Protectionism and the growth of overseas multinational enterprise in interwar Britain

Peter Scott and Tim Rooth

One of the key features of Britains twentieth century industrial development has been the expansion of overseas multinational enterprises. These have come to dominate a number of major capital-intensive industries, while making an important contribution to a wide range of British industrial production. The interwar period saw a considerable increase in the scale and scope of overseas multinationals in Britain, with several hundred new plants being established. This article examines the influence of Britains increasingly protectionist trading regime in stimulating this foreign direct investment (fdi) into Britain, and assesses the economic impact of tariff-induced inward investment.

The introduction of very selective tariff protection from 1915 is shown to have acted as an important stimulus to fdi in the sectors covered, encouraging the establishment of branch plants which were of considerable importance to the development of a range of high-tech, capital-intensive industries. The move to comprehensive tariffs from November 1931 led to a mushrooming of fdi, diversifying production in a broader range of industries and introducing new technologies, production methods and design standards. The stimulus to fdi induced by protectionism is shown to have exerted a positive influence on the British economy, especially in the long-term. This reinforces the findings of more general recent studies that, contrary to earlier analyses, the impact of the General Tariff on the British economy was positive and significant.

Early trade barriers and inward fdi

Since the late nineteenth century Britain has been the recipient of substantial direct investment by foreign manufacturers. During the decades prior to 1914 it maintained one of the most radically

Although there were virtually no UK tariffs prior to the

From the First World War Britain began to introduce protectionist measures. The first major move was the Nonetheless, its sectoral incidence proved a powerful inducement for fdi.

The 1920s saw a substantial increase in inward fdi; it has been estimated that 167 new manufacturing subsidiaries of overseas firms were established in Britain during the decade, compared to 76 from 1900 to 1909 and 58 from 1910 to 1919.

The 1925 silk duties attracted a number of foreign companies, including Dutch-based Enka (1925) and German-owned British Bemberg (1926).

The McKenna duties were an important factor behind inward direct investment in the British

The addition of rubber tyres to the McKenna list in 1927 induced major manufacturers, such as Firestone (which was paying 15,000 per week in import duties), Goodyear, the India Tyre & Rubber Co., the Overman Cushion Tyre Co., Michelin, and Pirelli, to leap the tariff walls by establishing UK factories or acquiring existing UK manufacturers.

In addition to the growth of tariffs, Britains continued openness to overseas enterprises provided a further

The Emergency Tariff and inward fdi

Following the 1931 economic crisis the new National Government undertook two actions which, together, had a profound effect on the flow of foreign-based enterprises to Britain: taking sterling off the gold standard (the impact of which is discussed below), and moving towards comprehensive protectionism. The These could produce spectacular levels of protection.

One consequence was a sharp fall in manufactured imports. Another was a dramatic rise in inward investment. Within a few weeks of 70 cases were also recorded of British manufacturers considering establishing new undertakings, or extending existing plants, with the assistance of foreign key workers.

Data on those firms which actually commenced production during the 18 months following the Abnormal Importations Act were published, as parliamentary answers, at six-monthly intervals. The figures, shown in .

New foreign firms in Britain, November 1931 -April 1933 and their employment

| Period | No. of firms | Employment

(UK) | Employment

(foreign key workers) |

|---|

|

|---|

| November 1931 to April 1932 | 123 | 3,882 | 370 |

| May to October 1932 | 95 | 3,465 | 245 |

| Total end October 1932 | N/A | 9,361 | N/A |

| November 1932 to April 1933 | 57 | 1,533 | N/A |

| Total end April 1933 | 254 | 10,883 | N/A |

Source:House of Commons, Parliamentary Debates, Vol. 266 (1932), cols. 133134; Vol. 273(1932), cols 73437; Vol. 278 (1933), cols 91719.

Notes: Refers to the end of the first week of May 1932.

Refers to the period from the end of the first week of May 1932 to the end of October.

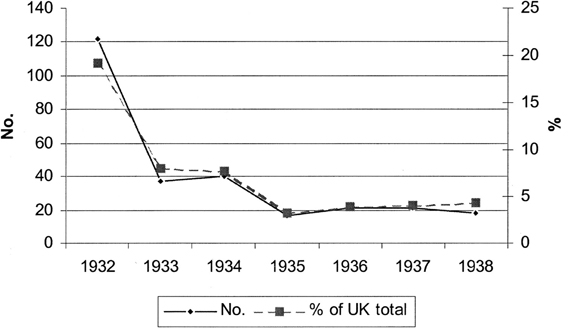

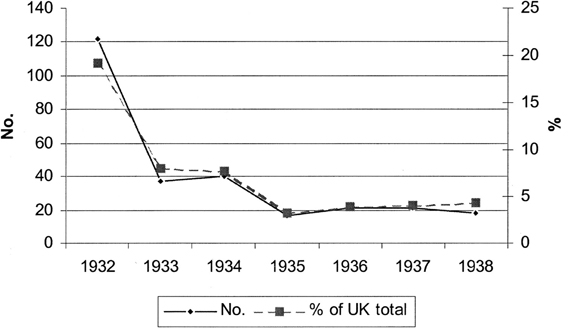

New foreign plants employing 25 or more people established in Britain during 19321938, number and proportion of all new plants

Source: Board of Trade, Survey of Industrial Development (London: HMSO, 19341939).

The distribution of foreign plants established in Britain between November 1931 and October 1932, and during the 1920s, by country of origin

| Country of origin | (1) | (2) | Total | 19209 |

|---|

|

|---|

| Germany | 65 | 40 | 105 | 6 |

| France | 11 | 7 | 18 | 7 |

| Austria | 11 | N/A | N/A | 0 |

| Belgium | 9 | 6 | 15 | 0 |

| USA | 9 | 10 | 19 | 127 |

| Holland | 6 | 7 | 13 | 14 |

| Switzerland | N/A | 6 | N/A | 2 |

| Italy | N/A | 2 | N/A | 1 |

| Hungary | N/A | 2 | N/A | 1 |

| Czechoslovakia | N/A | 2 | N/A | 0 |

| Other | 12 | 13 | 25 | 9 |

| Total | 123 | 95 | 218 | 167 |

Source: House of Commons, Parliamentary Debates, Vol. 266 (1932), col. 1331; Vol. 273 (1932), col. 337; Bostock & Jones database.

Notes: (1) November 1931 to end of first week of May 1932

(2) End of first week of May 1932 to end of October 1932.

'Total' represents November 1931 to October 1932.

The clothing, textile, and leather goods industries in these countries had experienced depression since the 1920s. The imposition of high British tariffs simultaneously provided apush factor for fdi, by restricting access to a major overseas market, and a pull factor, as, once operating in Britain, they would enjoy the benefits of a protected market in which domestic producers were not perceived to be particularly competitive. As the Czech hosiery manufacturer Eric Pasold recalled, devaluation and tariffs threatened to terminate his British sales, but where would the British get those millions of dozens of fleecy knickers from? I gathered there were very few Terrot-type knitting machines in the country British manufacturers did not have a reputation for being very efficient this would be the right time to establish an ultra-modern knitting mill, in England.

US firms, which had comprised 76.0 per cent of fdi during the 1920s, accounted for only 8.7 per cent of new overseas firms in the year following the Emergency Tariff. This may have been influenced by the Depression, which hit American industry with particular severity, domestic financial problems forcing many US corporations to curtail overseas expansion.

Next page