Berrett-Koehler and the BK logo are registered trademarks of Berrett-Koehler Publishers, Inc.

Copyediting: Elissa Rabellino. Design: Richard Wilson. Index: Rachel Rice. Jacket design: Mark van Bronkhorst. Proofreading: Debra Gates.

For my father, Sam Karger, zl.

May his memory be a blessing for us all.

Preface

Shortly after starting to work on Shortchanged, I visited a buy here, pay here used-car lot in Houston, Texas. Dressed in blue jeans, a T-shirt, and a baseball cap, I went to the lot to get a feel for how the system worked. The salesman showed me the typical overpriced $3,000$5,000 used cars that were slightly sporty, with high mileage and interiors that had obviously hosted a few parties. Even the cleaner cars had hardened cola spills, cigarette holes in the seats, and a musty smell reminiscent of smoke and fast-food burgers. I popped hoods, kicked tires, and tried to be enthusiastic about my dire need for a vehicle.

The salesman was affable until I asked about financing. Its only $60 a week, he said, pretty good for a car like this.

I nodded and then mistakenly asked, Whats the interest rate? The negotiations chilled as the salesman turned his back and walked away. I followed him, asking why I was suddenly getting the cold shoulder.

I dont know who you are, but I know youre bullshitting me.

Sheepishly I asked, How do you know?

None of my customers ever ask about interest rates. All they care about is how much they gotta pay each week. In a nutshell, thats how the fringe economy works.

For many years, I included a small amount of material on the fringe economy as part of my graduate course in social policy. Although I understood the general concept of the fringe economy, I wasnt fully aware of the details.

About five years ago, I arrived early for a dinner at a restaurant in a small, run-down Houston strip mall. With almost an hour to kill, I stopped in at a check-cashing outlet and browsed through the leaflets. Since it was tax season, many brochures advertised instant tax refunds. Being the only customer, I asked the clerk how these refunds worked. Through a small hole in the bulletproof glass we chatted about tax refunds, check cashing, and payday loans. After hearing the details I was taken aback. While I understood the economics of higher risk and higher cost, the abuse of unregulated market power in regard to the economically fragile angered and dismayed me. I had always known that the poor got a raw deal in the fringe economy; I just hadnt realized how bad it really was.

Throughout the dinner my feelings alternated between outrage and relief. As a tenured college professor, I felt relieved that Id never descend into that economic abyss. But, like much of the middle class, I had in the back of my mind that nagging what if? I knew that only a few shaky rungs separated me from the bottom of the economic ladder. Perhaps Id knock the rungs out myself, or maybe theyd break because of events I couldnt control. This brief encounter led to my journey into the dark underbelly of Americas fringe economy.

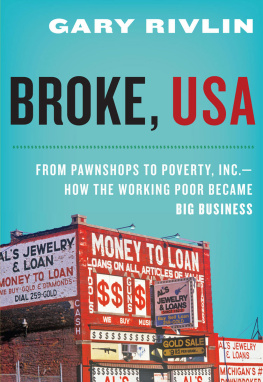

The first question Im often asked is, Whats the fringe economy? In the context of Shortchanged, I use fringe economy to refer to corporations and business practices that have a predatory relationship with the poor by charging excessive interest rates or fees, or exorbitant prices for goods or services. While some consumer groups use the term alternative financial services sector, I prefer fringe economy, because it better addresses the marginality of this economy and many of its customers.

After I list the visible parts of this economypayday lenders, check cashers, rent-to-own stores, buy here, pay here used-car lots, tax refund lenders, and so forthmost people know what Im talking about. But, as the book illustrates, these businesses are only the tip of a complex financial structure that engulfs virtually every area where people borrow, spend money, or purchase goods and services. At this point, a caveat is necessary. Some financial institutions that serve the poorespecially those in the nonprofit sectorare nonpredatory and are doing a remarkable job. Most for-profit businesses are not.

Despite its bland storefronts, the fringe economy is not composed primarily of family-run pawnshops, payday lenders, and check cashers. On the contrary, its an industry increasingly dominated by a handful of large, well-financed national and multinational corporations with strong ties to mainstream financial institutions. Its also a comprehensive, mature, and fully formed parallel economy that addresses the financial needs of the poor and credit-challenged in much the same way as the mainstream economy meets the needs of the middle class. The main difference is the exorbitant interest rates and fees and the onerous loan terms that mark fringe economy transactions.

I had several goals in writing this book. My first was to shed light into this dark and shadowy sector of the American economy. Paradoxically, while the fringe economy is everywhere, it is hidden from public view. For instance, weve all passed the throngs of pawnshops, check cashers, payday lenders, rent-to-own stores, tax refund lenders, and buy here, pay here car lots that are increasingly populating Americas cities and towns. While some of us have used these services, most of us dont really know what happens there. For others, fringe economy storefronts are like porn shops. We dont exactly know what goes on inside, but were pretty sure its unwholesome. As Shortchanged illustrates, this intuition is correcttheres indeed something seedy going on in most parts of the fringe economy. Behind this seediness are economic transactions marked by desperation and exploitation. Its a hidden world where a customers economic fate is sealed with a handshake, a smile, and fine-print documents that would befuddle many attorneys.