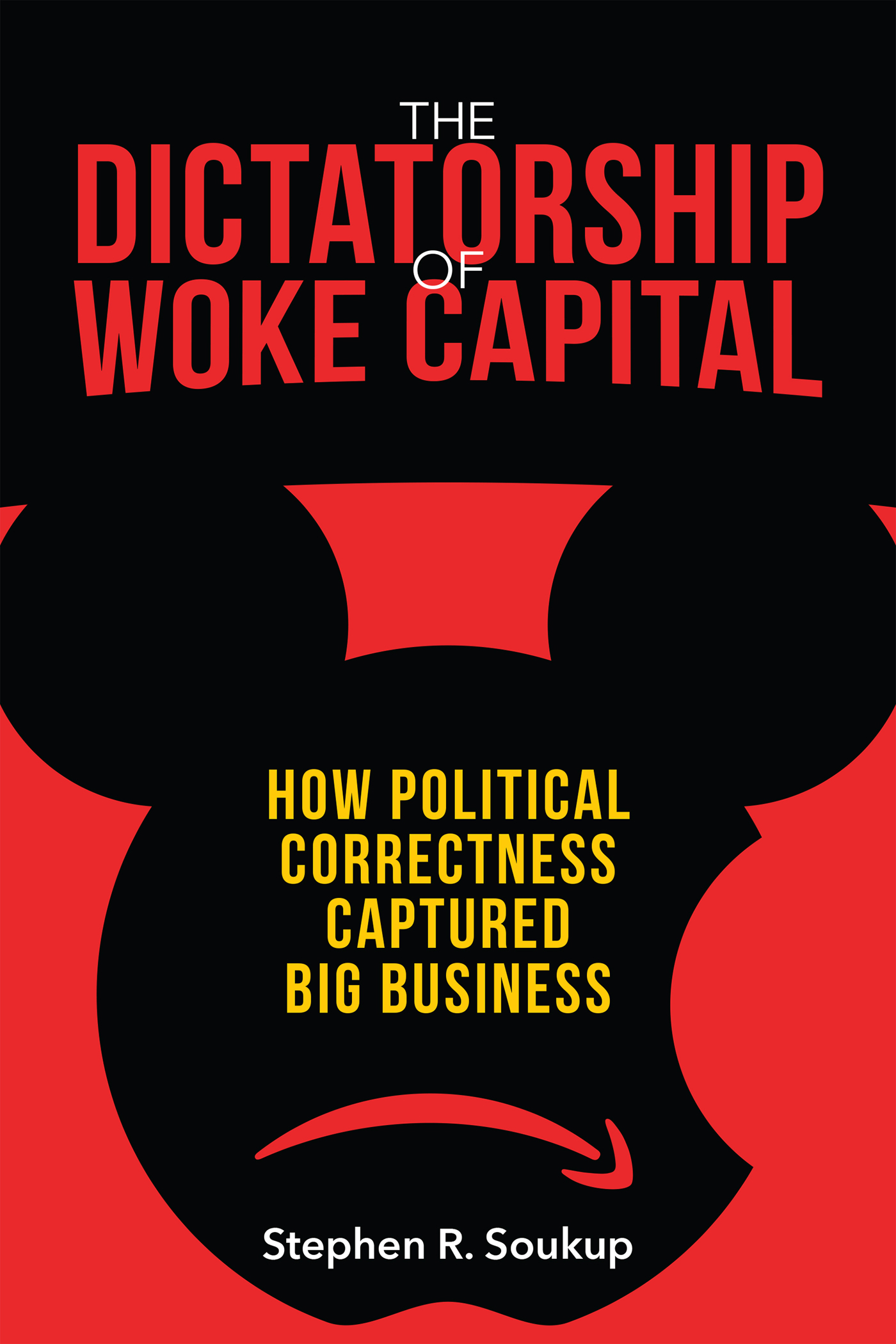

THE

DICTATORSHIP

OF

WOKE CAPITAL

2021 by Stephen R. Soukup

All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of Encounter Books, 900 Broadway, Suite 601, New York, New York, 10003.

First American edition published in 2021 by Encounter Books, an activity of Encounter for Culture and Education, Inc., a nonprofit, tax exempt corporation.

Encounter Books website address: www.encounterbooks.com

Manufactured in the United States and printed on acid-free paper. The paper used in this publication meets the minimum requirements of ANSI/NISO Z39.481992 (R 1997) (Permanence of Paper).

FIRST AMERICAN EDITION

LIBRARY OF CONGRESS CATALOGING-IN-PUBLICATION DATA

Names: Soukup, Stephen R., 1970 author.

Title: The dictatorship of woke capital / by Stephen R. Soukup.

Description: First American edition. | New York : Encounter Books, 2021. Includes bibliographical references and index.

Identifiers: LCCN 2020035578 (print) | LCCN 2020035579 (ebook) ISBN 9781641771429 (hardcover) | ISBN 9781641771436 (ebook)

Subjects: LCSH: EconomicsPolitical aspectsUnited States21st century.

