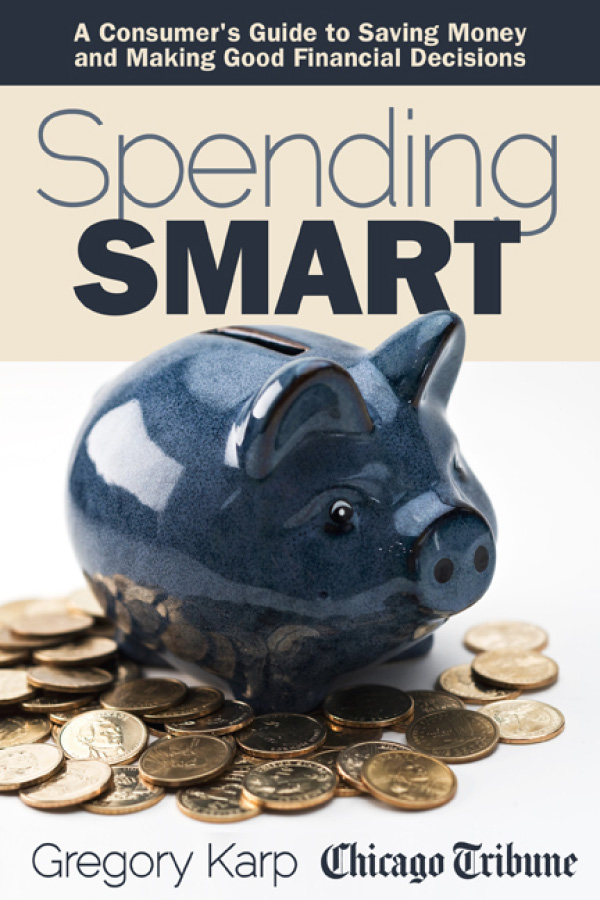

Gregory Karp - Spending Smart: A Consumers Guide to Saving Money and Making Good Financial Decisions

Here you can read online Gregory Karp - Spending Smart: A Consumers Guide to Saving Money and Making Good Financial Decisions full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2013, publisher: Agate Publishing, genre: Home and family. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:Spending Smart: A Consumers Guide to Saving Money and Making Good Financial Decisions

- Author:

- Publisher:Agate Publishing

- Genre:

- Year:2013

- Rating:3 / 5

- Favourites:Add to favourites

- Your mark:

Spending Smart: A Consumers Guide to Saving Money and Making Good Financial Decisions: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "Spending Smart: A Consumers Guide to Saving Money and Making Good Financial Decisions" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

Spending Smart is a compact but immensely helpful collection of columns penned by Gregory Karp. Offering tips for consumers across a wide variety of fields, including insurance, banking, cars, phones, homes, travel, and more, this book is a terrific primer for how to take better care of your money and find deals where others arent even looking.

The simple and sober advice from Karp has made him a newspaper mainstay for many years, as evidenced by this books vast amount of straightforward tips. In breaking down the true worth of a deal or exposing hidden value, Spending Smart is a readers go-to financial adviser while on the go. Perfect to pull up on smartphones, e-readers, and tablets, Karps friendly tone and measured counsel can be accessed just about anywhere readers have financial questions.

Praise for Gregory Karp

Greg Karp has a clear roadmap to wealth that is yours for the taking. Follow his simple steps and you will take control of your financial future. Get FIT now! Clark Howard, The Clark Howard radio show

Greg Karp gets it and you will too. His research and tips will help you keep more of the money you earn. Steve & Annette Economides, New York Times bestselling authors of Americas Cheapest Family Gets You Right on the Money

The author provides solid advice and solid writing on a topic that benefits from a fresh voice. Liz Pulliam Weston, MSN Money columnist and author of Your Credit Score

Gregory Karp: author's other books

Who wrote Spending Smart: A Consumers Guide to Saving Money and Making Good Financial Decisions? Find out the surname, the name of the author of the book and a list of all author's works by series.