Text copyright 2016 by Eric Braun and Sandy Donovan

Illustrations copyright 2016 by Free Spirit Publishing Inc.

All rights reserved under International and Pan-American Copyright Conventions. Unless otherwise noted, no part of this book may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, or otherwise, without express written permission of the publisher, except for brief quotations or critical reviews. For more information, go to www.freespirit.com/permissions.

Free Spirit, Free Spirit Publishing, and associated logos are trademarks and/or registered trademarks of Free Spirit Publishing Inc. A complete listing of our logos and trademarks is available at www.freespirit.com.

Library of Congress Cataloging-in-Publication Data

Names: Braun, Eric, 1971 author. | Donovan, Sandra, 1967author.

Title: The survival guide for money smarts : earn, save, spend, give / Eric Braun and Sandy Donovan.

Description: Golden Valley, MN : Free Spirit Publishing Inc., [2016] | Includes index.

Identifiers: LCCN 2016019320 (print) | LCCN 2016029861 (ebook) | ISBN 9781631980282 (pbk.) | ISBN 1631980289 (pbk.) | ISBN 9781631981159 (Web pdf) | ISBN 9781631981166 (epub)

Subjects: LCSH: Finance, PersonalJuvenile literature. | ChildrenFinance, PersonalJuvenile literature.

Classification: LCC HG179 .B7256 2016 (print) | LCC HG179 (ebook) | DDC 332.024dc23

LC record available at https://lccn.loc.gov/2016019320

Free Spirit Publishing does not have control over or assume responsibility for author or third-party websites and their content. At the time of this books publication, all facts and figures cited within are the most current available. All telephone numbers, addresses, and website URLs are accurate and active; all publications, organizations, websites, and other resources exist as described in this book; and all have been verified as of June 2016. If you find an error or believe that a resource listed here is not as described, please contact Free Spirit Publishing.

Reading Level Grade 7 & Up; Interest Level Ages 914;

Fountas & Pinnell Guided Reading Level Z

Edited by Kimberly Feltes Taylor

Cover and interior design by Emily Dyer

Illustrations by Steve Mark

Additional graphics: currency icons p.2 Eduard Kachan | Dreamstime.com; currency patterns used throughout book Jslavy | Dreamstime.com and Teenbull | Dreamstime.com

Free Spirit Publishing Inc.

6325 Sandburg Road, Suite 100

Minneapolis, MN 55427-3674

(612) 338-2068

www.freespirit.com

Free Spirit offers competitive pricing.

Contact for pricing information

on multiple quantity purchases.

Contents

Chapter 1: Revenge of the Sandwich

(What Is Money, Anyway?)

Chapter 2: Who Are You?

(And What Do You Want?)

Chapter 3: Beyond the Lemonade Stand

(Ways to Make Money)

Chapter 4: Its Time for a Plan

(Making a Budget)

Chapter 5: Arent You a Smartypants?

(Six Tips for Being a Smart Consumer)

Chapter 6: My Money Went Where?

(Being a Mindful Consumer)

Chapter 7: Your School for Cool Money Tools

(Banking and Borrowing)

Chapter 8: Looking into Your Crystal Ball

(Saving and Investing)

Reproducible Forms

You can download and print these forms at

www.freespirit.com/money-smarts-forms .

Use password 4goals .

