ALSO BY JEFFRY A. FRIEDEN

DEBT, DEVELOPMENT, AND DEMOCRACY: MODERN POLITICAL ECONOMY AND LATIN AMERICA, 19651985

BANKING ON THE WORLD: THE POLITICS OF AMERICAN INTERNATIONAL FINANCE

Copyright 2006 by Jeffry Frieden

All rights reserved

First published as a Norton paperback 2007

For information about permission to reproduce selections from this book, write to Permissions,

W. W. Norton & Company, Inc., 500 Fifth Avenue, New York, NY 10110

Production manager: Julia Druskin

The Library of Congress has cataloged the printed edition as follows:

Frieden, Jeffry A.

Global capitalism : its fall and rise in the twentieth century / Jeffry Frieden. 1st ed.

p. cm.

Includes bibliographical references and index.

ISBN 0-393-05808-5 (hardcover)

1. International economic relationsHistory20th century. 2. CapitalismHistory20th century. 3. GlobalizationEconomic aspectsHistory20th century. 4. International financeHistory20th century. 5. Economic history20th century. I. Title.

HF1359.F735 2006

337'.09'04dc22

2005024357

ISBN 978-0-393-32981-0 pbk.

ISBN 978-0-393-63577-5 e-book

W. W. Norton & Company, Inc., 500 Fifth Avenue, New York, N.Y. 10110

www.wwnorton.com

15 Carlisle Street, London W1D 3BS

Contents

by Paul Kennedy

by Paul Kennedy

Of all the ways in which the twentieth century makes its claim to a special place in history, few can equal in importance the enormous transformation of economic life. Were a farmer in Illinois or a peasant in Bangalore, both struggling to make ends meet around 1900, brought back to our planet today, he would be astounded at its transformation. The massive increases in productivity and wealth, the mind-boggling new technologies, and the improvements in material comforts would have made him speechless. Astonished though he would be, he would not of course have guessed at the many convulsions and setbacks that had occurred to the world economy in the hundred-year interval.

