Acknowledgements

We wish to thank the following people for their advice, support, kindness, and talents: Emily Ray Ryan, Jacob Thro, Dennis Thro, Megan Dimit, Dustin Dimit, Sydney Tucker, Andrew Tucker, Jack Ryan, Nick Ryan, Gabriel Ryan, Lynne Parrish, Kelsie Parrish, Stacy Ryan, and Gayle Baker.

Pay Less for College: The Must-Have Guide to Affording Your Degree

2023 Edition

Written by Elizabeth Walter and Debra Thro

2022 College Admissions HQ

https://collegeadmissionshq.org

All rights reserved. No portion of this book may be reproduced or transmitted in any form, electronic or mechanical, with the exception of worksheets found in for any other permissions.

ISBN: 978-1-7356029-8-1

Introduction

Paying for College Shouldnt Be Harder than Going to College

College is really expensive and a great many students and parents struggle to pay for it.

There is a growing awareness that financial aid know-how is critical to avoid drowning in college costs. The problem is, the resulting financial aid conversations typically offer little in the way of know-how, arming students and parents with only the most basic tools with which to tackle this challenge.

The usual financial aid advice, file the FAFSA, use Net Price calculators, and apply for scholarships, provides a false sense of confidence that this is all you need to know to get the best financial aid.

And every spring, when financial aid letters arrive, countless families are blindsided by the amount of money they must come up with. They thought they did all the right thingshow could this have happened? This late in the game, with little recourse, many turn to unwise choices such as taking out large student loans, raiding a retirement fund, sucking equity out of their home, or, tragically, maxing out credit cards to pay for college.

What they needed was a realistic expectation of what any college of interest would cost them, before they even applied. This is a familys best defense.

People dont know what they dont know. And what those families didnt know about college financial aid cost them thousands, even tens of thousands of dollars. You dont have to be one of them.

Your Road to Success

Paying for college is difficult. But its easy to wise up and confidently navigate a path that is consistent with your needs, resources, goals, and values.

- You can get a close estimate of what any college of interest will cost you before you even apply.

- You can save hundreds of dollars and a tremendous amount of time and effort in wasted application costs for colleges that wont give you the financial result you want.

- You can avoid painful surprises when financial aid packages arrive.

- You can save thousands, even tens of thousands of dollars in overall college costs.

- You can plan ahead for the college costs you will likely be responsible for at each college you apply to.

You can do this.

This Book Is Your Guide

The information and insights presented in this book offer true financial aid know-how and the power to save real money.

Chapters 1 and 2 boil down what you really need to know about college costs, Net Price, EFC, types of financial aid, and how to access aid.

Chapter 3 opens your eyes to the hard truth of how colleges build financial aid packages and what meeting need truly means.

Chapters 4, 5, and 6 help you discover sensible ways to seriously reduce the cost of your degree.

Chapter 7 guides families through a meaningful conversation to be sure everyone is on the same page about who is responsible to pay what college costs, and how and when those costs will be paid.

Chapter 8 prepares you for the many changes to the FAFSA and financial aid that will begin in the 2024-25 school year. These changes are intended to make financial aid easier to access, increase funding to the neediest students, and allow more leeway for financial aid officers to adjust financial aid packages.

The five Appendices provide detailed supporting information and resources for those who want to dig a little deeper. They include Links and Resources, a Financial Aid Glossary, and thorough guides to the FAFSA, the CSS Profile, the EFC (Expected Family Contribution), and financial aid when parents are divorced, separated, unmarried, or remarried.

Youve Come to the Right Place

Although the college financial aid system can feel intimidating, you can take control of it and we can help you. For 11 years we have been dedicated to helping students and parents get the college admissions process right and achieve much better results. We are American School Counselor Association (ASCA) certified College Admissions Specialists, members of Pennsylvania Association for College Admission Counseling (PACAC), and founders of College Admissions HQ, https://collegeadmissionshq.org. Visit us online for more college admissions tools, resources, and information.

The Cost of Attendance

The published sticker price to attend any college or university is called the Cost of Attendance, or COA.

