To my husband, Paul, and our sons, David and Brandon.

For all that you have taught me, are teaching me, and will continue to teach me.

I treasure you all.

Professors cant teach it.

Introduction

A Secret No More

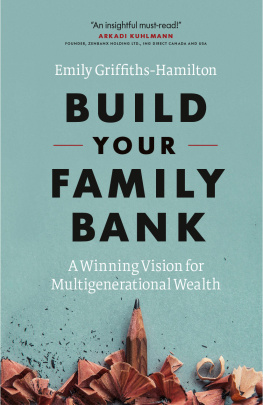

There is no better time than now to unlock the secrets behind successful succession and wealth-transition plans. Through research conducted over the past decade, we have gained new insight into why some families achieve successful multigenerational succession and wealth transitions and why others dont. Well, as Spanish novelist Miguel de Cervantes wrote in Don Quixote, Forewarned, forearmed; to be prepared is half the victory. By reading this book, you will be forewarned about why (and at what rate) most professionally advised succession and wealth-transition plans fail, and then forearmed with a successful solution: the Family Bank approach.

I arrive at the subject of succession and wealth-transition plans with three generations of experience. My maternal grandfather was the veterinarian Dr. William Ballard, one of Canadas greatest success stories in terms of dynamic wealth creation. Beginning in the depths of the Great Depression, he came up with a high-quality formula for dog food and then canned it for easier distribution. Canned dog food may seem like an obvious idea today, but my grandfather was at the forefront of the industry. My grandfather had four children: three daughters, one of whom is my mother, and one son. While he was alive, his financial assets were managed in a way that stewarded them for the benefit of future generations. When he died, the business passed to his son, as was typical of the era, and each daughter was bequeathed liquid assets. My grandfather also established trusts for each of his grandchildren.

My parents, as second-generation inheritors, also became dynamic wealth creators themselves. My father, Frank A. Griffiths, built a successful career in public accounting alongside his father, who was also a chartered accountant. At the same time, my father was building a sports and media empire. He and his partners began with the acquisition of the Vancouver, B.C., radio station CKNW. As the transaction was nearing a close, additional financing was required, and my parents secured that by way of a loan from my grandparents Family Bank. In this way, two elements of what I call the Family Bank approach were set in motion: successful multigenerational wealth transition requires that the familys financial capital be recirculated as loans from the Family Bank, rather than depleted through handouts with no expected repayment, and the need for each generation to work.

I am a third-generation inheritor, not just of financial wealth but more importantly of bedrock values passed down through my family from generation to generation. As the result of a complex corporate restructuring in my family, I received a substantial inheritance in my early thirties, in the form of ownership in a National Hockey League team and a privately owned state-of-the-art arena to which my partners and I added a National Basketball Association franchise. As a young inheritor, I was perhaps better prepared than many to maintain control of my inheritance. My core values, passed down from my family, protected me from foolish expenditures, and I had already undertaken work entirely independent of my family, earning a living as a chartered accountant like my father and grandfather before me. Through my professional training, I acquired the foundational knowledge that protected me from financial incompetence or mismanagement.

Despite this, a cover story entitled The Griffiths Family Saga: Line of Dissent, published in the May 1997 issue of the Financial Post Magazine, suggested that my father had had no succession plan in place when he died in 1994. But as a family insider, I can assure you that my father, a highly successful businessman and professional accountant, had most assuredly put in place a comprehensive succession plan, using the tools available to his generationthe same tools families commonly use today, with the same failed results.

Today, my husband and I are not only the parents of two sons, but also business partners. Our purpose in life, outside of our family, is providing excellent service to our clients. My personal passion involves helping families establish successful succession and wealth-transition plans, drawing on my own personal experience, my professional expertise, as both a chartered accountant (CA) and an Investment Advisor, and what I have learned and assimilated from extensive research compiled over the last decade. To that end, I have made it a goal to read everything on the subject, and use my knowledge to assist others. No family should have to see their name headlined in the national media the way ours was.

