Table of Contents

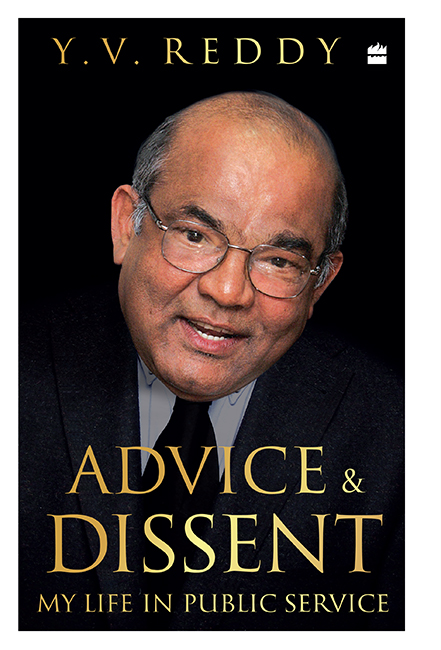

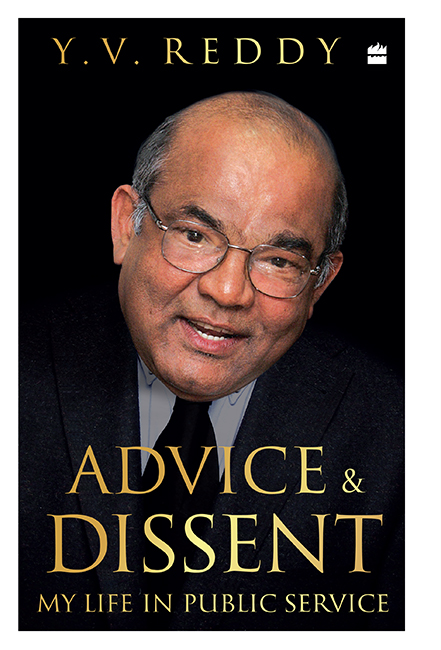

ADVICE

AND

DISSENT

My Life in Public Service

Y.V. REDDY

For my parents,

Ammannamma and Pitchi Reddy Ayya

CONTENTS

THIS BOOK IS THE STORY OF MY LIFE MOSTLY OF MY WORKING life. Why I wrote it is not important. There is no single reason for doing it. Why should someone read it?

Interest was expressed in the story of my life only after I became governor, Reserve Bank of India. Mainly, everyone wanted to know how I became governor. Then, after I retired, many wanted to know about my experiences in that role. But my work as governor cannot be looked at in isolation. Restricting the narrative to that time would not reveal my values, judgements and actions as governor, which result directly from influences that spanned a lifetime and were formed in a particular time in the history of our nation. While a good part of the book relates to my work as governor, it goes beyond, and looks at my life as a whole.

The story begins with my birth in 1941 and our gaining Independence in 1947. It ends with my submitting the report of the Fourteenth Finance Commission in December 2014. It shows how an individual growing up in India has been impacted by the Independence, the integration of princely states, Nehruvian socialism, the re-organisation of states, and the periodic general elections. We faced wars in 1948, 1962, 1965 and 1971. The 70s and 80s were lost decades for our economy since we refused to learn enough either from our own experience or that of others. It required a balance of payments crisis in 1991 to begin economic reforms. In a decade, by the beginning of this century, the profile of India changed. By the end of the story, we are, in many ways, proud of being Indians. The events described in this book, though related to my work life, reflect the transformation of India since Independence. I hope the readers find the nuggets on these transformations, sprinkled in the story of my work life, interesting and amusing.

The book has some unique perspectives.

Most of the autobiographies by central bankers have been written by governors. Surely, others who work with governors also have stories to tell. This book includes my perspectives as someone who assisted governors too.

Among academics and participants in the financial sector, a major area of current debate is the relationship between the government and central banks. It is hard to find the governments version of dealing with the central banks. Since I worked in the government also, and dealt with the RBI, a part of the story relates to this.

