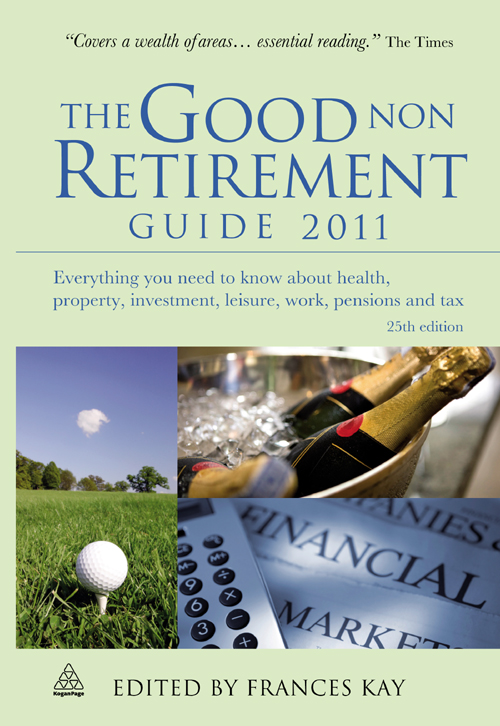

25TH EDITION

The Good Non Retirement Guide

Everything you need to know about health, property, investment, leisure, work, pensions and tax

FRANCES KAY

Publishers note

Every possible effort has been made to ensure that the information contained in this book is accurate at the time of going to press, and the publishers and author cannot accept responsibility for any errors or omissions, however caused. No responsibility for loss or damage occasioned to any person acting, or refraining from action, as a result of the material in this publication can be accepted by the editor, the publisher or the author.

This 25th edition published in Great Britain in 2011 by Kogan Page Limited

Apart from any fair dealing for the purposes of research or private study, or criticism or review, as permitted under the Copyright, Designs and Patents Act 1988, this publication may only be reproduced, stored or transmitted, in any form or by any means, with the prior permission in writing of the publishers, or in the case of reprographic reproduction in accordance with the terms and licences issued by the CLA. Enquiries concerning reproduction outside these terms should be sent to the publishers at the undermentioned address:

Kogan Page Limited

120 Pentonville Road

London N1 9JN

United Kingdom

www.koganpage.com

Kogan Page, 2011

The right of Kogan Page to be identified as the author of this work has been asserted by them in accordance with the Copyright, Designs and Patents Act 1988.

British Library Cataloguing in Publication Data

A CIP record for this book is available from the British Library.

ISBN 978 0 7494 6244 4

E-ISBN 978 0 7494 6245 1

Typeset by Saxon Graphics Ltd, Derby

Production managed by Jellyfish

Printed and bound in Great Britain by CPI Antony Rowe

eBook by Graphicraft Limited, Hong Kong

Stop press

Spending Review announcements

On 20th October 2010 the Chancellor of the Exchequer announced the Spending Review. This outlined the Governments spending plans to 2014/15 and represented 81 billion of cuts in public spending over four years. The following items are of most relevance to readers of The Good Non Retirement Guide .

State pension age to be raised

Millions of workers will have to delay their retirement after the state pension age was raised to 66. Retirement age for men will start rising from 65 in 2018, reaching 66 by 2020. For women who can collect their pension at 60, the pension age will start rising in 2016, also reaching 66 by 2020 this represents an increase of six years in a decade. These measures, which are being taken four years earlier than expected, will save 5bn a year by the end of the next parliament. But this move leaves those approaching retirement very little time to plan properly for a delayed retirement.

Current increasing longevity has meant maintaining the retirement age of 60 for women and 65 for men is unsustainable. The time-scale for raising the pension age to 67 and 68 is also likely to be accelerated. The Chancellor justified the move by saying that many other countries are now increasing the pension age. As a result of these changes, about 5.1 million people who had expected to retire at 65 will have to continue working for an extra year, saving the country about 30 billion in pensions and benefits between 2015 to 2025. A further 13 billion will be raised from additional income tax and national insurance contributions paid by workers who would have retired. The planned changes are intended to ensure that pensions remain sustainable for everyone. The trade off for a later retirement has to be a better state pension.

For younger people, however, the situation may get worse: the Government is considering increasing the pension age to 70 or even higher in future decades. If this does happen, at least it gives people plenty of time to plan ahead to ensure they can pay for their retirement.

The Government are to go ahead with plans to link the state pension to wage increases or inflation whichever is higher from 2011. Most importantly, these moves taken by the Government to cut the cost of supporting Britains ageing population underlines the need for individuals to take action to ensure they can still achieve the retirement they want.

Some good news for pensioners

Pensioners were largely protected when the Chancellor preserved a host of free measures which could have been axed. Universal benefits such as free eye tests, free prescription charges, free bus passes at 60, and free TV licences for the over 75s are untouched. There are no plans to means-test them. They will all be available to every person over a certain age.

Winter fuel payments are protected, although most people over 60 will receive 200 from 2011, compared to 250 in 2010. The additional temporary cold weather payments, of 25, paid to millions of people on low incomes and disabled people, which apply when the local daily temperature has been at or below freezing for seven consecutive days, have been made permanent.

Reform of public sector pensions

Public sector workers will have to pay a new levy on their salaries to fund their pensions. The average state employee will pay an extra three per cent of their salary towards their retirement schemes. The increased contributions are expected to cost public sector workers 1.76 billion a year by 2014, with some set to pay higher occupational pension contributions if they are members of big public service pension schemes. Payouts will no longer be based on final salaries, but on average earnings, from 2012. This decision was made in the wake of Lord Huttons independent commission (due to report in full in spring 2011) which has described the gulf between public and private sector schemes as fundamentally unfair. The chancellor announced that any increases in pension contributions would be staggered and progressive, with the lowest paid and members of the armed forces being protected. But those who gained the highest pensions from final-salary schemes are expected to pay the most.

NHS budget is being increased

Health is one of the few departments not to have been cut. The health budget in England will rise by 10bn by 2014 to 114bn. However that amounts to only 0.1 per cent annual rise once inflation is taken into account. This rise is likely to be more than swallowed up by increasing demands from factors such as obesity, the ageing population and the cost of new drugs.

Pension credit savings award frozen

Pensioners who have modest savings or a small private pension (up to 80 per week) are entitled to a payment of up to 20.52 a week on top of the basic state pension. This upper rate will not rise in line with prices or earnings for the next four years which represents a loss of up to 100 per year for the average claimant. This freeze reinforces the need for savers not to rely on government payouts to help them out in old age.

Council tax benefit cut

The Chancellor announced a 10 per cent cut in the council tax benefit budget from April 2013. Local councils will be expected to cut the amount of council tax benefit they pay by this amount. Those in receipt of this benefit are either too poor to pay council tax or the unemployed.

Working tax credit working hours threshold raised

There is to be an increase in the working hours threshold for working tax credits for couples with children from 2013. It is proposed that couples with children should work at least 24 hours a week between them in order to be eligible for working tax credit. Also, the percentage of childcare claimable under the family element of working tax credit will be trimmed from 80 per cent to 70 per cent.