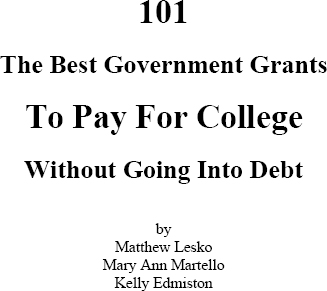

Grants, Scholarships, Low-Interest Loans, Free Services, Books & Free Term Papers

Free Money To Live On While You Go To School

Free Money To Pay Your Student Loans

Matthew Lesko

Information USA, Inc.

12083 Nebel Street

Rockville, MD 20852

1-800-Uncle-Sam

(1-800-862-5372)

http://www.lesko.com/

Copyright 2012

ISBN: 9781620958186

You Can Pay $0 or $32,000 To Go To College It's Up To YOU

Why Go To College?

It's because of self fulfillment, quality of life and most importantly, MONEY. We live in a fast changing world economy and future growth in developed economies like ours is going to rely on brain power. It's no longer muscle power like it was in the industrial revolution. Sure, nothing is certain, but the odds are with you if you keep getting more and more education. And it's true at any age. Look at the data!

(download: http://www.unclelesko.net/ )

Additional Lifetime Earnings Over Someone With High School Diploma

Bachelors Degree = $900,000

Masters Degree = $1.3 Million

PhD = $2.2 Million

Professional Degree = $3.2 Million

How Much Income People Gained From 1979 To 2011

College Graduates = Incomes Went UP 15.7%

Non-College Graduates = Incomes Went DOWN 25.7%

You're Missing Out On 99.9% of Available College Money

A lot of people say, "I make too much money to get grants to go to college." That's nonsense. I make more money than I ever imaged and when my two boys went to college I paid just a fraction of the total price. I was able to find grants and scholarships that have no income requirements to help pay for their education. We found them at the school, at the state government and even local non-profit organizations. There was even one program that offered one son a loan that he never had to pay back.

Remember that when you fill out the government's FAFSA form for receiving financial aid for college it only determines if you are eligible for 0.1% of the programs available. You still have to do some work to find the other 99.9% of the programs available. If you don't you'll be missing out on money like:

$35,000 To Become A Nurse Or Health Care Specialist

$8,000 To Study Massage Therapy

$20,000 To Become A Teacher Or Study Cyber Security

$10,000 In Cash And A Free Teaching Certificate

Uncle Sam Will Pay For Online Courses

350 Colleges For Students 55+ To Go For Free or Almost Free

Free Money To Live On While You Train To Be An Entrepreneur

Free Housing To Attend Medical School In Florida

Get Your GED At 94

$37,000 To Get A Graduate Degree

$16,000 For Women To Study Accounting

Free Help To Get Rid Of Your Debt

Ways Not To Pay Your Student Loans In Tough Times

300 Programs That Forgive Student Loans

An Extra $6,000/Yr For Groceries

$2,000 To Pay For Prescription Drugs

Pay Only 15% of Income On Student Loans And Get The Rest Forgiven

$6,000 To Pay Your Mortgage Payments

$4,000 For Child Care

$2,800 For Heating Bills

Student Internships Making $30,000 A Year

Part-Time Jobs Paying $20 Per Hour

Free Travel To Federal Parks And On Weather Ships

Go On A Free Archeological Dig

Free Money To Pay Your Expenses While You're Going To School

It is a very rare financial aid professional who will tell you about how to get free money for your living expenses while you go to college, but we will. And this is the money that can make or break you from getting your education. Programs like:

Extra $350 A Week To Live On While You Learn To Be an Entrepreneur

$400/Month Worth Of Prescription Drugs Now That You Have No Health Insurance

$400 A Month To Pay For Groceries

$3,000 A Month Of Health Insurance For You And Your Kids

Money To Pay Your Phone Bill

$200 A Month For Utility Bills

$500 In Emergency Money

$1,000 A Month To Help Pay Your Mortgage

$2,000 A Month For Child Care

Free Help To Get You Out Of Credit Card Debt

There is a good chance that your income will decrease while you are spending time taking classes, but your lower income can make you eligible for a whole bunch of programs that are aimed at people with lower incomes. These programs are certainly worth investigating because you can be making up to $45,000 a year and still be eligible for many of these programs.

Student Loan Debt Now Bigger Than Credit Card Debt

Recently the total amount of student loan debt held by Americans is greater than the total amount of credit card debt.

1) 66% Of Students Are In Debt

The % of college grads with bachelor's who graduated with debt doubled to 66% from 1993 to 2008

2) Average Student Debt Is $24,000

Students who graduated last year with loans averaged $24,000 in debt

3) Total Student Debt Went From $200 Billion In 2000 To $800 Billion In 2011

4) Students At For-Profit Colleges Make Up 50% Of Loan Defaults But Only 12% Of Students

This is why you want to find as much FREE money as you can to pay for your education and not pile on more college loan debt.

What Do You Do If You Have Student Debt That Is Causing You Trouble?

Here are some steps you can take if your current student loan debt is keeping you from going back to school and getting the education that you really need to get ahead.

1) Know Your Rights And Obligations

Contact National Consumer Law Center's Student Loan Borrower Assistance Project:

http://www.studentloanborrowerassistance.org/

2) Pay Only 15% Of Your Income For 25 (Or 10) Years

Contact Uncle Sam's Income Based Repayment Plan:

http://studentaid.ed.gov/PORTALSWebApp/students/english/IBRPlan.jsp

3) Get Part Of Your Debt Forgiven

Contact Uncle Sam's Income Based Repayment Plan:

http://studentaid.ed.gov/PORTALSWebApp/students/english/IBRPlan.jsp

4) 350 Programs That Help Pay Student Debt

If you would like to see programs that help with student debt, join Lesko's Government Money Club: http://www.lesko.com/

5) GET FREE Gov't Sponsored Debt Counseling

To contact your local office, see: http://www.lesko.com/free_independent.php

Don't Waste Money On An Over Priced College

If money is not a consideration in your education then this section does not apply to you. And come to think if it, if money is not an issue to you I wonder why you purchased this eBook.

My shorthand theory about choosing a college is that if you are not accepted at one of the top 10 Ivy League colleges, it probably does not matter much where you go, as much as it does to JUST MAKE SURE YOU GO. And with the cost of higher education rising faster than almost anything else in our economy, you should make price a very important factor in your consideration. Here is some data that will help you decide.

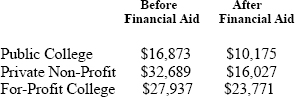

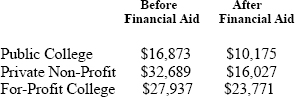

Average Price Of A Four-Year College

Before and After Receiving Financial Aid

Average Spending Per Student On Education

| Public College | $ 9,411 |

| Private Non-Profit | $12,279 |

| For-Profit College |