Table of Contents

To my mother, Norma Bromberg Goodman, who first nurtured my interest in personal finance and who has always supported with love and enthusiasm everything I do.

Acknowledgments

Master Your Debt would not have been possible without the generous and skillful contributions and extremely hard work of many talented people.

Foremost among these contributors is the team of Lynn Sonberg and Roger Cooper, who worked with me to hone the original idea of the book into its final form. Lynn skillfully guided the work from the original proposal through the research, writing, and editing process, always staying on top of the many details and maintaining a high standard for accuracy and clarity in the work. Roger was instrumental in framing the books direction.

The writing and research team also did a remarkable job of combining skillful writing with exhaustive research on many topics related to debt and credit. Linda Stern used her many years of experience covering these topics at Reuters to write most of the text, weaving in many real-life case studies with all the explanations of the massive changes occurring almost daily in the debt and credit world. Bill Westrom of Truth in Equity (www.truthinequity.com), Americas leading expert on mortgage and debt acceleration techniques, generously gave his knowledge, time, and resources to make sure that the sections on acceleration strategies that are so novel and powerful are as clearly and accurately explained as possible.

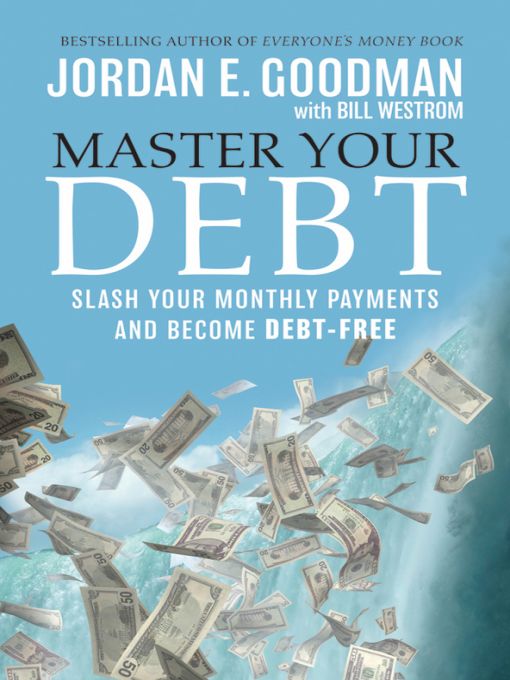

The team at John Wiley & Sons was also instrumental in making this project a reality. Executive Editor Debra Englander immediately embraced the concept of explaining how Americans need guidance in navigating the new and changing world of debt that is affecting them in their everyday lives. Kelly OConnor edited the manuscript with great care and skill. Joan ONeill, the publisher of the Professional and Trade Division at John Wiley, was extremely supportive of the book from conception through publication. Paul Dinovo created the eye-catching cover design. Senior Production Editor Stacey Fischkelta was responsible for overseeing the production of the book. The staff of Cape Cod Compositors, Inc., undertook the meticulous job of copyediting the manuscript. Herman Estevez skillfully took the photograph for the back cover.

My hope is that you, the reader of Master Your Debt, will use the knowledge you gain from this book to maximize the opportunities and avoid the pitfalls that this new era of debt brings to consumers in America. By combining the knowledge you glean from this book with all of the resources that I put at your disposal, you should be able to maintain the best credit rating possible, get the best deals available for all the kinds of loans you take on, and pay your debts off years sooner than you ever thought possible!

Jordan E. Goodman

January 1, 2010

INTRODUCTION

Master or Victim? You Decide

Forget what you think you know about using other peoples money. The game has completely changed.

The world of debteverything from credit cards to mortgages and student loansis completely different than it was just a few years ago, in the middle of the current decade. In this book I want to share the many secrets of debt management Ive discovered that can help consumers all along the credit spectrum. Ive studied the latest products and the newest rules, and also have some good information about the kinds of loans and credit card deals we can expect to see in the future. I want to share that with everyone, but mostly, I want everyone who reads this book to understand this: You can master debt and make it work for you. You can win the debt game.

The financial marketplace is always evolving, but recent developments have been especially dramatica sea change brought about by a credit crisis, a deep recession, and a new administration. Many loan products that were prevalent dont even exist now, and there are new ones taking their place. Those easy zero percent interest credit card deals have dried up, as have the most exotic mortgages and the Bad credit? No problem! attitudes of many car dealers. Private Student lenders have left the business in droves and may disappear altogether.

Now there is a different debt industry to take the place of the one that used to exist. There are new credit card rules, new student loan plans, and new mortgage modification programs. Its a whole new ball game.

So, yesforget what you used to know. The financial marketplace that we are dealing with going forward is not the one we had. Like every other wrenching economic shift, this change will produce new winners and new debt-destroyed victims.

More than ever before, the winners will be those people who are proactive about taking control of their financial destiny. Savvy consumers understand that the business of debt thrives on their remaining uneducated and passive. Those people who learn the new rules, find the new products, and make the right moves will become debt masters: They will be able to borrow money when they need it, pay it off cheaply and quickly, and sleep well at night.

Thats why I wanted to write this book and put it in your hands as quickly as possible. I have spent my entire professional life offering specific, actionable, impartial advice to financial consumers, starting with my 18 years at Money magazine. I have learned whom to trust, whom not to trust, and how to tell the difference. This may be the first book you see that includes details of the new government mortgage and credit card programs, and I rushed to complete it so you could use it as you begin to master your debt in this new era.

In it are the strategies, resources, and techniques that will make you a debt master. It is replete with the latest rules and regulations out of Washington and the newest products from Wall Street and your neighborhood mortgage broker. It includes products and strategies that are so new, most people have never even heard of them. And it also includes the wisdom Ive picked up in over 30 years of observing the marketplace and how it works.

I Hear What You Are Saying

I travela lot. As a financial journalist and educator, I speak to all sorts of groups; I appear on television, the radio, and on my own MoneyAnswers web site, and I get a steady stream of feedback from consumers who have questions about their finances.

And what I have been hearing is this: anger, worry, and confusion.

In Cincinnati, I spoke to Julian, a homeowner who was trying to refinance his home. With good credit scores and a steady job, he wasnt expecting any problems. But in six months there were four foreclosures on his street, and Julians home, which had been valued at $300,000 just six months earlier, was now appraised at $55,000. Thats $245,000 in equity up in smokeand forget about the refi.

In Virginia, I spoke with Chris. He had put almost $100,000 of home repairs and renovations on credit cards charging him around 4 percent interest. He had been paying his bills automatically, online and on time, without reading them carefully. So he failed to notice that his card issuers yanked his borrowing power and raised his interest rates all the way up to 26 percent. Now he is struggling just to stay even.

In New York, I talked to Phyllis and Greg. They seem to be living the American dream: They have their own graphic arts business and two great kids. But they have so much student debt they dont think theyll ever be able to buy a home. And they are flying without a health insurance safety net, living in fear of the medical emergency that will make their whole carefully calculated plan tumble down.