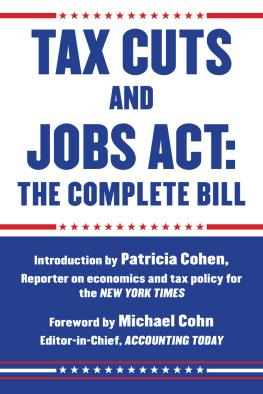

First Published by the 115th US Congress in 2017.

First Skyhorse edition 2018.

Foreword Copyright 2018 by Michael Cohn

Introduction Copyright 2018 by Patricia Cohen

Skyhorse Publishing books may be purchased in bulk at special discounts for sales promotion, corporate gifts, fund-raising, or educational purposes. Special editions can also be created to specifications. For details, contact the Special Sales Department, Skyhorse Publishing, 307 West 36th Street, 11th Floor, New York, NY 10018 or .

Skyhorse and Skyhorse Publishing are registered trademarks of Skyhorse Publishing, Inc., a Delaware corporation.

Visit our website at www.skyhorsepublishing.com.

10 9 8 7 6 5 4 3 2 1

Library of Congress Cataloging-in-Publication Data is available on file.

Cover design by Brian Peterson

Print ISBN: 978-1-5107-3729-7

Ebook ISBN: 978-1-5107-3730-3

Printed in the United States of America

CONTENTS

FOREWORD

By Michael Cohn, editor-in-chief of AccountingToday.com

T HE T AX C UTS AND J OBS A CT moved swiftly through Congress at the end of 2017, reaching President Donald Trumps desk only days before Christmas, with little time for debate over the most far-reaching tax legislation since 1986.

The Republican-led bill passed mostly along party lines in both the House and Senate using a budget reconciliation procedure that allowed the legislation to avoid an almost certain filibuster by Senate Democrats. The House and Senate versions of the bill diered in some significant ways, including the number of individual tax brackets and a repeal of the Aordable Care Acts individual mandate, so a conference committee of lawmakers from both chambers met to reconcile the two pieces of legislation. Much of the real work of crafting the legislation and working out the compromises occurred behind closed doors, to the chagrin of Democrats, who complained they were learning about important changes in the bill from press reports and leaks from lobbyists.

Republican lawmakers agreed on a set of last-minute changes to entice a handful of reluctant GOP senators to support the legislation. Some of the changes softened several of the most controversial provisions, although the bill is still likely to provoke controversy for years to come as its impact becomes clearer. The compromise legislation that emerged from the conference committee came up before the House and Senate again for a vote in the week before Christmas. The Senate parliamentarian ruled that some of its provisions violated Senate rules, so a few were struck out, including some related to tax breaks for education. Even the name of the bill itself was challenged, so it is ocially known as An Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018. The bill then came up for one last vote before the House before it passed the final time and was signed into law just in time to meet President Trumps pledge to pass the tax overhaul before Christmas. It was the most significant legislation passed during his first year in oce, and one of the most consequential for any president to sign, as it will affect nearly every American taxpayer. The repeal of the Aordable Care Acts individual mandate alone will probably have a substantial impact on the health care system and insurance market.

The bill reduces tax rates for both businesses and individuals. Many of the sharpest tax reductions are on the corporate side, where the maximum tax rate has declined from 35 percent to 21 percent. The corporate tax cuts are permanent, but the individual tax cuts are only temporary, many of them set to expire in 2025 or 2027, and in some cases even earlier, in order to keep the legislation from adding more than $1.5 trillion to the deficit over ten years. They are likely to be extended by a future Congress, but there is never any guarantee what Congress will do.

Under the original House Republican proposal, the tax plan would have reduced the number of individual tax brackets from seven to four. The Senate Republican plan kept the number of brackets at seven. In the end, the legislation retains seven tax brackets, but the maximum rate has gone down from 39.6 percent to 37 percent. The rates are now 10, 12, 22, 24, 32, 35 and 37 percent. The top rate would apply to single taxpayers with over $500,000 in income, and married couples with more than $600,000. Most people would see their tax rate go down under the plan, although many would also lose deductions or see the amount of those deductions sharply limited.

For example, the longtime deduction for state and local taxes, which has been a feature of the tax code ever since the 1913 introduction of the federal income tax, is now going to be limited to $10,000. Thats a compromise, though, since the original version of the legislation from House Republicans eliminated the deduction for state and local income and sales taxes entirely. The measure was seen as punishing so-called blue states, which traditionally vote for Democrats and rely heavily on state income tax revenue. In the end, after hearing objections from Republican lawmakers in those states, the conference committee decided to allow up to $10,000 in deductions for a combination of state and local property taxes and either income or sales taxes. Still, for taxpayers in high-tax states and cities, that may not be enough to make up for the deductions they would otherwise lose. Passage of the legislation prompted many people to scramble to pay their 2018 property taxes before the end of 2017 in states like New York and municipalities that allowed it. That way, they would be able to deduct more of their 2018 state and local income or sales taxes in 2019. The Internal Revenue Service (IRS) soon advised taxpayers, though, that prepayments would only be deductible for 2017 if the property taxes had been assessed before the end of the year.

Another popular deduction that has been scaled back under the bill is for mortgage interest. For new homes or new mortgages on a first or second home, the deduction is capped at $750,000 (or $375,000 for married taxpayers who file separately), down from $1 million. Homeowners who already have a mortgage as of December 15, 2017 can still take the full deduction of $1 million, or $500,000 for married couples who file separately.

Also on the chopping block is the deduction for alimony payments, but theres a little extra time to arrange a divorce as it only applies to divorce or separation agreements after the end of 2018. Personal casualty losses and theft losses cant be deducted either, unless they can be attributed to a disaster ocially declared by the president.

Taxpayers with serious medical problems who were worried Congress might repeal the medical expense deduction can breathe a sigh of relief. The final legislation actually enhances the medical expense deduction, at least for two years, lowering the threshold for claiming the deduction to 7.5 percent of adjusted gross income for the 2017 and 2018 tax years. The threshold used to be 10 percent, meaning the taxpayers medical expenses had to be at least 10 percent of their income. Thanks to the change, more taxpayers with high medical expenses should be able to qualify, albeit temporarily.

To make up for the lost deductions for taxpayers who traditionally itemize, the bill nearly doubles the standard deduction, from $6,350 to $12,000 for single taxpayers, from $12,700 to $24,000 for couples, and from $9,350 to $18,000 for heads of households. The doubling of the standard deduction is expected to cause more people to stop itemizing deductions, hence the concept of tax simplification. But that could be a problem for many charities that depend on contributions and the tax deductions associated with them. While the tax reform law does retain the deduction for charitable contributions, its expected to mainly benefit individual taxpayers whose total itemized deductions exceed the new standard deduction level of $12,000, or $24,000 for couples.