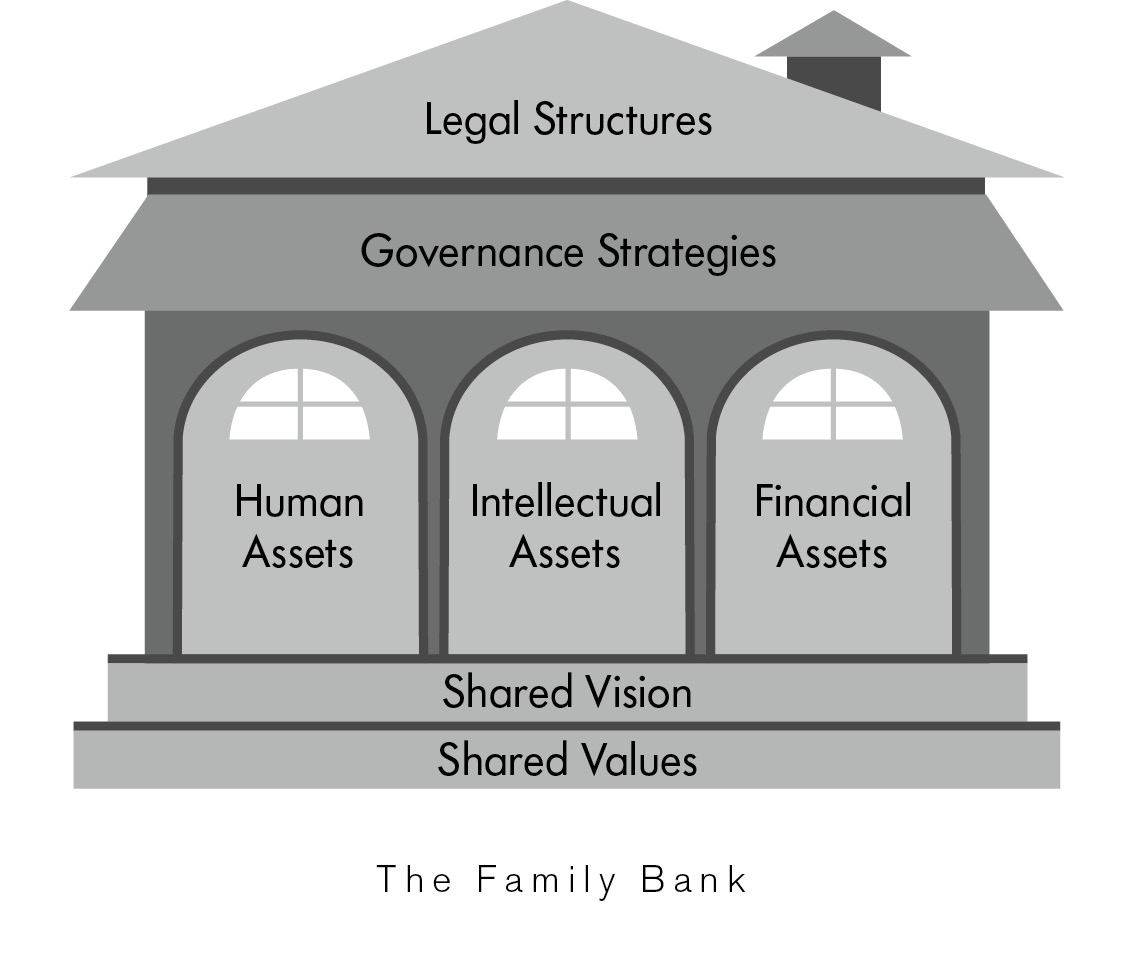

The Family Bank concept is not new. As James E. Hughes Jr. explains in his book Family Wealth: Keeping It in the Family, successful families have been using the Family Bank approach for generations. As Hughes rightly points out, a familys wealth is not limited to its financial assets but includes its arguably more important forms of wealth: its human and intellectual assets. That means a familys total assets are far greater than its financial assets alone. In this sense, you really are much richer than you think.

The Family Bank approach recognizes that the traditional method of succession and wealth-transition planning, which focuses on controlling financial assets and minimizing and deferring taxes, gets the order of the work backwards. The Family Bank approach, in contrast, pays close attention to the human elements of the family, then explores governance strategies and considers legal structures that meet the familys needs.

The failure rate today for succession and wealth-transition plans is an astounding 70 percent. Reading this book, you will learn the primary reasons behind that failure rate and how the Family Bank approach is designed specifically to address them. You will discover how to build your own Family Bank, beginning with the solid foundation of your familys shared values and vision. You will learn how to assess all of your familys assetshuman, intellectual, and financialand how to prepare succeeding generations so they can steward those assets successfully. By implementing these strategies, you will be able to craft a succession and wealth-transition plan that truly meets your needs.

The Family Bank is a dynamic approach to multigenerational wealth transitions that can be implemented at any stage in a familys life cycle. For illustrative purposes, I include general guidelines about how and when you might establish a Family Bank, but creating a framework that will suit your particular situation is what you and your family will do together. My work in succession and wealth-transition planning has shown me time and again that each Family Bank is as unique as each family. Also, adopting this approach is not an all or nothing propositionas you read, you can certainly cherry-pick the information and take away useful tips that resonate with your familys circumstance. Whether you want to implement all of my strategies or only a few is up to you. Practical, concrete, and simply applied, the Family Bank approach unlocks the secrets behind succession and wealth-transition planning, making them accessible to everyone.