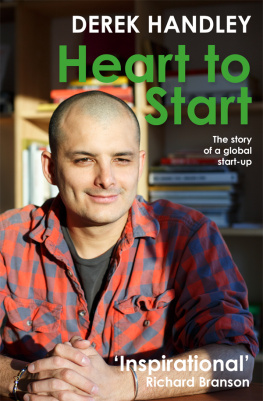

The true story of how young entrepreneur Derek Handley conceived big ideas in New Zealand and launched them into the world through a series of electric highs and crushing lows, before discovering what he was really put here to do. Heart to Start also includes a practical field guide to shaping your life dreams and goals and turning them into reality.

If youve always wanted to start something bold a business, an idea, a dream but could never quite take the first step, this book shares with you how it can be done and what it really takes.

If youve ever asked yourself Is this really what Im meant to be doing with my life? then you might find inspiration in this story of everything Ive risked and returned, lost and won, failed and fought for to ultimately find my purpose.

I dont remember exactly when, but at some point I decided to give the year away. Kind of like how you give old clothes to the Salvation Army, or how you give money in those little envelopes you send off to a charity. In Brooklyn, New York, its kind of like how you leave things on the stoop outside your home for people to pick up if they can make better use of them than you. Just like that, except I was giving one year of my life to causes and ideas that would move and inspire me enough to make a gift of my time and skills, to do whatever I could to help make something important happen.

Richard Branson and I were sitting on the couch together in the Temple House perched on the highest point of his home, Necker Island in the Caribbean. We each had a wine and I opened up about my idea of what I wanted to do next for advice as much as anything. I shared that Id tried a lot of things some worked, some didnt and eventually Id ended up financially OK out of my series of entrepreneurial adventures. But it wasnt nearly enough. I wanted to start a totally new journey worlds away from the one I knew.

I dont want to just start another company. I dont want to start a business that doesnt, in some fundamental way, contribute to the greater good of humanity. I feel a new wave of thinking about to wash over us that, as entrepreneurs, as dreamers and builders, we can do well for ourselves by doing good for the world. For me, the next year is a new chapter its a new journey to understand what this all looks like, to learn about what it all means before I get back out there and start again. So Ive decided I want to give the year away. To be a student. To eliminate all possible barriers and excuses to seeing things with new eyes.

Id read and heard about people I loved and admired who lived in service of humanity their whole lives, and decided that, for just one year, I was willing to try it out. A donation of a year, a year of service, to people who were hatching plans at the intersection of doing good and doing well. We would work together to try to create something extraordinary. That was the idea at least. And for months now, it had been the plan but I had never planned on giving all that time to just one person.

You read my book, and Ill give you a year of my life.

Done.

We knocked our glasses together. Id just struck my biggest deal ever on a handshake with Richard, and Id given it all away. No negotiating, no pushing, no horse-trading. No price, no special terms, no contract. Just one year, for one read. That was all I was asking for the simplest pact I had ever made. As long as the problem was big enough, the cause was bold enough and I loved the idea enough the year was his to work with. The token gesture I wanted in return was for him to read a book Id just written to get his thoughts on the things I believed in. The things I learned through this story. The things Id learned through living whats in this book. The things youre about to read.

I had just over a million dollars riding on a handful of shares, frothing at the brim with debt. Both the investments and I were resting on a knife-edge. My target: to make $100,000 for myself and a lot more for my partners. Why $100,000? Because it sounded round and even with a ring of freedom, and it was enough to start my own business to do things how I wanted to do them. I was 22.

Sweating it out in a small Melbourne apartment in October 2000, we were visiting my girlfriend Mayas cousins and there I was, pretending to enjoy a holiday knowing that our financial future was hanging by a thread before wed barely begun. As the share prices started slipping I knew something was up, I just didnt know what.

I could have sold the ones that I had risked the most on, Fletcher Challenge Forests, for more than 90 cents a share just a few weeks earlier while rumours were flying of a lucrative takeover of the company. I would have done well, repaid all my debts and student loans and been left with $60,000 or $70,000. For somebody who had just started his first job at an after-tax salary of about $20,000 a year, that should have seemed all right.

But no. $100,000 that was the figure. At a buck a share Id sell and maybe I thought they were worth that. I had borrowed heavily, paying around 13 per cent interest, and every day that dragged on ate into my potential profits. I held on.

On 3 October the share price was not at its peak, but was still a respectable 80 cents. Just three days later it had tumbled to 72 cents, as people in the know seemed to think the takeover wouldnt happen. I still held on.

Then day after day, as the mystery of when the company was going to say something about its future became too much to bear for investors, the shares started to fall off a cliff. Without a lot of time to think, I started unloading chunks at 60 cents, 58 cents, 56 cents to hedge my losses to a break-even position until I was left with just over half my original holding. Hoping for a turnaround with the remainder, I still held on.

At this point I was still in control if Id quit right then I wouldnt have had a dollar to my name but that would have been the worst of it.

The next week we returned to Auckland. On 10 October the directors of the Fletcher Challenge Group announced the details for the breakup of the conglomerate and any hope went up in smoke. The energy division, in which I had the fewest shares, had the best outcome, being taken over by Shell for a huge premium over the price the shares last traded at; the building division was to be separated from the group and made independent because it was the strongest business; and after all the months of speculation of being taken over by one of the many parties swirling around like vultures, the directors stunned the market by confirming that nobody wanted to buy Fletcher Forests Limited. In what I thought was just a panic, the shares immediately plunged to 50 cents and the seven figures in my investment portfolio sharply turned into six. Still I held on.