A BOOK LIKE THIS is an effort of many years and is based on discussions and arguments with many people from many countries and backgrounds. My thanks to everyone who took the time to listen and debate what is happening in the global economy with me, challenging me to sharpen my arguments and in many cases to reflect on what I was really trying to say. Over the years Tim, Eoin and James have been patient, supportive and encouraging in equal measure.

My U.K. agent, Sally Holloway, has been a calm and very wise guide as weve journeyed from the initial idea in her office in Oxford, through proposal and on to the final version of the book. Similarly, Andrew Franklin and his team at Profile Books in London have been great to work with, my thanks to them for taking on the project. On the other side of the Atlantic Zoe Pagnamenta has provided patient counsel and Erroll McDonald at Pantheon has been a wonderful supporter of the book from start to finish.

None of this would be possible without the support of my extended family (Jim, Mary, Rick, Joanna, Tim, Emily, Johanna, Rob, Sheila and Andrew). Most of all, though, this is possible because of Charlotte and our children, who have to put up with long mental if not physical absences when the writing takes over. My love and thanks to her and the littles.

1

Go East, Young Man?

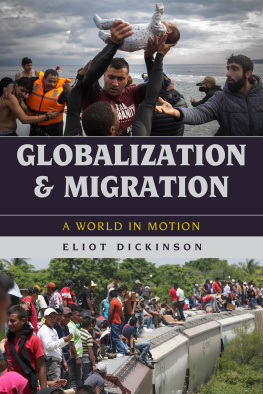

FOR THE PAST THIRTY YEARS or more, the global economy has been run based on three big assumptions: that globalization will continue to increase, that trade is the route to growth and development, and that economic power is moving from the West to the East. More recently, it has been taken as a given that our levels of interconnectednessboth physical and digitalwill rise without limit. But what if some or all of these assumptions are wrong? What if everything is about to change? Indeed, what if the global economy has already started to change its rules, but we just havent noticed?

This is a story that is hard to tell. When there have been thousands if not millions of books, articles and academic papers claiming that globalization is the only game in town, saying that it isnt so may lead to me being put to the back of the class. If you are to believe much that is written on the evolution of the global economy, we have arrived at the equivalent of Fukuyamas (in)famous End of History, but this time for companies.

Globalization has become something analogous, portrayed as the end of economic history in many articles. In the common currently accepted version of the story of our world economy, offshoring of production to Asia by the developed economies came, made and won. The specter of China in particular looms large, with millions of cheap workers, huge industrial cities created instantly where there was nothing and a scale of ambition that seems to dwarf that of the West. For many commentators, politicians and economists this is a game that is already over. In their eyes weve seen a permanent deindustrialization of the West and economic power has shifted significantly and permanently eastward.

But sometimes the stories that seem the most secure are actually fading away from the inside out. Our faith in the shining city on a hill, the project of American democracy, appears to have been significantly tarnished through the presidential election campaign of 2016. The long running Syrian conflict and the refugee crisis that it has spawned have challenged our ideas of progress and the march of peace through democratization. And there are new voices questioning whether weve really settled on this new global economic order, questioning whether we are telling the right story about the world economy as we move further into the new century. These are the voices that will be heard in this telling of the global economy.

THE CORE ARGUMENT of this book is that the accepted interpretation of the future of globalization is misleading and flawed. We are running the global economy on a model that went out of date without anyone noticing at some point in the past decade. But working as if continuing globalization (or hyper-globalization for some) is the only show in town opens us all up to huge risk, potentially as dangerous as the financial crash of 2008 that brought the world economy to its knees.

The Titanic provides an unexpected metaphor for this phenomenon. Apparently, the most senior officer to survive its sinking, Second Officer Charles Lightoller, said on his deathbed that there had been an order to steer away from the iceberg but that it had been misinterpreted. If true, how could such a thing have happened? Left is left or in this case, port is portsurely? Maybe not. At the time of the Titanics maiden voyage the shipping industry was going through major changes as sail was giving way to steam. With that came a change in how ships were steered, from tiller to wheel. Why is that important? Well, with a tiller you steer away from the direction in which you want to go, whereas with a wheel you steer toward it. So the order the captain would have given to turn to port on a steamship such as the Titanic was the exact opposite of that used on a sailing ship. And the helmsman may have misunderstood his command. The order and the execution were carried out in two different languages.

This may be just another great tall story to add to the Titanic archive but, whether it is true or not, it highlights the importance of having a narrative that reflects how the world works today, rather than how it worked yesterday. For if the story or shorthand we carry in our heads is out of date and wrong it can lead to catastrophic consequences, whether it is the loss of a ship, the greatest recession in a hundred years, or, as this book will suggest, many countries entering an economic wilderness in the coming decades.

Out-of-date stories and understandings are everywhere once you start to look, from our private lives up to narratives about the world itself. On a personal level, for how long after a relationship has effectively ended does one of the soon-to-be ex-partners cling to the belief that all is well? And how long do we hold on to a mental picture of ourselves in our twenties when weve long ago passed into our forties or fifties? On a macro level, the world has a long history of out-of-date stories causing more than a little troublethe long and bloody history of proving that the earth revolves around the sun, the Cuban missile crisis and, of course, every financial crash from the South Sea Bubble to that of 2008, in which many individuals, investors and governments believed wrongly that risk had been designed out of the financial system when the exact opposite was true. It is hard to shake a story once it has become established. But without challenging our world view on a regular basis we run the risk of steering the global economy into another iceberg.