Introduction

Raising Your Money IQ

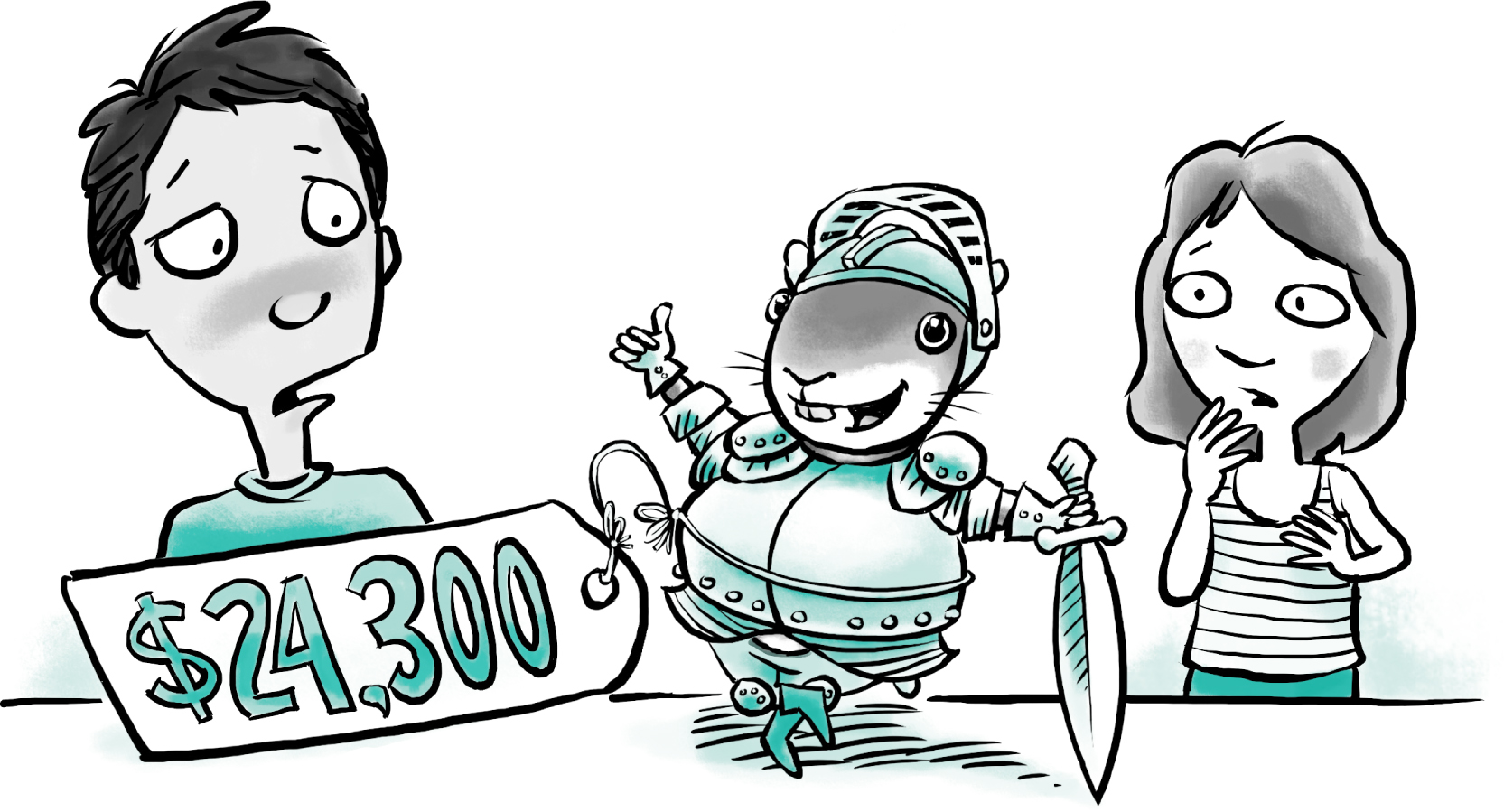

Theres something about money that makes people act totally weird. For example, we heard about a person who paid $24,300 for a suit of armor for his guinea pig. Somebody else bought a $95,000 truffle. In case you didnt know, a truffle is a fungus, kind of like a mushroom. This truffle was a very special kind. Only highly trained dogs could find it. Still, could a fungus really be worth that much money?

Most of us cant afford costly truffles, or armor for our guinea pigs. But we still find plenty of ways to make silly choices with our money. We buy brand names when cheaper versions are just as good. We buy a video game and then quit playing it after a week. We buy the large popcorn at the movies (the sign says its the best deal!) even though well never make it halfway through that grocery bag of popcorn. Many of us dont plan ahead or save enough.

Money, Money, Money

Different countries use different kinds of money, or . The United States and Canada use dollars, and thats the term we use in this book. If people use a different currency where you live, just think of that currency when you see the word dollar or the dollar sign ($ or  ).

).

EURO

BRITISH POUND

SOUTH KOREAN WON

UNITED STATES DOLLAR

NIGERIAN NAIRA

JAPANESE YEN

INDIAN RUPEE

CURRENCY:

the type of money used in a specific country

Maybe you dont make silly money choices. Maybe youve already got a savings account and some pretty sharp money smarts. If so, thats great! Or maybe you dont have much money and arent sure how to get it. Maybe youve just never given money much thought. Whatever the case may be for you, this book can help you raise your money IQ. (IQ stands for intelligence quotient. Thats just a fancy way of saying how smart you are about something.)

To raise your money IQ, youll start by thinking about your goals. Then youll consider ways you can earn money to reach those goals. Youll also learn how to set up a budget that will help you manage your money. (Think a budget sounds scary or boring? Dont worrya budget just means making a plan for your money.) Even though you may be too young to do things like work a real job, use a credit card, or invest in stocks, youll learn about these things, too. Looking to the future, when you can do these things, is an important part of being money smartand happy.

Warning! Having money smarts can lead to feelings of confidence, wisdom, and pride. Thats because being money smart is all about making decisions that say something positive about you and the things you care about.

About This Book

).

).