Dont Drop Ship! A Guide to Starting Your OwnDrop Ship Business

And Reasons Why You Probably Shouldnt

by Brian and King Kong / Published byBrilliant Building

Smashwords Edition

Copyright 2014 Brilliant Building

DISCLAIMER

I would just like to state for the recordthat the ideas, thoughts, and recommendations I have giventhroughout this document are strictly based on my own experiences.I am not a lawyer, and do not claim to be one, nor do I considermyself to be qualified in any way to provide legal advice as itrelates to establishing a business, paying taxes, or anything elsethat requires advice from a licensed professional.

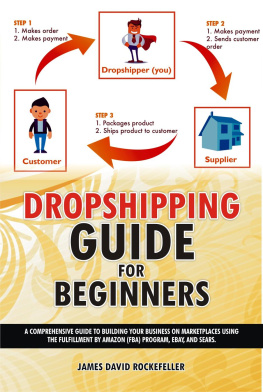

Introduction

Starting a drop ship business from the groundup has been the greatest, most practical, learning experience Ihave had to date as it relates to understanding the full range oftasks that go along with running a small business. Although thebusiness itself has yet to show a sustainable profit, the knowledgeI have learned over the last few years will last me a lifetime, andcan be applied to a multitude of lifes experiences and challenges.The following guide is meant to give you the insights I havelearned throughout this process and the knowledge that I wish I hadbefore I started. After reading this guide, my goal would be foryou to take advantage of the following benefits:

1. Save you from having to research all thesteps needed to establish a drop ship business, since I providedetails of the various steps throughout this guide.

2. Establish realistic expectations for whatrunning a drop ship business is really like.

3. Provide some of the tools necessary to runyour business, or at the very least provide you the informationneeded to access those tools.

PART I Establishing the Business

Note: An asterisk (*) denotes a mandatorystep in the setup process.

Editor's note: these steps are recommendedfor any business in the United States, not just drop shipbusinesses. However, most businesses fail, and it is a tremendouspain to go through this process each time you start a business.Consider taking steps to see if your business will fail BEFORE yougo through this process.

While our guide in the form of a checklist isstraightforward, keep in mind many of these documents and filingswill need to be renewed, and it is quite easy to neglect thesethings as you take care of other concerns. Are you certain you wantto do this? All of this must be done before you even know if thebusiness will be profitable.

Here is a method to validate whether yourdrop ship business is worth going through the hassle of setting upan actual business: First, create a site that is almost fullyfunctional, but when it comes time to check out, simply show thatthe items are out of stock. Have your site record how many peopleactually got to the checkout stage and would have ordered, had youactually been open for business. Its a dirty trick, I know, butuntil you have people writing you angry e-mails that they couldn'torder what they wanted, perhaps it's not yet time for you to starta drop ship business. If youve gotten to this point, then itstime to run through the following steps.

1. Post Office Box (PO Box)

Prerequisites: None

I run my drop ship company out of my house,but I use a Post Office Box as my mailing address. This keeps aseparation between home and work. It is not necessary, but I thinkit is a good idea. You can easily apply for a PO Box near youthrough the following site:

https://www.usps.com/manage/get-a-po-box.htmIf you are going to use one, I would encourage you to sign up forone sooner rather than later, so you can use the PO Box whensetting up your business in the steps that follow. Anotheralternative is renting a virtual office, which typically provides asuite of other services such as phone answering, though these aretypically much more expensive than a PO Box.

2. Employer Identification Number (EIN)*

Prerequisites: None

For tax purposes, I applied for an EIN to usefor my drop ship company. This enabled my drop ship company to haveits own Tax ID number, which I could use when applying for abusiness license, bank account, sellers permit, etc. An EIN isfree, and you can apply for an EIN here:

http://www.irs.gov/businesses/small/article/0,,id=102767,00.html

3. Fictitious Name Statement (FNS) *

Prerequisites: None

If you plan on conducting business in a nameother than your own, you will need to file for a FNS, also referredto as a DBA (doing business as). There are a few steps to filing aFNS, and will depend on your county. The first step is to contactyour county recorders office. The best way to do this is to Googlesearch for the following:

Name of your County Fictitious NameStatement Application

It will generally take you to the countyrecorders website, and will most likely be a .gov website. Onceyou find the correct page, you will need to follow the specificinstructions related to your county. Generally speaking the costwill be about $30, and the FNS will be good for 5 years. Read thesection on picking a name before doing this, however!

4. Business License*

Prerequisites: Permanent Physical Address,Fictitious Name Statement (if required)

The business license can be applied for atthe same time as the FNS, but will be with a different department.Depending on where the address of the business will be located, youmay have to apply for a business license from the county, from thecity, or perhaps both. The best way to find out is to do anotherGoogle search for the following:

Name of your County Business LicenseApplication

It will generally take you to the correctdepartments website for your county. From here, there will bedocumentation letting you know the specific application process andpaperwork needed for your county/city. If you are planning onrunning the business from your home, you may need to apply foradditional permits, which should be outlined in the applicationprocess. The business license will need to be renewed each year,and the cost will be based on gross sales. I generally pay about$30 a year for my business license for my drop ship company.

5. California Sellers Permit*

Prerequisites: Business License

If you are going to be selling products inCalifornia, you will need to apply for a California SellersPermit. There is no cost involved with obtaining a permit, and youcan find the necessary information on the California State Board ofEqualization web site here:

http://www.boe.ca.gov/sutax/faqseller.htm

6. Bank Account*

Prerequisites: Business License

Having a separate Bank Account for yourbusiness is a must have in my opinion. It helps to establish yourbusiness as its own entity, and separate your personal financesfrom the business finances. Additionally, it is a lot easier tokeep track of expenses if the business has its own bank account.Since there are hundreds of choices for checking accounts outthere, I do not have a recommendation on which bank to use, it willreally be a matter of personal preference. The process is prettystraight forward, and can easily be setup by either visiting thebanks website or simply going into one of the branches. I wouldrecommend shopping around to a few banks to compare fees. Manybanks will not open a business checking account without thebusiness license, so this step should be done after the businessentity has been setup.

Editors note: I would add that as soon asyou are able to, apply for a business credit card, or if you havedifficulty obtaining one, simply apply for a regular consumercredit card. The expenses are far easier to track when racking upcredit card purchases vs. entering them in by hand for each checkyou write.

7. Paypal Account

Prerequisites: None

My drop ship company uses Paypals WebsitePayments Standard to process all payments. The cost associated withthis service is as follows:

Next page