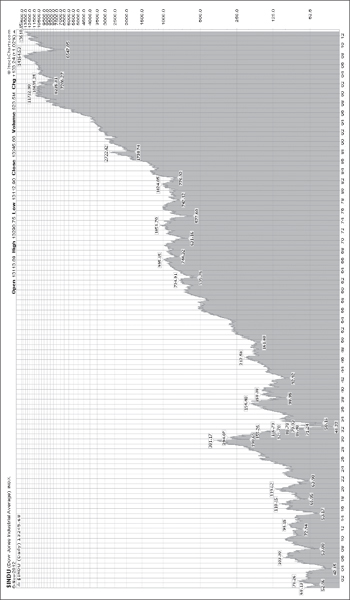

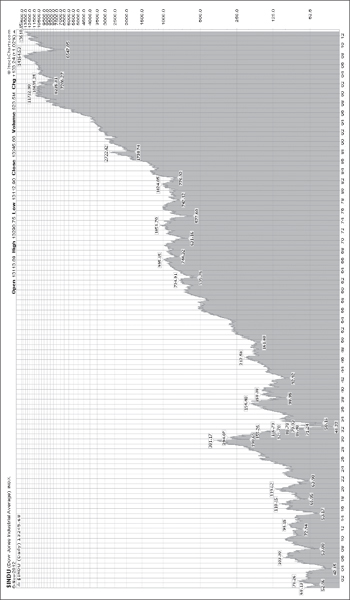

The Dow plunged nearly 700 points that day to its lowest reading in more than five years. By the days end, the Big Board had recovered, if one can use that word to describe closing down only 128 points. For the week, the Dow had lost almost 1,900 points, the worst decline, both in points and percentage of value, in the entire 112-year history of the exchange.

The stock market was reacting to a string of bankruptcies and forced reorganizations among some of the worlds largest financial firms, calamities brought about in large part by the housing bubble burst in 2007 and the gridlock in credit markets that followed. Credit markets stalled due to lenders fears of toxic assets subprime mortgage loans packaged as securities and sold to institutional and private investors. As long as the housing boom kept going and home prices continued to climb, all was well. But when the day cameas such days always willwhen enough people stopped making payments on loans they couldnt afford in the first place, foreclosures started to rise and home prices began to tumble. Now the stock market was following suit.

Chart courtesy of StockCharts.com

World finance ministers issued a statement warning that exceptional steps would be needed to ease the global financial crisis and to get the credit markets unfrozen. In an effort to maintain adequate liquidity so that a meltdown could be prevented, the Federal Reserve had already coordinated with central banks in other nations and announced an emergency rate cut. Despite these efforts, however, banks all over the world were hoarding cash, adding fuel to the fire as panicked investors watched a market in free-fall.

My first thoughts that day were of my family. How would I, a wife and mother of four, provide for my children when the financial world had fallen apart? Would my children ever have the same opportunities to achieve their dreams as I had? Would there be enough of an economy left for themor for anyoneto make their way?

My second thoughts were of my clients. How would this financial disaster affect their portfolios, their security, and the rest of their lives? What could I do to protect them and to justify the trust they had placed in me?

As it turned out, I was able both to protect my clients and to help them turn handsome profits in their portfolios, despite the chaotic events of October 10, 2008, and the shaky markets that continued for some time thereafter. Along the way, I structured an investment that allowed my clients to participate in the rescue of Morgan Stanley, one of the worlds largest banks, during the aftermath of the market panicand to make some very attractive returns while doing so.

I could do these things because of the time-tested principles that Ive learned over more than three decades helping people plan for and find financial securitythe same principles that Ill share with you in this book. During my career, I have learned one central fact: its not really about money. Instead, its about people first, then profits. Family, schooling, and career history have as much to do with financial security as savings and income do. Because I realize that my own personal history played a large part in making my financial career what it is today, I have my clients examine their own lives as their first step toward achieving financial success.

What you will find in this book are interwoven stories, each of which may touch or compel you differently, depending on where you are coming from. This is the story of my life and of the skills I learned along the way that enabled me to become a successful financial advisor. It tells what I came to love (and hate) about the financial business, and how I managed to survive and even thrive during the financial crisis of 2008. Students planning a career in economics or wealth management will find personal inspiration as well as a few nuggets from the research literature that will spark their thinking when term paper or dissertation topics come due.

Financial professionals in the early or middle stages of their careers will learn that the steps Ive mapped out in the five chapters of this book correspond to five distinct stages they can intentionally build into their relationships with clients. These are the five steps that I have distilled as best practices based on my thirty-plus years of experience in the field:

- Discovery

- Investment planning

- Mutual commitment

- Sixty-day follow-up assessment

- Regular progress meetings to ensure the plans flexibility

As you read, youll see how these steps relate to my life cycle as a professional and also to the investment progression of my clients. Ill show you how I help my clients build a tangible plan for protecting and accumulating wealth to create a secure future for themselves, their loved ones, and the causes and people they believe in. Ill also illustrate how I help my clients make sure that their plan is working, as well as how to determine whether it requires some mid-course correction. Depending on the topics you already cover with your wealth management clients, you may choose to execute the above steps in a variety of ways, incorporating them into your routine as additional in-person meetings and other communications, or whatever combination serves you and your clients best.

My story follows a path to financial independence that anyone can take. That is to say, this book is also for investors. You may be engaged in hands-on self-education with your money, allowing a small amount each month to create your own wealth using Charles Schwab or Vanguards do-it-yourself service, just to get a feel for how investment works. If youve now mastered the basics and are ready to move beyond what your experimentation, the Motley Fool, and the newspapers business section can teach you, then this book will help you envision your next step.