Praise forMind Your Own Mortgage

Picking up a new mortgage isnt like shopping for shoes. Its more like entering into the competition of your life.... You need your own coach to win the mortgage gamesomeone whos on your side, fully aware of the competitions strategies and whats in their playbook; a coach who will walk with you through the transaction, explaining every move with clear and sound advice from start to finish. Whether youre getting a new mortgage, refinancing an old one, or dealing with the mortgage you have already, you wont find a better mortgage coach than my friend Rob Bernab. The book you hold in your hands, Mind Your Own Mortgage, will bring him alongside with expert knowledge you can trust, passion that is genuine, and everything you need to play the mortgage game well. And come out victorious. Every time!

MARY HUNT

personal finance expert and

best-selling author and CEO of

Debt-Proof Living

Rob is a consumer advocate in the greatest sense. He is an innovator and pioneer, having championed efforts to bring clarity and certainty to mortgage consumers at E*TRADE Financial. He piloted our mortgage business into the stratosphere by offering the first-of-its-kind guaranteed up-front pricing which eliminated guesswork and gave consumers a fair shake. Mind Your Own Mortgage reverse engineers Robs vision from a business offering to a consumer-led revolution of the mortgage industry. Finally, consumers have what they need to hold any mortgage provider accountablenot to mention the tools needed to manage and pay off their mortgage debt.

R. JARRETTLILIEN

founder and managing partner

of Bendigo Partners and former

president and COO of E*TRADE

Financial

Wow. Mind Your Own Mortgage has the potential to dramatically change the mortgage lending landscapeprovided you read and apply the material. Rob is a regular guest on my radio program, and through our relationship, Ive come to realize theres a huge untold storyone that you must grasp in order to successfully navigate your mortgage debt from the time you obtain it to the day you kiss it good-bye. Robs book lays it out for youproviding the prescription to go from beginning to end with no pain in between.

FRANK PASTORE

The Frank Pastore Show,

Los Angeles, CA

Mind Your Own Mortgage is a powerful work, combining time-tested and stalwart financial truths with a fresh approach to mortgage finance that will test everything youve been led to believe about your most significant debt. Take care to unpack the contents of this book. Youll find stored within solid guidance that will consist in making better informed choices in your personal financial journey.

KENNY LUCK

CEO of Everyman Ministries,

Mens Pastor at Saddleback

Church, Lake Forest, CA, and

best-selling author

In my time serving alongside Rob at Saddleback Church, Ive watched Rob as he taught thousands of people the principles covered in Mind Your Own Mortgage. Follow the sound financial principles in this book and they will transform your life. Your mortgage is a critical component of your overall financial picture, and the consequences of getting it wrong can be severe. This book will help you get it right.

