CONTENTS

Guide

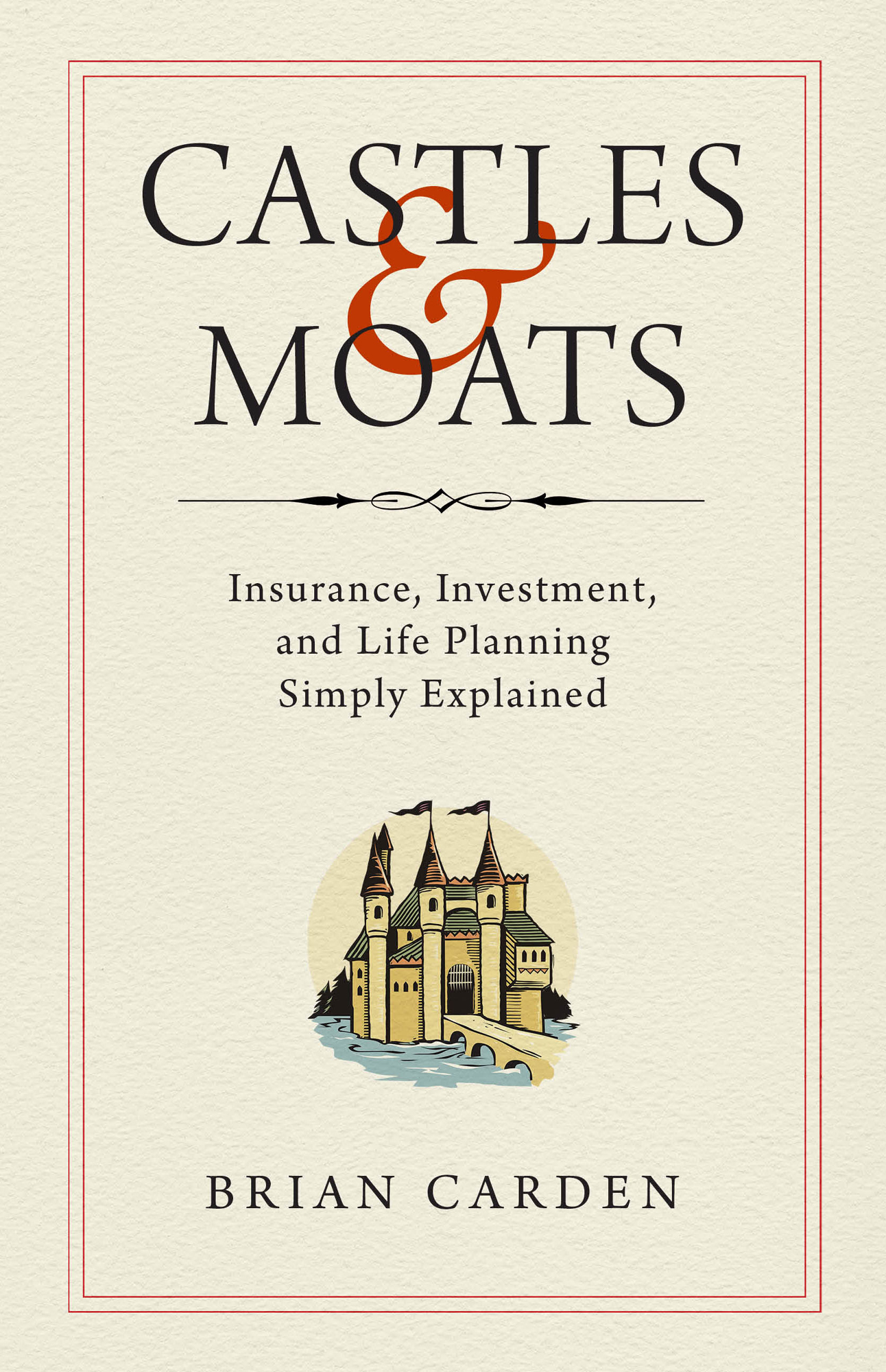

Castles and Moats

Insurance, Investment, and Life Planning Simply Explained

Brian Carden

Securities and Advisory services offered through Madison Avenue Securities, LLC.

Member FINRA/SIPC, a registered investment advisor. Elite Insurance Solutions, LLC, and Madison Avenue Securities are not affiliated.

www.brokercheck.finra.org

DISCLOSURES

Investing involves risk, including the potential loss of principal. It is not possible to invest in an index. Any references to protection, safety, or lifetime income generally refer to fixed insurance products, never securities or investments. Insurance guarantees are backed by the financial strength and claims paying abilities of the issuing carrier.

This book is intended for informational purposes only. It is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individuals situation.

Madison Avenue Securities, LLC, and Brian Carden are not permitted to offer and no statement made during this presentation shall constitute tax or legal advice. Our firm is not affiliated with or endorsed by the US Government or any governmental agency.