United StatesEconomic policy2009

Classification: LCC HC106.84 .S658 2021 (print) | LCC HC106.84 (ebook) DDC 322/.30973dc23

LC record available at https://lccn.loc.gov/2020035578

LC ebook record available at https://lccn.loc.gov/2020035579

Interior page design and typesetting by Bruce Leckie

CONTENTS

On March 24, 2020, the United States government, which Lincoln famously called the last, best hope of Earth, officially launched a partnership with BlackRock, Inc., the worlds largest money management firm. With the economy suddenly in shambles, crushed under the weight of the global coronavirus pandemic and associated social distancing measures, the Federal Reserve desperately needed help navigating uncharted territory and administering and managing its brand-new corporate bond programs. And in its hour of need, the Jerome Powellled Fed turned to Larry Fink and BlackRock.

It was an interesting, if unsurprising, choice for the Fed. With more than $7 trillion in assets at the time, BlackRock was already the undisputed king of the financial services world. More to the point, over the several previous months, it had also become one of the worlds largest and most powerful advocates of what Fink called a fundamental reshaping of finance. If anyone could help the Fed and help the nation, then it would seem that Larry Fink was the man.

The interesting thing is that Fink made his declaration on reshaping finance several weeks before he was tapped by the Fed and before he met with President Donald Trump, who later called him one of the smartest people we, the nation, have working to fix all our problems. Even before the coronavirus cratered the stock market and the American economy, Fink was already busy finding ways to fix that which he saw as broken, which included a great deal more than the fallout from a mere virus. Fink planned to reshape finance not just to save the country, but to save the world as well.

You see, Larry Fink is a born-again fundamentalist. Hes not a fundamentalist in the sense that market observers and participants might expect, i.e., someone with a deep and abiding dedication to market fundamentals or company fundamentals. Rather, Larry Fink is a religious fanatic, a believer in search of the pure, fundamental practice of his faith. Or, at the very least, by the start of 2020 he had decided to play one on TV. Fink had been building to a public profession of his faith for several years, and in late January, even as COVID-19 was already ravaging Wuhan, China, he made it official in a letter to clients of his firm (and a concurrent letter to CEOs). We believe, Fink professed, that sustainability should be our new standard for investing.

In so doing, Fink not only expressed his own belief in the importance of sustainability, but he also assuaged what he said were customers who had told him they were extremely worried about climate change. These customers had told him, apparently, that they worried not merely about the physical risk associated with rising global temperatures but about how the global transition to a low-carbon economy could affect a companys long-term profitability as well. He heard their cries and responded as a fellow believer.

Conveniently enough, by embracing sustainability as the value by which investments should be measured, Fink also aligned himself with the best and the brightest in the worlds of economics and financethe great global institutions, the United Nations, the World Bank, the International Monetary Fund, the self-identified guardians of the postwar global order. He aligned himself with the Federal Reserve, which had already begun investigating the process by which it could factor climate change into its lending practices. Perhaps most notably, he aligned himself specifically with the Fed chairman, Jerome Powell, who, twelve years earlier, had founded the Global Environment Fund, a private equity firm focused on sustainable energy and investments.

In short, Fink aligned himself with and placed himself at the forefront of the ESG movement, an investment trend focused on Environmental, Social, and Governance matters in assessing a companys long-term value. He placed himself in the position to be crowned king, not just of the financial services world but also of woke capital, the top-down, antidemocratic means by which some of the most powerful and best-known men and women in American business are endeavoring to change capitalism, the securities markets, and the fundamental relationship between the state and its citizensand to save the world.

When the histories of this era are written, 2019 will go down as the year of ESGthe year of planning for investment instability that, as it turns out, did nothing to limit investment instability. American investors alone plowed more than $20 billion into ESG funds in 2019, more than four times what they had invested in ESG the year before. ESG became the hottest, fastest-growing, and most conscience-allaying trend in the investment business. Larry Fink told clients that By the end of 2020, all active portfolios and advisory strategies will be fully ESG integrated.

And then he took over the Feds portfolios on behalf of the American people.

ESG investments promise solutions to issues that otherwise seem intractable. Thus, they have become an attractive alternative to at least two types of investors.

The first of these is the investor who very much wants to make gobs and gobs of money but doesnt want to seem crass and greedy. He wants to be seen as socially responsible, even as he earns an eight- or nine-figure salary and amasses a net worth in the billionsa kinder, gentler Gordon Gecko for the twenty-first century. Think here of Jamie Dimon, the CEO of BlackRocks competitor JPMorgan Chase. Dimon wants the Lord to make him chaste, but not yet. He mouths the words of the creed but doesnt quite believe them. To him, ESG is the means to an end. And that end is Jamie Dimon and his friends getting filthy rich.

The second type of investor is the utopian/religious fundamentalist, the kind of investor who believes that he can change the world and can make himself rich in the process, a happy coincidence. This investor is the modern-day Calvinist, someone who believes that his wealth and success are outward signs of his righteousness. Likewise, he believes that a companys value as an investment is an outward sign of its adherence to the precepts of sustainability. To mix metaphors, this is the investor who buys stock in the company that makes the ropes with which the capitalists will be hanged, specifically because it will be used to hang the capitaliststhe

Next page