Guaranteed Personal Loans

Personal Loans, Unsecured Personal Loans ad Personal Loans Debt Consiladtion

By Martin Sterling

Volume 1

Copyright Martin Sterling 2014

Table Of Contents

Understanding Loans

Loans are a useful way to acquire a particular thing at a time when you dont have the funds for it, whether its buying your own house and lot, getting a new car, or just being able to pay your tuition fee or a hospital bill. One can resort to loans in times of emergency, when you need the money then and there but your resources are depleted and your bank statements dont seem to add up. The question is, why do it in the first place?

Easy. To get money to be able to buy or pay off something you need at the moment.

Take for example Andy and his daughters tuition fee problem. Andy knows that he has to pay his daughter Jills $28,500 tuition every year, but unfortunately, Andys father had a sudden heart attack two weeks before the enrollment period for the fall term. Despite his fathers health insurance, continuing medication at least required Andy to allocate some of his earnings for Jills grandfather as well as to shoulder a portion of the hospital bill amounting to about $3,000. Just like that, he suddenly finds himself short on cash, and unable to pay Jills complete tuition.

Now, Andy has two choices here: first is to magically come up with roughly $15,000-the cost of the tuition for the semester- for Jill; second is not to enroll Jill for the fall semester. Of course, the latter is not an option for the caring Andy. This is where personal loans may serve as an attractive option.

In taking out a loan, Andy likewise has two options: to borrow $15,000 to pay the tuition fee or to borrow $3,000 to pay for the hospital bill. Regardless of what he chooses, Andys problems will be solved at the moment. If he chooses the former option, Andy can pay the hospital bill with his own money as well as Jills tuition fee, but this time using anothers resources. If he chooses the second option, he can use anothers resources to pay the hospital bills and then use his own savings to pay for Jills tuition. Either way, problem solved.

Student Loans

Suppose that Andy resorted to the second option, that is, he borrowed money to pay the $3,000 medical expenses and used his savings to pay Jills tuition. The following semester, however, Andy realizes that the tuition fee payments have taken a toll on his bank statement. Jill suggests that it might be better to borrow funds to cover her tuition fee for the remaining amount of time in school. Jill realized after all that she can pay for her own tuition after college, without having to burden her father with any more financial dilemma at present, especially with his grandfather needing medical sustenance for his heart condition. She decides to confer with university officials who then tell her that she may apply either for a subsidized student loan or for a private loan.

Jill wonders, whats the difference?

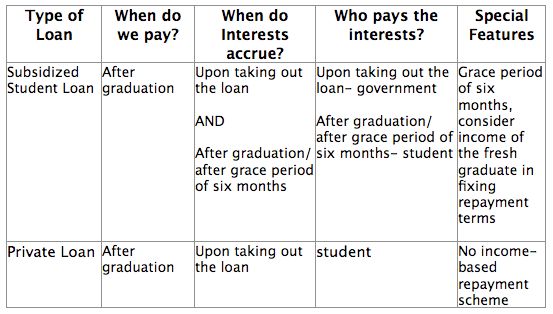

Supposing Jill takes the direct subsidized student loan at the beginning of her junior year in August 2009, Jill starts paying her $28,500 annual tuition fee loan only after graduation, for a total amount of $57,000 plus interests and fees. An advantage of this type of loan is that interest only begins to run once Jill starts working, not while she is still enrolled in the university. Who will then shoulder the interest during the two-year period that Jill is still a student?

Under a direct subsidized student loan with a 4% interest rate, for instance, the education ministry of the government usually shoulders the 4% interest payments during the time Jill is still in school. Some packages also offer a grace period of six months after graduation. This means that the 4% interest payments will still be shouldered by the government not only when Jill is still studying, but even for six months from the time of her graduation from university. This is to give Jill some time to look for a stable job and to adjust her finances accordingly. Moreover, a direct subsidized loan will consider Jills income in fixing repayment terms, such that the amount of installment she has to pay every month is proportioned to her monthly salary.

However, if Jill takes the unsubsidized loan, which is usually offered by private financial institutions, the total amount that Jill would have to pay would cover the period where she started to take out the loan, that is, from the time that she was still a student. This means that apart from the yearly $28,500 tuition fee she receives every year, she will also shoulder the 4% interest payments for the duration of her stay in the university, as well as after. Since Jill obtained the loan during her third year, the total amount of $57,000 representing the tuition fee payment for her two remaining years in the university (otherwise known as the principal amount) as well as the 4% annual interest from her junior year up to the time she completes the payment will be the full repayment value of the loan. If she completes the payment in February 2016, then the 4% interest rate would be proportioned to the February payment, considering that the last payment did not reach the full term, the starting date of which was in August 2009.

The income-based repayment scheme would also not be available, to Jills disappointment.

Car Loans

A year later, Andy decides to buy a car for Jills eighteenth birthday. She has always wanted to get one, but saving up seemed to take a decade (literally). Unfortunately, a car amounts to a couple of months worth of Andys salary, especially with his dads recent heart attack. His savings could not simply accommodate a new expense.

Instead of saving up for the future, Andy decides to borrow money from his bank again, but this time to buy a car for Jill. He realized, why not enjoy a ride in the car now, while putting the portion of his income originally meant to be saved to paying the loan amount he borrowed to buy that car? He goes to the nearest Chevrolet car dealership to check out their latest models. To his pleasant surprise, he finds out that Chevrolet offers car loans for interested buyers. Instead of going to the bank, Andy can make repayments directly to Chevrolet. Three hours later, he comes out of the store holding the keys to a Chevrolet Impala, with an estimated worth of $27,000, and a term of three years to pay and with an annual interest of 3.84%. Jill, euphoric from this birthday surprise from her father, takes him out for a regular drive on Sunday afternoons.

Business Loans

One day, tired from having to deal with the same stressful workweek for every single month, Andy decides to quit his job and open up a diner, just like what Jills mom had dreamed of before cancer took her away. The problem is, Andy does not have enough savings (again) to use as capital and start up his own business. He needs about $10,000 as start-up capital. He decides to talk to his trusty old bank to explore his options. After two-to-three months, the bank gives Andy his much-needed capital to help him set up his diner, on the condition that Andy mortgage his diner as well as all improvements and machinery to it. Andy, seeing that the package only offers a 4% annual interest rate, latches on to the deal. He gets his $10,000, which, after many years, helped him cope with Jill moving out, getting married, and starting her own family. The diner became the favorite hang-out of brooding teenagers and middle-aged couples.

Personal Loans vs Business Loans