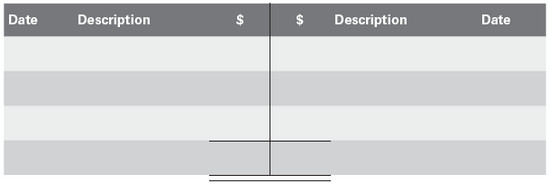

D ouble-entry bookkeeping (bookkeeping, for short) is best taught through t-accounts; named thus because of their shape. T-accounts have a left side and a right side. Hereafter these will be referred to as the DEBIT side and the CREDIT side. This links back to the golden rule of accounting: that every debit must have an equal and opposite credit otherwise your ledgers would not balance.

Over the next few pages we will walk you through each of the Mobius Inc examples, completing the t-accounts as we go.

Bookkeeping comes naturally to a small number of people, but to the majority, however, this is something which needs to be practised and given careful consideration. Regardless of whether you get it within five minutes or five years, for almost everyone there is a light-bulb moment where everything clicks into place and you reflect uncomprehendingly on the times you couldnt see how it worked.

Approaching double-entry bookkeeping

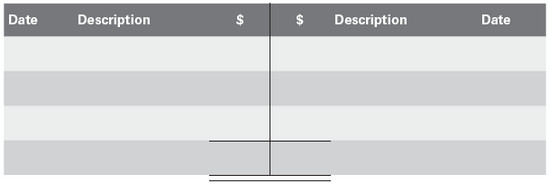

Step 1: Set up your t-accounts

A t-account captures the key information about a transaction:

For example, our first transaction involves two t-accounts: cash at bank and in hand; and share capital. The cash at bank and in hand t-account would appear as shown in .

Table A.1 Cash at bank and in hand

Note that there the $ or value columns need to be totalled. That is because each t-account needs to balance out at the end of the period of account:

- On the one hand, statement of financial position balances, for example cash at bank and in hand dont stop existing at the end of a period and therefore the amounts left over can be carried forward to the next period.

- On the other hand, income statement accounts, for example rental costs, relate to a period of account and once they have been incurred and paid, they should be closed out.

More on this later

Step 2: Write out your journal entry

Certainly, while youre in the initial learning stages of bookkeeping it is good practice to write out every journal entry. As you progress, you might stop doing this. Note, however, that if you dont write out the entry in full and you make an error (eg a transposition error, post two debits instead of a debit and credit, miss one side of the transaction), tracing the error back is more difficult.

The question states:

Mobius Inc (1)

On day 1, you opt to put financial distance between you and the trading entity and transfer $1,000 from your personal bank account to a bank account you hold in the name of the new enterprise Mobius Inc.

The journal entry is as follows:

$ | $ |

Debit | Cash at bank and in hand | 1,000 |

Credit | Share capital: equity and reserves | 1,000 |

Useful tip

People who struggle with double-entry bookkeeping often dont understand the relevance of posting an entry as either a debit or a credit. The interconnectedness of position and performance provides the clue that we need. The grid below might help you to understand.

First, however, remember the accounting equation:

Assets MINUS Liabilities EQUALS Equity + Reserves

(Assets Liabilities = Equity and Reserves)

For this equation to work, an increase in assets would necessarily lead to either:

- a decrease in another asset;

- an increase in liabilities; or

- an increase in equity and reserves.

Examples might be:

- a decrease in another asset, eg swapping cash for inventory;

- an increase in liabilities, eg buying inventory on credit from a supplier;

- an increase in equity and reserves, eg selling share capital for cash.

To continue

We know that the profit is taken to equity and reserves to close it out at the end of a period. A simple double entry effecting both the statement of financial position and income statement (ie performance and position) might be:

- An operating expense being paid, eg rent.

- Cash would reduce (decrease in assets) and the rental cost in the income statement would increase.

Assuming this was the only transaction a business undertook during the period of account, at the end of the year this rental expense would be the loss for the period. This balance would be taken to retained earnings (a sub-heading under reserves).

Therefore, our accounting equation holds: a decrease in assets is offset by a decrease in equity and reserves.

The accounting equation tells us that there are two equal and opposite sides to every transaction. This can be summarized as shown in .

Table A.2

Debit | Credit |

Assets and liabilities (excluding equity and reserves) | Assets increase Liabilities decrease (ie positive effect on financial position) | Assets decrease Liabilities increase (ie negative effect on financial position) |

Income statement and Equity and reserves | Expenses increase (Revenue decreases) (ie negative impact on performance; reduce profit) Equity and reserves decrease | Expenses decrease (Revenue increases) (ie positive impact on performance; increase profit) Equity and reserves increase |

Or, in shorthand ().

Table A.3

Debit | Credit |

Assets and liabilities (excluding equity and reserves) | + |

Income statement and Equity and reserves | + |

)

Table A.4

Cash at bank and in hand |

Date | Description | $ | $ | Description | Date |

Day 1 | Initial investment capital | 1,000 |

Share capital |

Date | Description | $ | $ | Description | Date |

1,000 | Bank | Day 1 |

Step 4: Close out the t-accounts

Assuming that this is the only transaction, you now need to move your closing balances to a trial balance and then into the financial statements ().

Table A.5

Cash at bank and in hand |

Date | Description | $ | $ | Description | Date |

Beginning of day 1 | Balance brought forward |

Day 1 | Initial investment capital | 1,000 |

1,000 | Balance carried forward | End of day 1 |

1,000 | 1,000 |

Beginning of day 2 | Balance brought forward | 1,000 |

Share capital |

Date | Description | $ | $ | Description | Date |

Balance brought forward | Beginning of day 1 |

1,000 | Bank | Day 1 |

End of day 1 | Balance carried forward |

Next page