CHRIS GOULARD

Pastor of Financial Stewardship,

Saddleback Church, Lake

Forest, CA

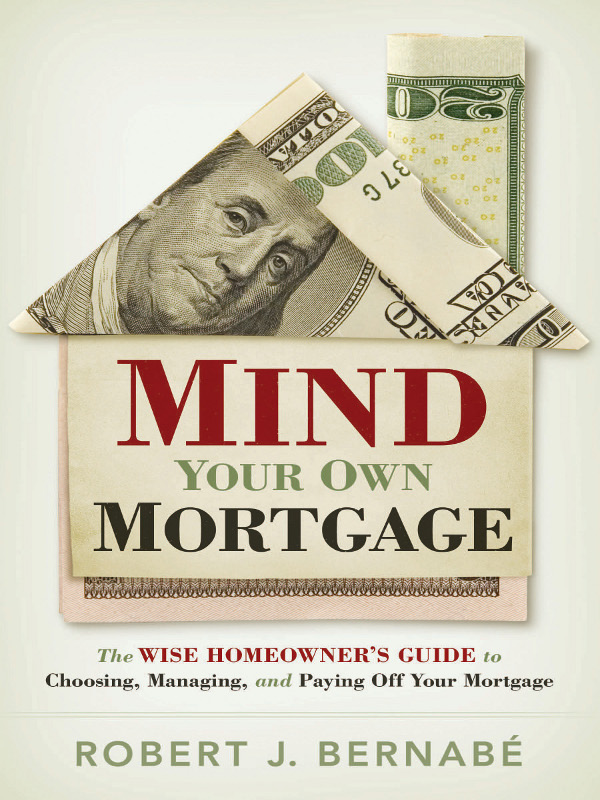

MIND

YOUR OWN

MORTGAGE

MIND

YOUR OWN

MORTGAGE

TheWISE HOME OWNERS GUIDEto

Choosing, Managing,andPaying Off Your Mortgage

Robert J. Bernab

2010 by Robert J. Bernab.

All rights reserved. No portion of this book may be reproduced, stored in a retrieval system, or transmitted in any form or by any meanselectronic, mechanical, photocopy, recording, scanning, or otherexcept for brief quotations in critical reviews or articles, without the prior written permission of the publisher.

Published in Nashville, Tennessee, by Thomas Nelson. Thomas Nelson is a registered trademark of Thomas Nelson, Inc.

Published in association with Rosenbaum & Associates Literary Agency, Brentwood, Tennessee.

Thomas Nelson, Inc., titles may be purchased in bulk for educational, business, fund-raising, or sales promotional use. For information, please e-mail SpecialMarkets@ ThomasNelson.com.

Library of Congress Cataloging-in-Publication Data

Bernabe, Robert, 1960

Mind your own mortgage : the wise home owners guide to choosing, managing, and paying off your mortgage / Robert Bernabe.

p. cm.

ISBN 978-1-59555-088-0

1. Mortgage loansUnited States. 2. House buyingUnited States. I. Title.

HG2040.5.U5B475 2010

332.7'20973dc22 2010000221

Printed in the United States of America

10 11 12 13 14 RRD 5 4 3 2 1

To my beautiful wife, whose faith and dedication to our family inspires me on a daily basis. I love you, honey! I thank God for granting me the honor to marry his daughter.

To anyone across America who recognizes their mortgage can make or break their financial dreamsand those who dont. This book was written expressly for you. If you absorb the content and put it into practice, you will discover a whole new way to manage your mortgage debt and gain new perspectives. Youll have the tools you need to take control and youll be well on your way to that glorious day of being mortgage free.

To all those who have the courage to say no to excess consumerism and are ready to live a better life. You will build a strong household economy and together we will build a strong American economy.

CONTENTS

The New Deal

S imple, clear, and straightforward.

Wouldnt it be nice if the word mortgage brought these terms to mind?

If you feel helpless when it comes to shopping for a mortgage, you are not alone. Buying a mortgage isnt like finding the cheapest gallon of gas in town. You cant look at the sign on the mortgage storefront and make a determination. You have to walk inside the store and give up a pile of personal information. And what do you get in return? Instead of a simple quote, you are presented with a complicated list of fees and charges and confusing interest rate options. Its hard enough to extract information from one lender try checking out more than one. Go aheadwalk inside each shop to obtain your quotes and then go figure out whos got the best deal. Thats nearly impossible!

Think about this: money is a commodity. Mortgages are made of money. Isnt commodity pricing supposed to be simple? Is there any difference between a thirty-year fixed-rate mortgage from one lender to the next? There isnt. And correspondingly, that thirty-year mortgage is priced as a commodity throughout the entire supply chain... until it reaches you. Then things become convoluted to the point of being contrary to what they should be. Why, if things were the way they should be, mortgage companies would be forced to become transparent and compete on price. Heres the bottom line: simple, clear, and complete price information is purposely withheld to prevent a market where consumers can easily determine the best deal.

But in your hands lies a shopping system that will allow you to obtain the necessary information, so you can make the best choice the next time around. You are going to force commodity pricing so you can determine who has the best deal. Youre going to shop for your mortgage like its a gallon of gas!

Next page