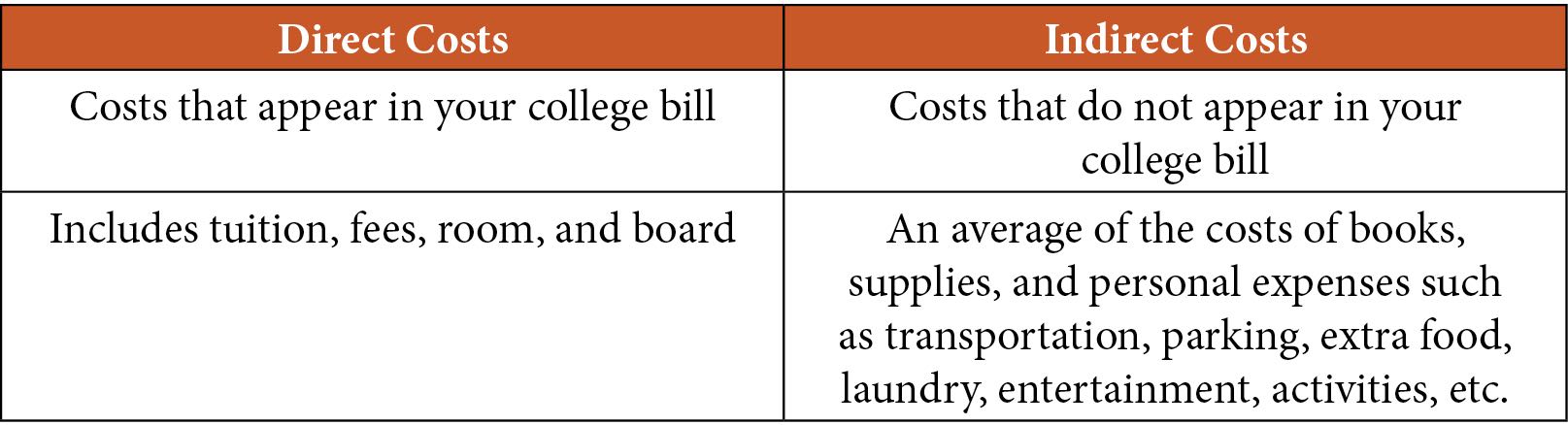

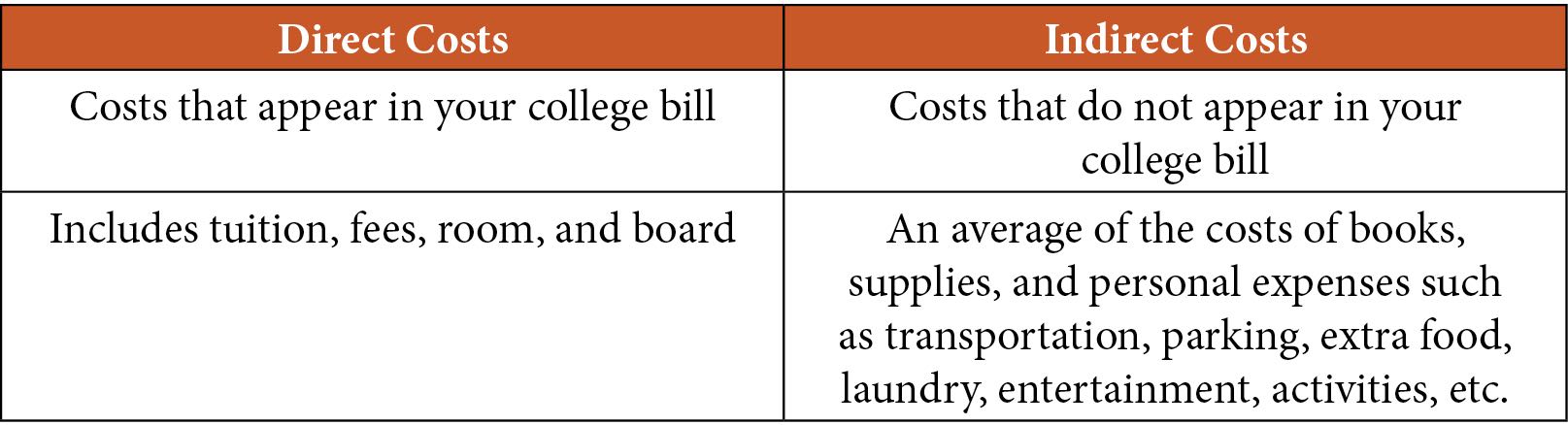

The COA Includes Both Direct and Indirect Costs

2022 College Admissions HQ

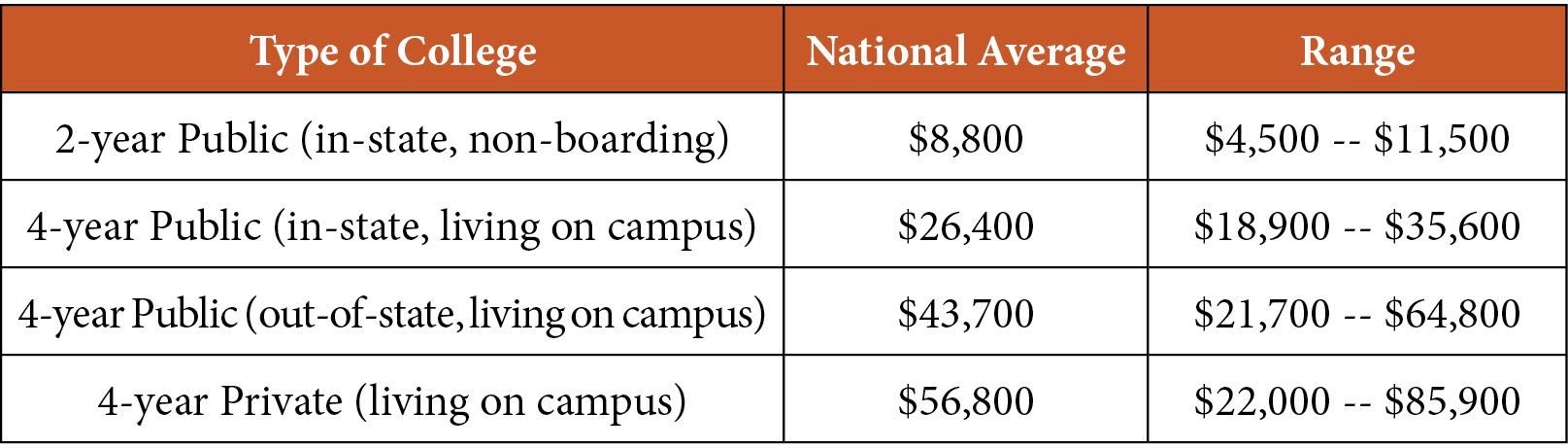

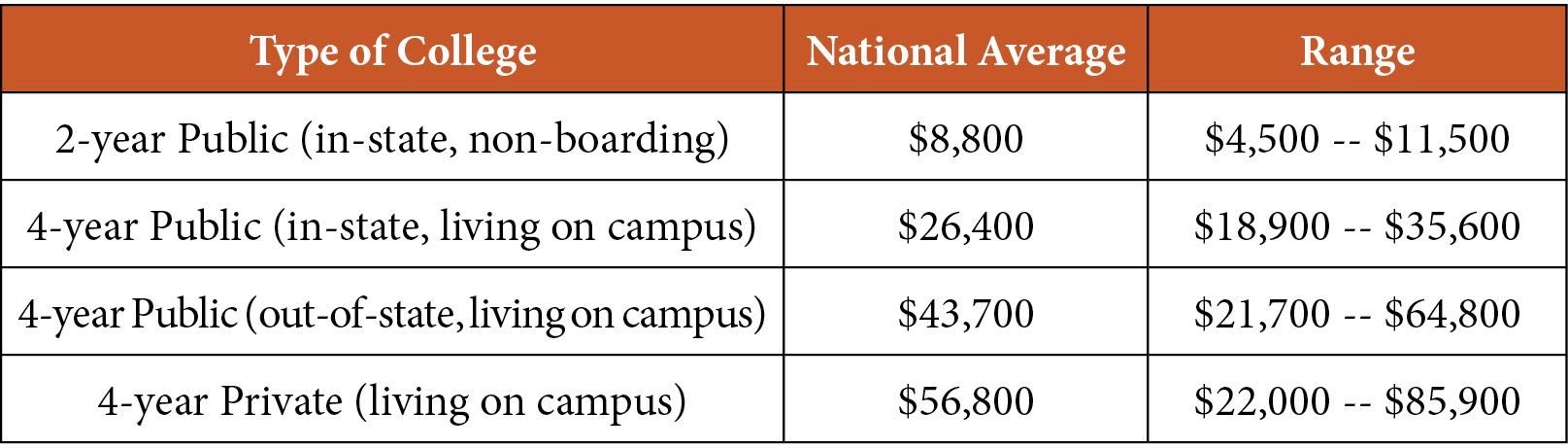

COAs vary widely between different types of colleges as detailed in this table:

2022-23 Total Annual COA for Full Time Students

2022 College Admissions HQ

Its Your Net Price That Matters

Dont be fooled by the COA when shopping for colleges. COAs are sticker prices, and while you may end up paying the sticker price (especially at less expensive colleges), most students do not pay full price (especially at very expensive private colleges). Its your Net Price (the cost you actually pay to attend) that really matters. Net Price includes what you pay now, and what you borrow and pay over time with interest.

Simply stated, your Net Price is the colleges COA minus any free money (grants, scholarships, and discounts) you are awarded.

Your Net Price will be different at different schools because each college has its own COA. In addition, the amount of free money colleges award is both different between colleges and different between students attending the same college.

Net Price Begins with Your EFC

EFC, or Expected Family Contribution, is the minimum amount of money your family is expected to pay each year towards the COA.

EFC is determined each year by financial aid formulas that assess both parent and student income and assets as reported on the FAFSA. Most families are surprised by how large their EFC is because they cant possibly pay that much money each year toward college. Unfortunately, the EFC is calculated to reflect not only what you can pay now, but also what you can borrow and pay over time. Borrowing to meet the EFC contributes heavily to overall student and parent education debt.

Next page