To appreciate the progress we have made on the external front to a point where we had to handle problems of plenty, one has to recall the desperation and humiliation we faced at the time of the balance of payments crisis in 1991. Why did we use gold to meet our payment obligations? What were the options? As governor my focus on securing policy independence for India through many measures, particularly the building of adequate forex reserves, cannot be appreciated without understanding the distress that provoked it.

The crisis of 1991 happened for many reasons, political and economic, as well as global and domestic. That our economic policies were unsustainable was known by the mid-80s. This was the period of the New Economic Policy of Rajiv Gandhi a policy that delivered modernisation and growth with borrowed money and borrowed time. A retreat to academia in the late 80s helped me study the New Economic Policy, against the background of the major shifts in theory and practice of development planning. There was a reassessment of the relative roles of the market and the state and an appreciation of the importance of incentives and institutions. It was at this stage that I evolved from an approach rooted in beliefs and ideology to a purposeful, pragmatic and eclectic approach to policy.

My work with the Andhra Pradesh government influenced the priority given by the Reserve Bank to state finances. I drew upon my experience of working with N.T. Rama Rao in my stint as Reserve Bank governor and Finance Commission chairman. NTR had the unique distinction of leading a regional party to the position of the single largest opposition party in Parliament. He initiated a new era in Unionstate relations. More important, the saffron-clad leader who seldom read newspapers pioneered e-governance and popularised information technology in the state. Personalities matter in politics and politics matters in economic policy.

My experiences have been rich and varied. Interactions with political leaders at various levels of government gave me an understanding of their worldview. The lessons I learnt have stayed with me and informed my thinking throughout my career in the Reserve Bank of India. I touch upon these in the first few chapters in the book.

If I were to sum up my overarching approach to central banking, it would be this: Selecting what appears to be best in various doctrines, methods or styles. In other words, it is the art of being eclectic. At the end of the day, the outcomes of my time in the RBI were a governors dream high growth, low inflation most of the time, stable rupee and a robust banking system; not the nightmare of high inflation, low growth, stressed banks and depreciating rupee. I am aware, however, that it would be foolish to claim credit for the achievements in the economy.

I became popular as an ex-governor more than as a governor. How and why did this happen? I have explained the reasons for our being both conservative and innovative in our policies. A governor has to exhibit quiet confidence neither exuberance nor diffidence. He has to often pretend that the Reserve Bank is independent without offending the government. We are not equal to the government but have to convince others that we are not subordinate to it. My work as governor was challenging and at times fascinating. I narrate some of the important and interesting events; but I must maintain a fine balance since I have to respect sensitivities and confidences. As a result, on many occasions, I am less than forthright and frustratingly non-humorous. Making the book technical enough for public policy aficionados and finance specialists while being of interest to the common person was the most difficult part of writing. One tool that was useful in providing important detail without overloading the narrative was the use of end notes. These can be accessed by the interested reader while being safely ignored by everyone else.

In the book, I present my attempts to do what I felt was right and in the best interests of the common person. I hope to provide a sense of context and share the diversity of views and judgements surrounding memorable events. I attempt to give the reader an appreciation of the interaction between individuals, institutions and interests. I do not make any judgements nor do I engage in the game of debits and credits.

People have asked me if there is a life after having been governor. Yes, there is. One can continue in public policy or shift to the private sector. I preferred to avoid both. But, thanks to the global financial crisis, my wisdom was in demand globally, which I enjoyed for a few years. I planned to end my association with finance after giving the Per Jacobsson Lecture in June 2012 titled Society, Economic Policies and the Financial Sector. The title captured my approach to the role of finance in the broader context of economic policies that serve the society. After the lecture, I made another attempt at retiring. Yet, compulsions led me to chair the Fourteenth Finance Commission, which lasted for two years. In this book, I make a reference to my brief association with my work on these unforeseen but unforgettable assignments.