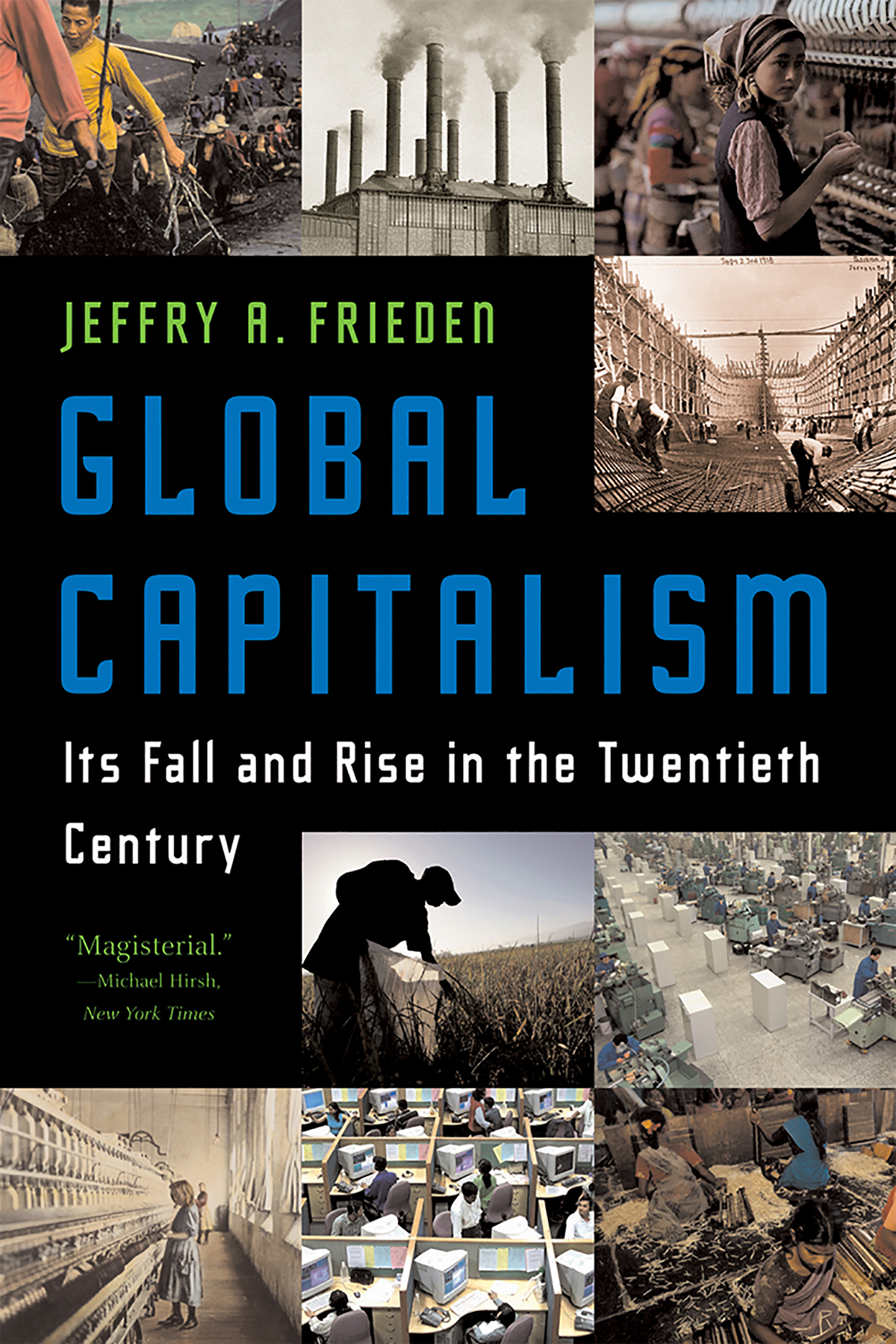

Recording that tale is the task that Professor Jeffry A. Frieden sets himself, with insight and poise and vast learning, in Global Capitalism . This work has a powerful theme that runs right through, thus helping the reader to make sense of the whole; this is not your standard economic history textbook, though it surely will be used in many classes. That theme is captured well in the subtle combination of the title and subtitle of Professor Friedens book: fall and rise, and global capitalism.

At the core lie the creative gales of modern world capitalism (to borrow Joseph Schumpeters famous phrase). Already by the late nineteenth century those gales were blowing across the globe, creating new structures of production, trade, and finance, and battering their predecessors into the ground. They coexisted with contemporary forces of nationalism and militarism that were in their way equally rampant and pervasive. This was an explosive mix, producing in turn the death and destruction of World War One, and the calamitous economic and political reverberations of the succeeding two decades.

It is hard to suggest a single part of Professor Friedens impressive book for special attention, but it seems to me that his discussion of political economies between the two world wars is really wonderful. Here he shows how troubled the capitalist system of free markets and laissez-faire had become, not simply because of its failure to provide sufficient wealth and jobs but also because of the reactions against liberal capitalism in the political realm. With the USSR pushing for socialism in one country, the fascist states practicing a mixture of economic autarky and external aggression, and the United States (by now the worlds greatest power) retreating to the wings of the worlds stage, the old system could not survive. Things fell apart.

They were put together again by the remarkable turnaround in Americas commitment to world affairs following Pearl Harbor, a commitment that was to last throughout the Cold War that followed, and that was of a strongly coeval nature: global capitalism could not survive without the military power and political will of the West, and the latters capacities could only be sustained by the productive successes of the capitalistic system. This time, things held together.

Professor Friedens story is by no means triumphalist, like the accounts offered by conservative, free-market economists of our present day. He is all too awareas were Marx, Schumpeter, and Keynes before himthat capitalism, by its very nature, creates losers as well as winners. His account of the mass unemployment of the 1930s is very sobering, and his analysis (see ) of the African catastrophe of our current times is profoundly depressing. Moreover, he is wise enough to conclude this great survey, not on any supremely confident note, but by asking a number of serious questions about our world economy as it lurches through the first decade of the twenty-first century. In consequence, the reader comes away from this book not only impressed by its display of knowledge and judgment but also somewhat disturbed by the prospects for the world of commerce, finance, and markets that lie ahead. And it is surely right for us to put down this text in a mood of deep reflection. Schumpeters creative gales are not yet finished, and it is the merit of Global Capitalism to have reminded us that our system of economic exchange comes with its perils as well as its manifold benefits.

National economies are more open to one another than ever before. With international trade at an unprecedented level, much of what people consume is imported and much of what they produce is exported. Businesses send huge quantities of capital to other nations; in some countries as much as half of all investment is made abroad. Millions of people migrate yearly in search of jobs. Manufacturers, farmers, miners, bankers, and traders must think globally about every economic decision they face. Technologies, artistic movements, business practices, musical trends, and fads and fashions reach all corners of the developed world almost instantaneously. Global economy and culture form a nearly seamless web in which national boundaries are increasingly irrelevant to trade, investment, finance, and other economic activity.

Many people now regard globalization as inevitable and irreversible. After decades of international economic integration, people in the worlds economic centers think of global capitalism as the normal state of things, certain to continue into the foreseeable future and perhaps forever.

The situation at the turn of the twentieth century looked remarkably similar. In the early 1900s international economic integration was largely taken for granted. It had been the norm for the worlds economic leader, the United Kingdom, for sixty years, and for the worlds other major industrial and agricultural nations for about forty years. Open trade relations, international finance, untrammeled international investment and immigration, and a common monetary order under the gold standard had been the central organizing principles of the modern world for generations.

But it took only a few months for the entire edifice of globalization to collapse. World War One broke out in August 1914 and swept away the foundations of the preexisting global economic order. For years world economic and political leaders attempted, without success, to restore the pre-1914 international economy. The international order disintegrated and imploded brutally into the Great Depression of the 1930s and World War Two.

Next page