Mortgage Free

How to Pay Off Your Mortgage in Under 10 Years

Without Becoming a Drug Dealer

Heidi Farrelly

Ebook Edition

Copyright 2015, Heidi Farrelly

License Notes: This ebook is licensed for your personal enjoyment only. This ebook may not be re-sold or given away to other people. If you would like to share this ebook with another person, please purchase an additional copy for each person you share it with. If youre reading this book and did not purchase it, or it was not purchased for your use only, then you should return to a retailer, and purchase your own copy. Thank you for respecting the hard work of this author.

Edited by Elaine Roughton

Cover Illustration by Sillier Than Sally- www.sillierthansally.com

Dedication

To my amazing husband.

You have supported me through all of my crazy ventures, and always believed in me.

You encouraged me when I stopped believing in myself, and together we have travelled the world, are raising a beautiful daughter, and have paid off a house!

I cant wait to retire with you and spend the rest of our lives doing what we lovetogether.

I love you with all my heart.

Bonus Material

Throughout the book you will have the option to download and use bonus materials.

Head to www.How2Without.com for FREE access to these, such as printable checklists and worksheets that will help you achieve your goal of financial freedom.

Contents

Conclusion

Introduction

A goal without a plan is just a wish.Antoine de Saint-Exupery

Is this book for you?

- Youre struggling to save a deposit and buy your first home.

- Youve bought a house and are chugging along paying your minimum repayments but cant see an end in sight.

- You want to create a passive income for yourself and spend more time doing what you love, but you just cant seem to get ahead.

- You want to retire early, but it seems impossible.

I f you can relate to any of the above, then you need this book!

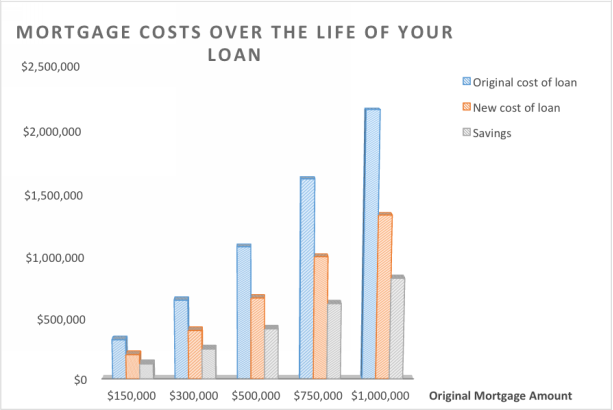

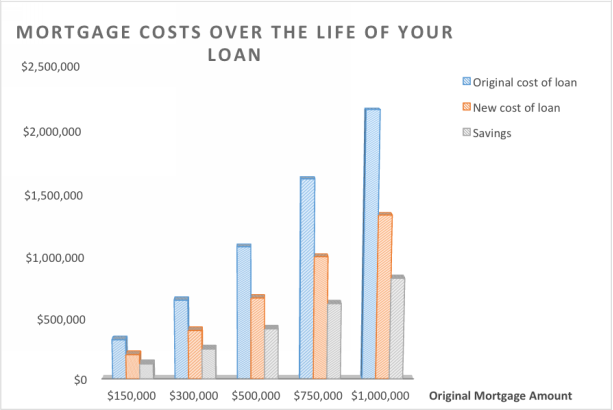

A $500,000 mortgage takes 30 years to pay off, and over its life it will incur $579,191 in interest. That makes the total cost of your loan a whopping $1,079,191, and thats if you never redraw.

This book will show you how to pay off your mortgage in under 10 years, and knock the total cost of that loan down to $665,184, saving you more than 20 years and $414,000 dollars. This kind of knowledge is invaluable and will literally change your life, and MORTGAGE FREE puts it all at your fingertips.

Who I am

How do I know all this? Because Ive been there, Ive lived through it all, and what a roller-coaster ride it can be! We did several things wrong, like redrawing half way through our 10-year plan to pay for IVFtwice!and we still hit our target.