The information and opinions contained herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by Madison Avenue Securities.

Castles & Moats Insurance, Investment, and Life Planning Simply Explained

2022 Brian Carden

All Rights Reserved.

No part of this book shall be reproduced or transmitted in any form or by any means, electronic, mechanical, magnetic, and photographic, including photocopying, recording or by any information storage and retrieval system, without prior written permission of the publisher.

No patent liability is assumed with respect to the use of the information contained herein. Although every precaution has been taken in the preparation of this book, the publisher and author assume no responsibility for errors or omissions. Neither is any liability assumed for damages resulting from the use of the information contained herein.

Published by Forefront Books.

Cover Design by Bruce Gore, Gore Studio Inc.

Interior Design by Bill Kersey, KerseyGraphics

Jacket illustration: Shutterstock/bigredlynx

ISBN: 978-1-63763-045-7 print

ISBN: 978-1-63763-046-4 e-book

In honor of my mom, Ethel Carden, who gave me the gift of writing and sharing my words on paper and the memory of Dad. His wisdom, teaching, and love are written throughout these pages. As Dan Fogelberg said about his father in his song Leader of the Band,

I am his living legacy.

Acknowledgments

T HERE ARE SO MANY PEOPLE who have helped, guided, trained, and mentored me throughout my career, all of the successful days and not-so-successful days, that I could spend three pages on acknowledgments. Hopefully you know who you are, because I sure do!

This book would have stayed in a Word document forever without the help of the following people: Jonathan Merkh with Forefront Books, my golfing buddy and more importantly, my friend. Hes the catalyst who told me to do this, and I cant thank him and his staff enough. To Allen Harris, my editor, who was very patient with me in the drafting, rewriting, correcting, and honing of this manuscript into something Im quite proud of. And to Beth Tallent, my publicist, for her encouragement to complete this book and for her ongoing support in helping me help others.

Introduction

A FTER THIRTY-NINE YEARS IN THE insurance and investment businessand after gaining a lot of wisdom and experience in the financial world (often the hard way)Ive come to some realizations. The biggest one is that most Americans are totally confused about the who, what, when, where, why, and how of managing their finances, insurance needs, investments, and their other assets. Sometimes we feel like we dont know anything. Sometimes, we do. And, of course, there are the times when we think we understand something, but it turns out we dont. Thats where we usually get into the most trouble. Like Mark Twain once said, What gets us into trouble is not what we dont know. Its what we know for sure that just aint so.

When I started in the financial and insurance industry in the early 1980s, there was little knowledge of the then-new Individual Retirement Accounts (IRA) or 401(k) plans. There were no financial planners. You put $2,000 into an IRA or savings account, and they gave you a toaster! Yes, they actually did that. Mutual funds were just becoming available to the average person. Whole life insurance was still considered a valuable tool for protecting families and growing cash values. People saved money in three ways: savings accounts or Certificates of Deposit (CD) at the bank, payroll deduction for US Savings Bonds, or cash values in their life insurance policies. Only rich people bought stocks, and they could only buy them through a stockbroker. There were no college savings plans. Instead, we worked summer jobs or worked part-time while taking classes. People worked at the same company for forty years and then retired with a monthly pension check they would receive for the rest of their lives.

Things are a lot different today. You can find virtually every financial product, concept, or tool you could ever possibly imagine with a quick Google search. Hey, if its on the Internet, it must be true, right? You can also get your fill of information from all the financial entertainers that are all over the airwaves, the media, podcasts, and the Internet. There is a ton of financial information but virtually no education on how these financial tools work or how we should use them in our personal financial planning.

If you dont believe me, Google financial planning and youll get at least 2.9 billion hits. Mutual funds returns 2.94 million hits. Again, lots of information but minimal education.

When I was a kid, Mom and Dad had insurance agents, stockbrokers, and bankers to go to with their financial questions. Believe it or not, these people still exist! Our immediate access of point-and-click, self-service options on the Internet has not replaced themnot yet anyway. And thats a good thing. We still need these professionals to help us reach our financial goals, to help guide us through the minefield of our personal finances and to help us build our castles and dig our moats.

Why Me?

The title of this bookCastles and Moatsis a metaphor Ive used for years, and its the foundation for my belief system of how all of your insurance, investment, retirement, and life planning should work.

Simply put: if youre going to build a castle of financial wealth, you better build a moat of protection around it!

Just to be clear about why Im writing this book, I assure you its not because I like to hear myself talk, and its not an item on this sixty-something-year-old guys bucket list. Im writing this because Ive had basically the same handful of conversations over and over and over with friends and clients for nearly four decades. I have said that, in my purest form, I am a financial psychologist. I have a business degree, but most of my work is emotionally based, helping people make good decisions with their finances.