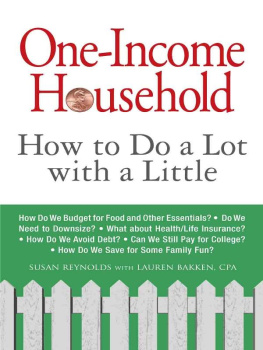

One-Income

Household

How to Do a Lot

with a Little

SUSAN REYNOLDS WITH LAUREN BAKKEN, CPA

Avon, Massachusetts

We dedicate this book to all the families who struggle to live on one income in todays world. As two single mothers who raised children on their own for many years, we know the obstacles one-income families face, and we have both empathy for those who struggle and admiration for those who navigate the waters successfully. Yes, you can live on one income!

Copyright 2009 by Susan Reynolds

All rights reserved.

This book, or parts thereof, may not be reproduced in any form without permission from the publisher; exceptions are made for brief excerpts used in published reviews.

Published by Adams Business,

an imprint of Adams Media, a division of F+W Media, Inc.

57 Littlefield Street, Avon, MA 02322. U.S.A.

www.adamsmedia.com

ISBN 10: 1-60550-133-6

ISBN 13: 978-1-60550-133-8

eISBN: 978-1-44051-977-2

Printed in the United States of America.

J I H G F E D C B A

Library of Congress Cataloging-in-Publication Data

is available from the publisher.

This publication is designed to provide accurate and authoritative information with regard to the subject matter covered. It is sold with the understanding that the publisher is not engaged in rendering legal, accounting, or other professional advice. If legal advice or other expert assistance is required, the services of a competent professional person should be sought.

From a Declaration of Principles jointly adopted by a Committee of the

American Bar Association and a Committee of Publishers and Associations

Many of the designations used by manufacturers and sellers to distinguish their product are claimed as trademarks. Where those designations appear in this book and Adams Media was aware of a trademark claim, the designations have been printed with initial capital letters.

This book is available at quantity discounts for bulk purchases.

For information, please call 1-800-289-0963.

Contents

Chapter One

The One-Income Dilemma

Chapter Two

Facing Reality

Chapter Three

Adjusting Your Attitude

Chapter Four

Making a Plan

Chapter Five

Digging Out

Chapter Six

Making Housing Decisions

Chapter Seven

Avoiding Foreclosure

Chapter Eight

Funding College

Chapter Nine

Navigating Health, Life, and Disability Insurance

Chapter Ten

Navigating Home, Car, and Mortgage Insurance

Chapter Eleven

Maximizing Tax Breaks

Chapter Twelve

Mining Your Resources

Chapter Thirteen

Living Frugally

Acknowledgments

We would like to thank Paula Munier, director of innovation and acquisitions; Chelsea King, our enthusiastic editor; Katie Corcoran Lytle, project manager; and everyone at Adams Media who helped this book come to fruition. Adams Media is a company that prides itself on providing books that delve deeply into complicated topics, with the primary motivation to provide genuine service to its readersand we admire that!

Introduction

While the vast majority of middle-class American households survive on two incomes, many also live on or, at the very least, experience a period when they choose or are forced to pare down to one income. In most dual-income situations, a couple decides to have children and commits to a period of time during which one parent provides full-time care. But one of the incomes can also be lost in other ways layoffs, permanent loss of a job, relocation, health problems, divorce, the necessity of caring for an elderly parent, or family lifestyle choices. Whether or not a family has the luxury of choice, transitioning from two incomes to one creates a tangible financial challenge. Oftentimes, because couples are unaware of the real costs involved, they dont even bother to lay everything out on paper or make a plan, creating a rocky rather than a smooth transition. Relying on a vague idea or having fuzzy expectations only leads to a rude awakening. Reality often falls far short of what they thought it would be like to live on one income, leading many couples down to path to financial debacle.

One-Income Household offers concrete, easily understood financial advice and a wealth of ideas on how to survive on one income and how to transition from two incomes to one. It deals with realistic middle-class scenarios, including guidelines and worksheets tailored to really help you construct a realistic assessment of your situation, and creates a workable plan that meets your needs, protects your assets, and builds for your futureand those of your children. We provide budgeting guidelines and warnings about the pitfalls and common traps, as well as tips for ways to stay on target and save money. The book addresses individuals and families who live on one income, including those who are planning for this transition and those who are surprised by a turn of events. The advice is tailored for the laymaneasy to understand, in plain and simple terms, with the upbeat attitude of you can do it. Because you can!

The One-Income Dilemma

Chapter One

When a Divorce Plummets You into One-Income Status When a Stay-at-Home Mom Overspends When a Wife Is Caught Unaware When a Relative Becomes Ill When Its a Lifestyle Choice When a Job Suddenly Goes Away Facing the Challenge

ITS NOT EASY for a couple with a combined income of $83,000 a year, making payments on a two-bedroom house in the suburbsas well as payments on two cars, furniture, and college loansto pare down to one income. Its hard enough to make those ends meet, let alone be able to afford the additional expenses that come with children, such as college funds and added insurance. Its a rude awakening when $83,000 drops to $45,000or less. Many couples are caught completely unaware of the real costs and how drastically their lifestyle will change.

Even if staying home with the children is not the deciding factor, many families lose one income when layoffs or job loss occur, a job change requires relocation, one partner becomes ill, or a child or an elderly parent needs full-time care. Its not uncommon for families to coast along thinking that they are fine, but things can go wrong. It can happen in a flashto anyone.

When a Divorce Plummets You into One-Income Status

Prior to marriage, Jennifer had worked as journalist, earning approximately $25,000 a year. When she married Edwin, he was making approximately $50,000 a year. Not long after they married, Edwin launched his own sales corporation and landed a hot line that boosted his income to as much as $300,000 a year for several years in a row. After the birth of their first child, a mere year after they married, Jennifer surrendered her full-time job and contributed to the family finances primarily through freelance work, which was unpredictable and provided income for little more than child care and clothing. After the birth of their second child, Jennifer rarely worked, except to assist Edwin, for which she did not receive a salary. Nine years later, they had two children under the age of eight and owned a $400,000 home (with $100,000 in equity) in a very upscale neighborhood.

Edwins corporation had allowed him to determine and pay his own salary. It also allowed him and Jennifer to amass retirement funds (pre-tax) and to deduct many business expenses, such as travel, entertaining, and the costs of maintaining a home office (also pre-tax). Although they werent set for life, everything looked rosy. All of the familys needs were methealth care, dental care, clothing, housing, transportation, and entertainment.

Next page