We learned, we listened to advice from those around us, we did our homework and kept an eye on our figures, and it all paid off.

My family came out the other side debt free. We are happier, have more financial freedom, and appreciate the little things far more than we ever did before.

Its not what you make, its what you can hold onto.Michael Farrelly

This is something my father in-law always says. While I always agreed, I secretly thought it would be a lot easier if you made more to begin with!

Now I know the truth. It really doesnt matter what you make. You can kick and scream and cry into your coffee all you want, but the simple truth is that the more people make, the more they spend.

How extra repayments can change your life

We all do it. A $1 an-hour pay rise doesnt seem like much, and so it just gets sucked into our spending. But over the year it adds up to over $2,000! Do you know that if you took that $1 an hour and made an extra repayment of $40 a week, you would save 4 years and 10 months and $87,924 over the life of a $500,000 loan?!! For 40 bucks!! Imagine what you could do if you were really trying!

This is a fictional story, but one that is true of many families today.

Bob and Anne, and Sally and Patrick, each bought their homes for $375,000 in the same neighbourhood several years ago, and became good friends. They each had a 20% deposit, which left them with mortgages of $300,000.

Bob and Anne make $88,000 a year. They have an overseas holiday once a year, travel their own backyard every other month, and enjoy a full and active life. Oh, did I mention they also pay over half of their weekly wage into their mortgage? By doing this they will have their 30-year loan paid off in 10 years and will have only paid around $173,473 in interest.

Sally and Patrick make $142,000 a year. They too have an overseas holiday once a year, but there the similarities stop. Sally and Patrick enjoy eating out, travelling, staying in 5 star hotels, and their new house is full of nice furniture and new gadgets, and they both drive new cars. They pay the standard rate on their mortgage, and over their 30-year loan they will have paid $347,514 in interest; 20 years and $174,042 more than their friends.

Sally and Patrick might make more, but 10 years down the track they will still be continuing to pay their mortgage, while Bob and Anne will be debt free. They have set themselves up for life and can now enjoy all the things Sally and Patrick doand so much morewithout a mortgage holding them back. They just booked a 3-month holiday around the Caribbean.

This could be you!

Debt free aint easy

If you thought there was no way you were ever going to be debt free before you reached retirement, think again. Its not easy, but it is definitely doable! By the time you have finished this book you will have been shown how to budget, how to cut your excess spending, how to save a deposit while paying debt or raising a family, what and where to buy, and ultimately how to pay off your mortgage in under 10 years instead of 30.

Becoming debt free is not all roses and sunshine, but I promise you if you follow even some of the solutions in this book, you will be free of your mortgage years ahead of your peers. You dont have to give up everything you love doing, either; in fact, I have dedicated a whole chapter to continuing the things you love. Life is for living, and I plan on living it!

This book will change your life. Want to know how some people own 5 homes while youre struggling to pay off one? Do you want to know how to be mortgage free at 40? Do you want to work less and spend more? I promise these are not pipe dreams! I started where you are now, and I wish this book had been around when we first bought.

It is possible. It is achievable. Sometimes youve just got to be pointed in the right direction. This book is applicable to everyone, everywhere, and will show you how to make the most out of your mortgage, your property, and your future. Just remember, It always seems impossible until it is done.Nelson Mandela

The longer you wait, the harder it becomes to get ahead. MORTGAGE FREE shows you how to change simple things, straight away, that make a massive difference to your loan term. If you want to put your mortgage behind you and start living the life youve always wanted, then read on, and take back your future.

Because being debt free is the ultimate gift you can give to yourself, and your family.

Chapter 1: Sustainable Budgeting

Do not save what is left after spending, spend what is left after saving.Warren Buffet

Budgetinga dirty word

N obody likes to hear the word budget. Its up there with diet in the dirty word stakes, but the reality is, if you dont know what you spend your money on you just cant save.

Next page